Recent from talks

Nothing was collected or created yet.

Vinyl revival

View on Wikipedia

The vinyl revival, also known as the vinyl resurgence, is the renewed interest and increased sales of vinyl records, or gramophone records, that has been taking place in the music industry. Beginning in 2007,[1][2] vinyl records experienced renewed popularity in the West[3][4][5] and in East Asia[6][7] amid steadily increasing sales, renewed interest in the record shop, and the implementation of music charts dedicated solely to vinyl.[8]

The analogue format made of polyvinyl chloride had been the main vehicle for the commercial distribution of pop music from the 1950s until the 1980s when it was largely replaced by the cassette tape and then the compact disc (CD). After the turn of the millennium, CDs were partially replaced by digital downloads[9] and then streaming services. However in the midst of this, vinyl record sales were increasing and was growing at a quick rate by the early 2010s, eventually reaching levels not seen since the late 1980s in some territories. Despite this, records still make up only a marginal percentage (8% in the US as of 2023) of overall music sales.[10] Alongside these there has also been a swift increase in the sales and manufacturing of new record players/turntables.[11]

The revival peaked in the 2020s, with various publications and record stores crediting Taylor Swift with driving vinyl sales.[12][13][14][15] For 2022, the Recording Industry Association of America reported that: "Revenues from vinyl records grew 17% to $1.2 billion – the sixteenth consecutive year of growth – and accounted for 71% of physical format revenues. For the first time since 1987, vinyl albums outsold CDs in units (41 million vs 33 million)."[16] The revival has been relatively muted in certain other countries like Japan and Germany – the world's second and third largest music markets after the U.S.[17] – where CDs continue to outsell records by a significant margin as of 2022.[18][19]

History

[edit]In June 2017, Sony Music announced that by March 2018 it would be producing vinyl records in-house for the first time since ceasing its production in 1989. The BBC reported that "Sony's move comes a few months after it equipped its Tokyo studio with a cutting lathe, used to produce the master discs needed for manufacturing vinyl records", but the company "is even struggling to find older engineers who know how to make records".[20]

In Brazil

[edit]It was reported by the Brazilian record companies that in 2023 the revenues from vinyl records had shot up by 136%, the highest of the physical formats. Despite physical formats representing a tiny fraction of the Brazilian music industry, the increase in vinyl contributed to physical formats growing to their highest level since 2018.[21]

In China

[edit]In China, which has grown rapidly in recent years to become one of the world's largest music markets,[22] the last vinyl record production plant located in Shanghai stopped in 1998. An experienced audio and video company invested in the creation of a new production plant in Guangzhou in 2015.[23] Since then, there has been a notable increase in the popularity of vinyl records and has led to a Chinese equivalent of Record Store Day.[24] Many Chinese had also not experienced the format before, due to most of the population living in poverty at the time when it was at its peak in the West.[23]

In France

[edit]Between 2016 and 2021, sales volumes and revenues generated from vinyl records had tripled.[25] In the year 2023, vinyl sales had reached 5.5 million units. Despite it being only half that of CD sales, it matches a similar amount of market revenue due to the higher retail prices of vinyl.[26]

In Germany

[edit]

In Germany a revival of vinyl records already took place in the 1990s in conjunction with the rise of the rave and techno scene. In the mid-1990s, the rave culture had become a mass movement in the country, with raves having tens of thousands of attendees, youth magazines featuring styling tips, and television networks launching music magazines on house and techno music. In this context Der Spiegel in 1998 describes this "renaissance" of the LP format and declares that "LPs are in again". The CD format was regarded as "uncool", while vinyl records could be beatmatched into each other more easily and had more room for album cover art. Record bags were a common fashion accessory at that time.[27] In the early 2000s the mainstream rave movement declined, and by the end of the decade a majority of the so-called "techno record stores" and record store chains that had emerged in the 1990s had disappeared again.[28]

Around 2007 another revival of vinyl began, this time also concerning the collection of other genres such as pop music, and increasingly promoted by the music industry.[5]

In 2016 there were 476 record stores in Germany, and 3.1 million vinyl records were sold.[29] In 2020, sales of vinyl LPs in Germany increased to 4.2 million units sold.[30] Almost three quarters of the 20 most popular records of this year belong to the rock music genre.[31]

In Japan

[edit]Sales of music CDs in Japan began in 1982. By 1986, the compact disc began replacing the gramophone record as the primary means of music distribution in Japan.[32] As opposed to declining CD sales in Western markets, CDs remained a huge market in Japan, with sales of over 100 million each year from 1998 until 2018.[33] Beginning in the early 2000s decade, there was growing nostalgia for vinyl records, although CD sales were still strong.[34] Inspired by the Record Store Day event in the United States, Japanese record stores began promoting the revival of gramophone records in 2012.[35][34] Concurrently, popular musicians including Sakanaction, AKB48, Perfume, and Masaharu Fukuyama began releasing their music for vinyl distribution.[34] In 2014, HMV Record Shop, a proponent in selling vinyl records, opened in Shibuya.[35] Technology brands such as Sony Electronics and Panasonic released revived models of gramophone record players, starting in 2016.[34]

From the mid-2010s decade, vinyl records have enjoyed renewed popularity, with specialized shops opening in Shibuya, Shinjuku, and Ginza.[35] From 2010 to 2020, vinyl sales in Japan increased tenfold, from 105,000 copies to 1,219,000 copies.[35] Although the 2020 figure did not match that of 2000 (when nearly two million vinyl records were sold), it was the best figure since 2004.[36] Popular artists such as Perfume and Back Number have led the way for vinyl revival, and CD sales have declined by 35% from 2008 to 2018.[36]

In the United Kingdom

[edit]Similarly in the United Kingdom, the compact disc surpassed the gramophone record in popularity in the late 1980s. This started a gradual decline in vinyl record sales throughout the 1990s. The popularity of indie rock caused sales of new vinyl records (particularly 7 inch singles) to increase significantly in 2006.[37][38] Sales of vinyl LP records in the UK increased every year between 2007 and 2014.[4] In December 2011, BBC Radio 6 Music began an occasional Vinyl Revival series in which Peter Paphides met musicians who revealed, and played selections from, their vinyl record collections.[39] In November 2014, it was reported that over one million vinyl records had been sold in the UK since the beginning of the year. Sales had not reached this level since 1996. The British Phonographic Industry (BPI) predicted that Christmas sales would bring the total for the year to around 1.2 million. However, vinyl sales were still a very small proportion of total music sales. Pink Floyd's The Endless River became the fastest-selling UK vinyl release of 2014 – and the fastest-selling since 1997 – despite selling only 6,000 copies.[40] In 2016, 3.2 million vinyl records were sold in the UK, the best sale for a quarter of a century.[41]

As of 2016, the revival continued,[42] with UK vinyl sales exceeding streaming audio revenue for the year.[20] In January 2017, the BPI's 'Official UK recorded music market report for 2016', using Official Charts Company data, noted that "Though still niche in terms of its size within the overall recorded music market, vinyl enjoyed another stellar year, with over 3.2 million LPs sold – a 53 per cent rise on last year".[43] The BPI also reported that "The biggest-selling vinyl artist was David Bowie, with 5 albums posthumously featuring in the top-30 best-sellers, including his Mercury Prize shortlisted Blackstar, which was 2016's most popular vinyl recording ahead of Amy Winehouse's Back to Black, selling more than double the number of copies of 2015's best seller on vinyl – Adele's 25".[43]

BBC Radio 4's Front Row discussed the increase in coloured vinyl releases in October 2017 in the wake of recent albums in the format by Beck, Liam Gallagher, and St. Vincent.[44] According to the BPI, more than five million vinyl records were sold in 2021 in the UK, an increase of 8% over 2020 and the 14th consecutive increase since 2007. The BPI estimated that almost one in four album purchases that year were on vinyl, the highest proportion since 1990.[45]

In March 2023, the BPI published an analysis of Official Charts data, and claimed that vinyl purchases have increased for a 16th consecutive year in the UK. The vinyl market in 2023 has experienced a 11.7% year-on-year rise to 5.9 million units, up from a 2.9% increase the previous year.[46] In 2024, BBC reported that, for the first time since 1992, vinyl records have been included in the set of goods used by the UK's Office for National Statistics (ONS) to track prices and calculate the rate of inflation.[15]

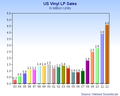

In the United States

[edit]In the 1980s, gramophone records declined in popularity. The major label distributors restricted their return policies, which retailers had been relying on to maintain and swap out stocks of relatively unpopular titles.[citation needed]

First, the distributors began charging retailers more for new product if they returned unsold vinyl, and then they stopped providing any credit at all for returns. Retailers, fearing they would be stuck with anything they ordered, only ordered proven, popular titles that they knew would sell, and devoted more shelf space to CDs and cassettes. Record companies also deleted many vinyl titles from production and distribution, further undermining the availability of the format and leading to the closure of pressing plants. This rapid decline in the availability of records accelerated the format's decline in popularity, and is seen by some as a deliberate ploy to make consumers switch to CDs, which were more profitable for the record companies.[47][48][49][50] Between 2003 and 2008, over 3,000 record stores in the country closed their doors.[51] But ever since 2007, the popularity of vinyl records has risen again with annual sales increasing by 85.8% between 2006 and 2007 in the United States, although starting from a low base,[52] and by 89% between 2007 and 2008.[53] In 2009, 3.5 million units sold in the United States, including 3.2 million albums, the highest number since 1998.[54][55] The largest online retailer of vinyl records in 2014 was Amazon with a 12.3% market share, while the largest physical retailer of vinyl records was Urban Outfitters with an 8.1% market share.[56]

In its 'Shipment and Revenue Statistics' report for 2016, the Recording Industry Association of America noted that "Shipments of vinyl albums were up 4% to $430 million, and comprised 26% of total physical shipments at retail value – their highest share since 1985".[57] In 2019, Rolling Stone said that "Vinyl records earned $224.1 million (on 8.6 million units) in the first half of 2019, closing in on the $247.9 million (on 18.6 million units) generated by CD sales. Vinyl revenue grew by 12.8% in the second half of 2018 and 12.9% in the first six months of 2019, while the revenue from CDs barely budged. If these trends hold, records will soon be generating more money than compact discs".[58] Best Buy discontinued CDs in 2019, but as of January 2020[update] still sells vinyl. Target Corporation and Walmart still sell CDs, but use less shelf space for them and use more space for vinyl records, players, and accessories.[59]

By 2019, vinyl sales continued healthy growth at the expense of other physical media and despite the growing prominence of streaming,[3] presently the cheapest (legal) way to listen to music.[60] In the first half of 2020, vinyl recordings outsold CDs (in terms of revenue) in the US for the first time since the 1980s.[61] In 2020 vinyl recordings accounted only for 5.1% ($619.6m) of total US music revenues and CDs accounted for 4% ($483.3m) of revenues. Digital and streaming formats accounted for the remainder of the $12.2 billion in US music revenues, with paid subscriptions accounting for 57.7% of total revenue at $7.0 billion.[62] Americans across age groups have been contributing to the preservation and revival of vinyl records.[63][60][64] According to a 2019 YouGov poll, 31% of the U.S. population is willing to pay for music on vinyl, including 36% of Baby boomers, 33% of Generation X, 28% of Millennials, and 26% of Generation Z.[64]

Taylor Swift leads the vinyl revival. Her ninth studio album, Evermore (2020), sold 102,000 vinyl LPs in a single week in June 2021, breaking the record for the biggest vinyl sales week for an album since MRC Data began tracking sales in 1991.[65] In 2021, for the first time in the last 30 years, vinyl record sales exceeded CD sales; one of every 3 albums sold in the US was a vinyl LP. Indie retailers sold almost half of all vinyl LPs, while Taylor Swift was the format's top-selling artist, accounting for 2.6% of total sales.[66] As per the MRC Data mid-year report for 2021, sales of vinyl records in the US surpassed that of the CDs; 19.2 million vinyl albums were sold in the first six months of 2021, outpacing the 18.9 million CDs sold. This has been attributed to a phenomenon of listeners looking for tangible ways to consume music, especially the fanbases of various musicians.[67] In 2022, Swift's tenth studio album, Midnights, sold 945,000 vinyl LPs in the last two months of the year, garnering the largest vinyl sales year for an album in Luminate Data history. Swift sold 1.695 million vinyl LPs across her entire catalog in 2022, with one of every 25 vinyl LPs sold that year in the U.S. being a Swift album—a sum larger than the next two biggest-sellers of vinyl combined: Harry Styles with 719,000 and the Beatles with 553,000.[68]

In March 2023, the RIAA published a revenue report for 2022, in which vinyl accounted for $1.2 billion of physical media sales out of a total of $1.7 billion. This was the first instance of vinyl sales growth outpacing CD sales growth since 1987 as CDs saw an 18% decline in sales year-on-year.[69]

Reasons

[edit]Records are perceived as more durable, come in significantly larger packaging (allowing more detail in the album art to be visible), and may include bonus items absent from a CD copy of the same album (for example, a poster or clothing article, or exclusive liner notes). These factors can cause a CD to be seen as a poor value even if an LP is more expensive.[59][non-primary source needed][27][better source needed]

CDs are capable of more accurate sound reproduction and are effectively free of noise and sound artifacts,[70] but many listeners find records' imperfections more subjectively pleasant than digital audio.[59][42] The rise in vinyl demand also correlates with the rise in popularity of streaming services throughout the 2010's, with many listeners choosing to purchase a beloved album on vinyl after discovering it on Spotify or Apple Music.[71] Records are also tactile, physical, collectable items that offer a drastically different listening experience than the ubiquitous streaming services.[72]

In spite of many record sales being modern artists or genres, records may be considered a part of retro style, benefiting from a general cultural interest in the technology and media of the past.[73]

According to Adriaan Neervoort, owner of Wanted Music, in Beckenham, Kent, "Vinyl has a more engaging human sound, it comes beautifully packaged. People want to know more about music and they want to engage with it more."[15]

Sales

[edit]NOTE: Many citations below include CD sales, not just vinyl sales[citation needed]. This chart should be reviewed and revised for accuracy.

| Countries | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Global Trade Value $US (SP&LP) |

$55m | $66m | $73m | $89m | $116m[74] | $171m | – | – | $416m[42] | – | – | – | – | |||||||||||||

| Australia (SP/LP) |

10,000 | 17,996[75] | 10,000 | 19,608[76] | 10,000 | 53,766[77] | 13,677 | 39,644[78] | 13,637 | 44,876[78] | 21,623 | 77,934[79] | 10,069 | 137,658[80] | 277,767[81] | 374,097[82] | 655,301[83] | 786,735[83] | – | – | ||||||

| Germany (SP&LP) |

400,000[84] | 700,000[85] | 1,200,000[85] | 635,000 (LPs only) |

700,000 (LPs only)[86][87] |

1,000,000[88] | 1,400,000[88] | 1,800,000[88] | 2,100,000[88] | 3,100,000[88] | – | – | – | |||||||||||||

| Finland[89] (SP&LP) |

10,301 | 13,688 | 15,747 | 27,515 | 54,970 | 47,811 | 72,480 | 82,313[90] | – | – | – | – | – | |||||||||||||

| Hungary (LP) |

2,974[91] | 2,923[92] | 3,763[93] | 1,879[94] | 8,873[95] | 9,819[96] | 14,719[97] | 24,132[98] | – | – | – | – | – | |||||||||||||

| Japan (SP&LP) |

324,000[99] | 212,000[99] | 102,000[99] | 105,000[99] | 210,000[99] | 453,000[99] | 268,000[99] | 401,000[99] | 662,000[99] | 799,000[99] | 1,063,000[99] | 1,116,000[99] | 1,219,000[99] | |||||||||||||

| Netherlands (LP) |

– | – | 51,000 | 60,400 | 81,000[100] | 115,000[101] | – | 300,000± | 650,000+[102] | 1,000,000+[103] | – | – | – | |||||||||||||

| Spain (LP) |

– | 40,000 | 106,000[104] | 97,000 | 141,000[105] | 135,000[106] | – | – | – | – | – | – | – | |||||||||||||

| Sweden[107] (SP&LP) |

11,000 | 22,000 | 36,000 | 70,671 | 101,484 | 168,543 | 200,008 | – | – | – | – | – | – | |||||||||||||

| United Kingdom (SP/LP) |

1,843,000 | 205,000 | 740,000 | 209,000 | 332,000 | 219,000 | 219,000 | 234,000 | 186,000 | 337,000 | – | 389,000 | – | 780,000 | – | – | – | – | – | - | - | 3.2 million[108] | – | 4.2 million[109] | - | - |

| United States (LP) |

988,000 | 1,880,000[110] | 2,500,000[111] | 2,800,000[112] | 3,800,000[113] | 4,600,000[114] | 6,100,000[113] | 9,200,000[113] | 11,900,000[115] | 13,000,000[116] | 14,320,000[117] | 16,800,000[118] | ||||||||||||||

| ||||||||||||||||||||||||||

Annual bestselling LPs in the US

[edit]| Year | Album | Artist | Sales |

|---|---|---|---|

| 2008 | In Rainbows | Radiohead | 25,800[126] |

| 2009 | Abbey Road | The Beatles | 34,800[126] |

| 2010 | 35,000[127] | ||

| 2011 | 41,000[128] | ||

| 2012 | Blunderbuss | Jack White | 34,000[128] |

| 2013 | Random Access Memories | Daft Punk | 49,000[129] |

| 2014 | Lazaretto | Jack White | 87,000[129] |

| 2015 | 25 | Adele | 116,000[115] |

| 2016 | Blackstar | David Bowie | 54,000[130] |

| 2017 | Sgt. Pepper's Lonely Hearts Club Band | The Beatles | 72,000[117] |

| 2018 | Guardians of the Galaxy: Awesome Mix Vol. 1 | Various Artists | 84,000[131] |

| 2019 | Abbey Road | The Beatles | 246,000[132] |

| 2020 | Fine Line | Harry Styles | 232,000[133] |

| 2021 | 30 | Adele | 318,000[134] |

| 2022 | Midnights | Taylor Swift | 945,000[68] |

| 2023 | 1989 (Taylor's Version) | 1,014,000[135] | |

| 2024 | The Tortured Poets Department | 1,489,000[136] |

Graphs

[edit]-

Global vinyl sales in US$

-

US vinyl sales in units

-

UK vinyl sales in units

-

UK vinyl sales in UK£

-

British consumer spending on music formats

Record Store Day

[edit]Most customers prefer to buy vinyl from small, independent record stores with a larger selection than department stores.[59] Record Store Day is an internationally celebrated day observed the third Saturday of April each year. Its purpose, as conceived by independent record store employee Chris Brown, is to celebrate the art of music.[137] The day brings together fans, artists, and thousands of independent record stores across the world.[138]

Record Store Day was officially founded in 2007[137] and is celebrated globally[137] with hundreds of recording and other artists participating in the day by making special appearances, performances, meet and greets with their fans, the holding of art exhibits, and the issuing of special vinyl and CD releases along with other promotional products to mark the occasion.

In 2013, for the week of Record Store Day in the United Kingdom, 68,936 records were sold (an 86.5% rise from 36,957 in 2012). This can be broken down into 1,249 7" albums, 25,100 12" albums, 27,042 7" singles and 15,545 12" singles.[139] From December 29, 2017 to June 28, 2018 there was a 19.2% increase in vinyl sales compared to the same period the previous year.[140] Vinyl sales hold over 18% of physical record sales in the United States, a 7% increase from previous years.[141]

UK Official Record Store Chart

[edit]The Official Record Store Chart is a weekly music chart based on physical sales of albums in almost 100 independent record stores in the United Kingdom.[142][143] It is compiled by the Official Charts Company (OCC), and each week's number one is first announced on Sunday evenings on the OCC's official website.

The chart's launch was first announced by the OCC on 17 April 2012[144] – at the time, British record stores were selling 4.5 million albums per year, and were contributing towards 95 per cent of the country's total vinyl sales.

Nomenclature debate

[edit]Arising within the renewed popularity of vinyl records, there is a small debate over the issue of how they should properly be referred to in English. While many refer to them as "records" or "LPs", sometimes they are referred to as "vinyl", an informal term derived from its material composition. The disagreement arises over how the word "vinyl" is used. Those who remember the vinyl records' original popularity in the 1980s and before, use the term "vinyl" in context such as "I have that album on vinyl", and also when using it as a mass noun, e.g. "I have a huge collection of vinyl". Those whose experience with records is only during the more recent revival, have developed a different way of using the word, referring to vinyl records in the plural as "vinyls", as well as using the indefinite article "a", such as saying "I need to go buy a vinyl". Arguments are made based on the rules of language, and whether "vinyls" could be a proper way of referring to records in the plural. On the "vinyls" side, a key argument is whether vinyl is a "mass noun": "These nouns — such as cheese, beer and wine — refer to stuff that comes in variable but conceptually undifferentiated quantities that are measured rather than counted."[145]

See also

[edit]References

[edit]- ^ Allen, Katie (16 July 2007). "Back in the groove: young music fans ditch downloads and spark vinyl revival". The Guardian. Retrieved 12 August 2022.

- ^ "Infographic: The LP is Back!". Statista. 6 January 2014. Retrieved 16 July 2017.

- ^ a b Solsman, Joan E. (28 February 2019). "US music fans throw more money at vinyl, CDs than iTunes downloads now". CNET. Retrieved 28 October 2021.

- ^ a b "Vinyl revival: LPs to get their own official chart". The Daily Telegraph. Retrieved 16 July 2017.

- ^ a b Wunder, Jörg (9 October 2008). "Vinyl lebt: Die Welt ist eine Scheibe" [Vinyl lives: The world is a disc]. Der Tagesspiegel. Retrieved 2 February 2020.

- ^ St. Michel, Patrick (11 April 2017). "Hard-core vinyl fans are fueling a revival in obscure Japanese music from the 1980s". The Japan Times. Retrieved 11 April 2017.

- ^ "The rise and charms of LP bars in South Korea". The Economist. Seoul. 18 February 2021. Retrieved 18 February 2021.

- ^ "UK's first official vinyl chart launched as sales rise". BBC News. 12 April 2015. Retrieved 4 May 2024.

- ^ Halliday, Josh (6 January 2012). "Digital downloads overtake physical music sales in the US for first time". The Guardian. ISSN 0261-3077. Retrieved 4 May 2024.

- ^ "Infographic: Despite Comeback, Vinyl Is Still Far From Its Glory Days". Statista Daily Data. 19 April 2024. Retrieved 4 May 2024.

- ^ Noisey Staff (4 January 2016). "The Resurgence Is Real: British Entertainment Chain HMV Sold One Turntable Per Minute in the Build Up to Christmas". Vice. Retrieved 6 May 2024.

- ^ DiGiacomo, Frank (8 June 2021). "Hip-Hop, R&B And Pop Challenge Rock's Vinyl Dominance In 2021". Billboard. Archived from the original on 7 November 2021. Retrieved 16 July 2021.

- ^ Young, Alex (20 January 2022). "Taylor Swift, the indisputable Queen of Vinyl, named 2022 Record Store Day Ambassador". Consequence. Archived from the original on 19 November 2022. Retrieved 6 March 2022.

- ^ Millman, Ethan (6 March 2024). "How Taylor Swift Took Over Your Local Record Store". Rolling Stone. Retrieved 6 March 2024.

- ^ a b c "Taylor Swift-led vinyl revival recognised by price data gurus". BBC. 11 March 2024. Retrieved 25 March 2024.

- ^ "Year End Music Industry Revenue Report". RIAA.com. Retrieved 16 March 2024.

- ^ "RIAJ Yearbook 2015: IFPI 2013, 2014. Global Sales of Recorded Music" (PDF). Recording Industry Association of Japan. p. 24. Archived (PDF) from the original on 16 June 2015. Retrieved 7 June 2015.

- ^ "3 observations on… how Japan's music industry caters to (and relies on) 'superfans' more than any other market". Music Business Worldwide. 23 October 2023. Retrieved 3 May 2024.

- ^ "Statistik | Absatz von physischen Tonträgern und digitalen Musikprodukten". miz.org (in German). Retrieved 3 May 2024.

- ^ a b "Sony Music goes back to vinyl records". BBC News Online. BBC. 29 June 2017. Retrieved 29 June 2017.

- ^ "Vinil supera CD e é mídia física que mais fatura no Brasil".

- ^ Cardew, Ben (4 April 2023). "China's music industry expects strong subscriptions growth". Music Ally. Retrieved 3 May 2024.

- ^ a b "逆流而上的黑胶唱片,数位趋势下的一支奇兵?_澎湃号·湃客_澎湃新闻-The Paper". www.thepaper.cn. Retrieved 3 May 2024.

- ^ "黑胶回潮 收藏不如聆听". cul.china.com.cn. Retrieved 3 May 2024.

- ^ "France's recorded music industry topped $1bn in 2021". Music Business Worldwide. 15 March 2022. Retrieved 3 May 2024.

- ^ Bazoge, Mickaël (27 March 2024). "En France comme aux États-Unis, les vinyles en position de force face aux CD". 01net.com (in French). Retrieved 3 May 2024.

- ^ a b "Jung ist die Nacht: CLUB-TIPS" [Young is the night: club tips]. Spiegel Special. 1 August 1998. p. 6. Archived from the original on 11 November 2017. Retrieved 20 June 2019.(PDF version)

- ^ "Münchens letzter Techno-Plattenladen schliesst: Schade wenn das verloren geht!" [Munich's last techno record store closes: what a pity if that gets lost!] (PDF). Flashtimer. August 2008. Archived from the original (PDF) on 5 October 2023. Retrieved 2 February 2020.

- ^ Mildbradt, Friederike (20 February 2017). "Deutschlandkarte:Schallplattenläden" [Germany map: record stores]. Die Zeit. Retrieved 2 February 2020.

- ^ "Sales of music data carriers Germany 2020". Bundesverband Musikindustrie (in German). Retrieved 1 November 2021.

- ^ "Vinyl-Boom bleibt ungebrochen" [Vinyl boom remains unbroken]. Bundesverband Musikindustrie (in German). 9 June 2021. Retrieved 1 November 2021.

- ^ レコードの歴史年表 [History of the gramophone record]. Niikappu (in Japanese). Retrieved 30 October 2021.

- ^ "Japan's CD album output fell 100 million for first time in 2018, industry data shows". The Japan Times. 8 May 2019. Retrieved 8 May 2019.

- ^ a b c d Ideguchi, Akinori (24 March 2021). アナログレコードの〈復活〉はどう語られてきたか – 1988 年から現在まで [The "revival" of the analog records: how is it told? From 1988 to present]. Journal of Applied Sociology (63). Rikkyo University: 1–16.

- ^ a b c d レコードの人気復活、10年で生産枚数10倍 [The revival of the gramophone, production increased tenfold over ten years]. Yomiuri Shimbun (in Japanese). 12 January 2021. Retrieved 30 October 2021.

- ^ a b レコード復権、若者つかむ 10年で生産枚数11倍に [The vinyl revival has caught on to the young generation: sales increased 11 times during 10 years]. The Nikkei. 16 July 2019. Retrieved 16 July 2019.

- ^ Tony Glover (14 May 2006). "Back in the Groove". The Business Online.com. Archived from the original on 31 December 2006. Retrieved 14 January 2007.

- ^ Chris Hastings (17 September 2006). "Why singles are top of the pops again". London: Telegraph.co.uk. Archived from the original on 14 March 2007. Retrieved 4 October 2006.

- ^ Presenter: Peter Paphides (4 December 2011). "Vinyl Revival: Damon Albarn: Series 1 Episode 1 of 8". Vinyl Reviva. BBC. BBC Radio 6 Music. Retrieved 13 October 2017.

- ^ Lee, Dave (27 November 2014). "Vinyl record sales hit 18-year high". BBC News. Retrieved 27 November 2014.

- ^ The Guardian, January 2017

- ^ a b c Morris, Chris. "Vinyl Sales Are Not Just a Hipster Thing Anymore". Fortune. Retrieved 16 July 2017.

- ^ a b "BPI official UK recorded music market report for 2016". www.bpi.co.uk. British Phonographic Institute. 3 January 2017. Retrieved 1 September 2017.[permanent dead link]

- ^ Presenters: Presenter: Stig Abell; Producer: Timothy Prosser (13 October 2017). "Kit Harington, Kele Okereke, Dynasty, Porridge". Front Row. 24:40 minutes in. BBC. BBC Radio 4. Retrieved 13 October 2017.

- ^ Gayle, Damien (29 December 2021). "Vinyl turns tables as UK sales take highest market share since 1990". The Guardian. Retrieved 29 December 2021.

- ^ "Vinyl sales increase again with growth accelerating in 2023". www.musicweek.com. Retrieved 11 March 2024.

- ^ Browne, David (4 October 1991). "A Vinyl Farewell". Entertainment Weekly. No. 86.

- ^ Souvignier, Todd (2004). The World of DJs and the Turntable Culture. Hal Leonard Corporation. pp. 41–42. ISBN 978-0-634-05833-2.

- ^ Negativland. "Negativland: Shiny, Aluminum, Plastic, and Digital". Urbigenous Library. Retrieved 6 November 2008.

- ^ Plasketes, George (1992). "Romancing the Record: The Vinyl De-Evolution and Subcultural Evolution". Journal of Popular Culture. 26 (1): 110,112. doi:10.1111/j.0022-3840.1992.00109.x.

- ^ BROWN, AUGUST. "Vinyl getting some new attention". Sarasota Herald-Tribune. Retrieved 6 May 2024.

- ^ Browne, David (8 January 2009). "Vinyl Returns in the Age of MP3". Rolling Stone. Archived from the original on 4 June 2008. Retrieved 12 June 2008.

- ^ Kreps, Daniel (8 January 2009). "Radiohead, Neutral Milk Hotel Help Vinyl Sales Almost Double In 2008". Rolling Stone. Archived from the original on 19 March 2009. Retrieved 5 March 2009.

- ^ "2009 R.I.A.A. 2009 Year-End Shipment Statistics" (PDF). Archived from the original (PDF) on 2 June 2010. Retrieved 26 September 2012.

- ^ Kornelis, Chris (27 January 2015). "Do CDs Sound Better Than Vinyl?". L.A. Weekly. Archived from the original on 9 April 2016. Retrieved 10 April 2016.

- ^ "Urban Outfitters Doesn't Sell the Most Vinyl". Billboard. Retrieved 16 July 2017.

- ^ Friedlander, Joshua P. "News and Notes on 2016 RIAA Shipment and Revenue Statistics" (PDF). riaa.com. Recording Industry Association of America. Retrieved 31 August 2017.

- ^ Leight, Elias (6 September 2019). "Vinyl Is Poised to Outsell CDs For the First Time Since 1986". Rolling Stone. Retrieved 14 December 2019.

- ^ a b c d Deffes, Olivia (30 January 2020). "Repeat performance: Music lovers warming up to vinyl -- again". The Advocate. Retrieved 30 January 2020.

- ^ a b Eckersley, Marina (3 November 2019). "Gen Xers, millennials and even some Gen Zs choose vinyl & drive record sales up". The Conversation. Retrieved 28 October 2021.

- ^ Beaumont-Thomas, Ben (14 September 2020). "Vinyl records outsell CDs in US for first time since 1980s". The Guardian. Retrieved 14 September 2020.

- ^ "U.S. Sales Database". RIAA. Retrieved 13 April 2021.

- ^ Jensen, Erin (18 November 2019). "Hold your heads high, millennials and Gen Z! There are (at least) 6 things you haven't ruined". Life. USA Today. Retrieved 28 November 2019.

- ^ a b Ballard, Jamie (12 April 2021). "How many Americans are still buying vinyl records?". YouGov. Retrieved 1 November 2021.

- ^ Caulfield, Keith (6 June 2021). "Taylor Swift's 'Evermore' Returns to No. 1 on Billboard 200 Chart". Billboard. Retrieved 15 July 2021.

- ^ Caulfield, Keith (13 January 2022). "1 Out of Every 3 Albums Sold in the US in 2021 Were Vinyl LPs". Billboard. Retrieved 17 January 2022.

- ^ Whitten, Sarah (13 July 2021). "Music fans pushed sales of vinyl albums higher, outpacing CDs, even as pandemic sidelined stadium tours". CNBC. Retrieved 15 July 2021.

- ^ a b Caulfield, Keith (11 January 2023). "Bad Bunny's 'Un Verano Sin Ti' Is Luminate's Top Album of 2022 in U.S." Billboard. Retrieved 11 January 2023.

- ^ Hurler, Kevin (10 March 2023). "Vinyl Outsold CDs for the First Time Since 1987". Gizmodo. Retrieved 10 March 2023.

- ^ Lehrman (7 July 2016). "Does music sound better on vinyl records than on CDs?". Tufts Now. Retrieved 11 July 2021.

- ^ "Try before you buy: How record stores embraced streaming to drive the vinyl revival". www.musicweek.com. Retrieved 10 August 2023.

- ^ ""You can touch your music"". Components. Retrieved 10 August 2023.

- ^ "Your turntable's not dead". Umusic.co.uk. 13 July 2012. Retrieved 29 November 2016.

- ^ a b "CD: The indestructible music format that REFUSES TO DIE". Theregister.co.uk. Retrieved 29 November 2016.

- ^ "ARIA releases 2007 wholesale music sales figures". Aria.com.au. Retrieved 29 November 2016.

- ^ "ARIA – 2009 Sales" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ "ARIA – 2009/2010 Sales" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ a b "ARIA releases wholesale figures for 2011" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ "ARIA – 2012 Sales" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ "ARIA - 2013 Sales" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ "ARIA - 2014 Sales" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ "ARIA - 2015 Sale" (PDF). Aria.com.au. Retrieved 16 July 2017.

- ^ a b Australian Recording Industry Association Limited (16 April 2018). "ARIA 2017 MUSIC INDUSTRY FIGURES SHOW 10.5% GROWTH". ARIA Charts. Retrieved 26 November 2018.

- ^ "Musikindustrie – BVMI official figures" (PDF). Musikindustrie.de. Archived from the original (PDF) on 4 March 2016. Retrieved 16 July 2017.

- ^ a b c "German Biz Eyes Growth In 2011, Hopes To Top U.K." Billboard. Archived from the original on 15 January 2013. Retrieved 29 November 2016.

- ^ "Musikindustrie: Online-Dienste wachsen, CD-Verkauf schrumpft mäßig". Heise.de. 19 April 2012. Retrieved 29 November 2016.

- ^ "Miz – Musikwirtschaft" (PDF). Miz.org. Archived from the original (PDF) on 11 June 2016. Retrieved 16 July 2017.

- ^ a b c d e "Absatz". Bundesverband Musikindustrie. Retrieved 6 February 2018.

- ^ "Musiikkituottajat - Tilastot - Äänitteiden vuosimyynti". Ifpi.fi. Retrieved 29 November 2016.

- ^ "Musiikkituottajat - Tilastot - Äänitteiden vuosimyynti - 2014". Ifpi.fi. Retrieved 29 November 2016.

- ^ "MAHASZ – 2007 Sales". Mahasz.hu. Archived from the original on 4 March 2016. Retrieved 16 July 2017.

- ^ "MAHASZ – 2008 Sales". Mahasz.hu. Archived from the original on 4 March 2016. Retrieved 16 July 2017.

- ^ "MAHASZ – 2009 Sales". Mahasz.hu. Archived from the original on 4 March 2016. Retrieved 16 July 2017.

- ^ "MAHASZ – 2010 Sales". Mahasz.hu. Archived from the original on 4 March 2016. Retrieved 16 July 2017.

- ^ "MAHASZ – 2011 Sales". Mahasz.hu. Archived from the original on 4 March 2016. Retrieved 16 July 2017.

- ^ "MAHASZ – 2012 Sales". Mahasz.hu. Archived from the original on 20 December 2014. Retrieved 16 July 2017.

- ^ "MAHASZ – 2013 Sales". Mahasz.hu. Archived from the original on 20 December 2014. Retrieved 16 July 2017.

- ^ "MAHASZ – 2014 Sales". Mahasz.hu. Retrieved 16 July 2017.[permanent dead link]

- ^ a b c d e f g h i j k l m "The Recording Industry Association of Japan (RIAJ)". Riaj.or.jp. Retrieved 26 July 2020.

- ^ "Marktinformatie audio 2014 en voorgaande jaren - NVPI". Nypi.nl. Archived from the original on 17 July 2014. Retrieved 29 November 2016.

- ^ "3voor12 - Verkoopstijging vinyl grotendeels te danken aan Record Store Day". Nvpi.nl. 7 January 2013. Retrieved 29 November 2016.

- ^ "FD - Vinylplatenmarkt in één jaar verdubbeld". Nvpi.nl. Retrieved 23 June 2018. English: Vinyl record market doubled in one years time.

- ^ "NOS - Muziekbusiness in Nederland bloeit, dankzij streaming en vinyl". Nvpi.nl. 21 September 2017. Retrieved 23 June 2018. This figure is for all sales of vinyl media in the Netherlands LP, SP, single etc., not CD's or other physical media.

- ^ "Promusicae – 2008/2009 Figures" (PDF). Promusicae.es. Retrieved 16 July 2017.

- ^ "Promusicae – 2010/2011 Figures" (PDF). Promusicae.e. Retrieved 16 July 2017.

- ^ "DE LA MUSICA 2012_WEB_ok.pdf Promusicae – 2011/2012 Figures". Promusicae.e. Retrieved 16 July 2017.

- ^ Andersson, Aron (7 May 2014). "Så har vinylförsäljningen fått nytt liv". Metro.se. Retrieved 29 November 2016.

- ^ "UK vinyl sales reach 25-year high". BBC. Retrieved 29 November 2016.

- ^ Savage, Mark (3 January 2019). "Is this the end of owning music?". BBC. Retrieved 18 December 2019.

- ^ "Radiohead, Neutral Milk Hotel Help Vinyl Sales Almost Double In 2008". Rolling Stone. Retrieved 29 November 2016.

- ^ "Vinyl LP Sales Up 33% In 2009". Rolling Stone. Retrieved 29 November 2016.

- ^ "Vinyl Sales Increase Despite Industry Slump". Rolling Stone. Retrieved 29 November 2016.

- ^ a b c "HITS Daily Double : Rumor Mill - THE FALL & RISE OF THE VINYL ALBUM". Hitsdailydouble.com. Retrieved 29 November 2016.

- ^ "Digital Music News". Digitalmusicnews.com. Archived from the original on 20 April 2013. Retrieved 29 November 2016.

- ^ a b "2015 NIELSEN MUSIC U.S. REPORT" (PDF). Neilsen.com. Archived from the original (PDF) on 30 May 2019. Retrieved 16 July 2017.

- ^ "Nielsen Releases 2016 U.S. Year-End Music Report". Nielsen.com. Archived from the original on 16 December 2017. Retrieved 16 July 2017.

- ^ a b Caulfield, Keith (3 January 2018). "U.S. Vinyl Album Sales Hit Nielsen Music-Era Record High in 2017". Billboard. Retrieved 9 April 2018.

- ^ "Nielsen Music's Top Album Of 2018 In US Is Drake's 'Scorpion'". Billboard. Archived from the original on 15 April 2021. Retrieved 19 July 2021.

- ^ "Revival on the Black Market: Editorial". Kunststoffe-international.com. Retrieved 29 November 2016.

- ^ "Building a House of Wax in Cleveland". The New York Times. 23 October 2011. Retrieved 29 November 2016.

- ^ "U.S. Vinyl Record Sales May Be 6X Higher Than Soundscan Reports". Hypebot.com. 25 October 2011. Retrieved 29 November 2016.

- ^ "SoundScan may be under reporting US vinyl sales - Complete Music Update". Thecmuwebsite.com. Archived from the original on 23 March 2016. Retrieved 29 November 2016.

- ^ "Increase in vinyl sales helps independent music stores". NewsWire.co.nz. Retrieved 29 November 2016.

- ^ Champeau, Guillaume (9 January 2009). "Face au CD en déclin, le disque vinyle fait un retour en force - Business - Numerama". Numerama.com. Retrieved 29 November 2016.

- ^ "Despite Pandora & Spotify, total U.S. music sales grew in 2012". Venturebeat.com. 4 January 2013. Retrieved 29 November 2016.

- ^ a b "'Abbey Road' Is Top-Selling Vinyl Album for Third Year". Rolling Stone. Retrieved 29 November 2016.

- ^ Gray, Chris (6 January 2011). "Music Sales Down 2.5 Percent In 2010". Houstonpress.com. Retrieved 29 November 2016.

- ^ a b "Adele's '21' 2012's Best Selling Album; Gotye Has Top Song". Billboard. Retrieved 29 November 2016.

- ^ a b "Vinyl Album Sales Hit Historic High in 2014, Again". Billboard. Retrieved 29 November 2016.

- ^ "The Official Top 40 biggest selling vinyl albums and singles of 2016". Officialcharts.com. Retrieved 16 July 2017.

- ^ "THE TOP-SELLING VINYL RECORDS OF 2018". Billboard. Retrieved 23 January 2019.[permanent dead link]

- ^ "Top-selling vinyl albums in the U.S. 2019". www.statistica.com. Retrieved 17 March 2021.

- ^ "YEAR-END REPORT U.S. 2020" (PDF). Musicbusinessworldwide. Retrieved 17 March 2021.

- ^ "Adele's '30' Was The Bestselling Vinyl Album Of 2021, Taylor Swift Rules With Several Bestsellers". Forbes. Retrieved 28 October 2022.

- ^ Caulfield, Keith (10 January 2024). "Morgan Wallen's 'One Thing at a Time' Is Luminate's Top Album of 2023 in U.S." Billboard. Retrieved 10 January 2024.

- ^ Caulfield, Keith (15 January 2025). "Taylor Swift's 'Tortured Poets Department' Is Luminate's Top Album of 2024 in U.S." Billboard. Retrieved 15 January 2025.

- ^ a b c "Record Store Day - About Us". Recordstoreday.com. Retrieved 29 November 2016.

- ^ Passey, Brian (26 February 2011). "Vinyl records spin back into vogue". USA Today. Retrieved 2 March 2011.

- ^ "Record Store Day vinyl sales leap 87% year-on-year - News - Music Week". Musicweek.com. Retrieved 16 July 2017.

- ^ Helfet, Gabrielle (9 July 2018). "Over 7.6 million vinyl LPs were sold in the US during the first half of 2018". the vinyl factory. Retrieved 13 December 2018.

- ^ Helfet, Gabrielle (9 July 2018). "Over 7.6 million vinyl LPs were sold in the US during the first half of 2018". the vinyl factory. Retrieved 13 December 2018.

- ^ "New chart for record shop sales". The Independent. Independent News & Media. 18 April 2012. ISSN 0951-9467. OCLC 185201487. Archived from the original on 24 December 2012. Retrieved 20 April 2012.

- ^ "Independent record store chart launched in the UK". BBC News. London. 17 April 2012. Archived from the original on 25 April 2012. Retrieved 20 April 2012.

- ^ Kreisler, Laura (17 April 2012). "The new Official Record Store Chart is go!". London: Official Charts Company. Retrieved 20 April 2012.

- ^ "Okay, fine. Call them 'vinyls.'". The Washington Post. 17 April 2014. Retrieved 6 May 2022.

External links

[edit]Vinyl revival

View on GrokipediaHistorical Development

Decline of Vinyl Records

The decline of vinyl records accelerated in the late 1970s and 1980s as cassette tapes gained prominence due to their superior portability, lower production costs, and compatibility with emerging personal audio devices like the Walkman introduced in 1979. Cassettes overtook vinyl in US market share by 1984, representing over 50% of physical format revenues while vinyl's share fell below 40%.[6] By the end of the decade, vinyl unit shipments in the US had dropped significantly from their 1977 peak of 344 million LPs and EPs.[7] The 1990s saw the compact disc (CD) solidify its dominance, offering superior sound quality, durability, and random access playback, which appealed to consumers seeking an upgrade from analog formats. In 1993, CD revenues reached a record $6.5 billion, comprising over 50% of the US music market, rising to over 60% by 1994, while vinyl's share dwindled to less than 5%. By 1997, vinyl accounted for under 1% of total US recorded music revenues, with LP/EP shipments at just 2.7 million units.[8][9] This shift prompted major labels to curtail vinyl production; Sony halted manufacturing in 1989, citing the CD's rapid adoption.[10] The advent of digital technologies further marginalized vinyl in the late 1990s and 2000s. Napster's launch in 1999 popularized peer-to-peer file sharing, disrupting physical sales and accelerating the move to digital downloads, while Spotify's 2008 debut introduced widespread streaming, reducing demand for tangible media. US vinyl sales continued their descent, falling below 3 million units by 1997.[9] Globally, numerous pressing plants closed amid dwindling orders, leaving production capacity limited to a few facilities in the US, such as United Record Pressing, and Europe, like Optimal Media in Germany, by the early 2000s.[11]Onset and Growth of the Revival

The vinyl revival began to take shape in the mid-2000s as independent labels increasingly embraced reissues of classic albums on analog formats, capitalizing on growing nostalgia among music enthusiasts. Labels like Light in the Attic Records, founded in 2002, played a pivotal role by reissuing obscure and out-of-print titles from the 1960s and 1970s. This trend was fueled by a small but dedicated collector base seeking the tactile and sonic qualities of vinyl amid the dominance of digital downloads. A key milestone came in 2009 with the establishment of Third Man Records by musician Jack White, which aggressively promoted analog recording and vinyl production as a counterpoint to digital music. The label, initially launched in 2001 as a vehicle for White's projects like The White Stripes, opened a Nashville storefront and pressing plant in 2009, focusing on limited-edition releases and live recordings to revive interest in physical media. White's advocacy, including his insistence on analog mastering, helped legitimize vinyl as a viable format for new music, inspiring other artists and labels to follow suit.[12] Cultural shifts further accelerated the revival through online communities and innovative artist releases. Forums like Vinyl Collective, established in 2004, became hubs for collectors to discuss, trade, and celebrate vinyl, fostering a sense of community that extended beyond traditional record stores.[13] Similarly, Radiohead's 2007 album In Rainbows was released in a limited-edition "discbox" format featuring double vinyl, CD, and digital download, allowing fans to "pay what you want" online before physical copies shipped; this approach not only generated buzz but also highlighted vinyl's premium appeal, with the edition selling out rapidly. The revival gained mainstream momentum in the early 2010s through blockbuster releases that drove significant vinyl sales. Adele's 2011 album 21 became a catalyst, with its vinyl edition contributing to the album's overall U.S. sales of over 5.8 million units that year, including notable physical format uptake as vinyl outsold expectations in a digital era.[14] Likewise, Taylor Swift's 2014 album 1989 boosted the trend, selling 3.66 million copies in the U.S. and marking one of the first major pop releases to emphasize vinyl variants, helping propel the format's visibility.[15] These events underscored vinyl's crossover appeal. By the late 2010s, the revival's growth was evident in surging U.S. sales figures, rising from approximately 1 million units in 2007 to 15.6 million in 2017, according to industry data, reflecting a compound annual growth rate that outpaced other formats. This demand prompted expansions in manufacturing infrastructure, such as at United Record Pressing in Nashville, which, as North America's largest plant, increased capacity in the 2010s through facility upgrades to handle the influx of orders, producing millions of discs annually by the decade's end.[16] Such developments addressed previous supply shortages and solidified vinyl's resurgence. This foundational expansion laid the groundwork for continued growth into the 2020s.Recent Trends in the 2020s

The COVID-19 pandemic significantly accelerated the vinyl revival through increased home listening, with U.S. vinyl LP units reaching 22.9 million in 2020, a 24% increase from 18.5 million in 2019.[17] This surge was driven by lockdowns that shifted consumer focus to physical media as an engaging alternative to digital streaming, contributing to vinyl comprising 62% of physical format revenues in the first half of the year.[18] Adoption among Generation Z has become a defining trend, with surveys indicating Gen Z as the driving force behind vinyl's popularity, motivated by the format's aesthetic appeal on platforms like TikTok and its collectible value. By 2025, younger demographics continued to view records as tangible art objects rather than solely audio sources.[19] Signs of a potential slowdown emerged in 2025, as U.K. vinyl sales rose only 6% year-over-year to 3.2 million units in the first half, hampered by lingering global supply chain disruptions following the 2022 peak demand.[20] These issues, including raw material shortages and production bottlenecks, have raised concerns about market saturation and sustainability beyond the post-pandemic boom.[21] Artists have adapted by emphasizing limited-edition releases and custom packaging to appeal to younger buyers, exemplified by Taylor Swift's Midnights (2022), which sold over 945,000 vinyl copies in the U.S. that year.[22] Such strategies, featuring unique variants and visual designs, enhance collectibility and align with social media-driven trends among Gen Z.[19]Reasons for the Revival

Cultural and Consumer Drivers

The vinyl revival has been propelled by consumers' nostalgia for a pre-digital era, where physical music formats evoked personal memories and emotional connections. In an age dominated by streaming and intangible media, vinyl offers a counterpoint through its tangible nature, allowing buyers to engage with music as a physical artifact rather than ephemeral data. This appeal is heightened by digital fatigue, with many seeking the ritualistic process of playing records as a mindful escape. For instance, a 2025 analysis by the Vinyl Alliance found that 50% of surveyed collectors view vinyl purchases as a deliberate break from digital overload, emphasizing its role in restoring a sense of presence and authenticity in music consumption.[19] Recent data from the same analysis highlights Generation Z (ages 18-24) as the primary driver, with 76% purchasing vinyl monthly.[19] A key draw lies in vinyl's aesthetic and social dimensions, which transform listening into a visually and communally rich experience. Large-format album artwork and detailed liner notes provide contextual depth—biographical insights, lyrics, and photography—that digital platforms often omit, turning records into cherished display pieces. Socially, this fosters sharing on platforms like Instagram via hashtags such as #VinylCollection, where users post curated setups to build online communities and express identity. Moreover, vinyl serves as a generational bridge, with family heirlooms like inherited collections introducing younger listeners to classic albums, strengthening intergenerational bonds through shared musical heritage.[23][24] Perceptions of superior sound quality further motivate adoption, with audiophiles often describing vinyl's analog warmth—characterized by subtle imperfections and dynamic range—as more immersive and emotionally resonant than compressed streaming audio, despite the subjectivity of such claims. Objective analyses may favor high-resolution digital for fidelity, but consumer surveys highlight the ritual and atmosphere of vinyl playback as enhancing perceived immersion. A 2023 Luminate survey revealed that among vinyl buyers, a notable portion prioritize this sensory engagement over convenience, with 50% lacking turntables yet valuing the format's evocative qualities.[25][26] Collector culture has surged alongside these drivers, with enthusiasts drawn to limited-edition variants like colored pressings and picture discs that prioritize visual artistry over standard black vinyl. These editions, often featuring vibrant hues or embedded imagery, appeal to buyers treating records as decorative or investment art rather than mere playback media. Data from 2023 indicates that 50% of U.S. vinyl purchasers did not own turntables, underscoring a shift toward collecting for aesthetic and status value.[26] Industry efforts to produce such variants have amplified this trend, catering directly to consumer desires for uniqueness.Industry and Technological Factors

Major record labels have significantly invested in vinyl production infrastructure to meet growing demand during the revival. In response to surging interest, companies like Universal Music Group expanded their manufacturing capabilities.[27] For instance, by the late 2010s, major labels collaborated with independent pressers to address bottlenecks, as vinyl sales approached 50 million units annually in the early 2020s.[28] This included strategic investments in new equipment and capacity expansions at plants like those operated by GZ Media.[29] Artist endorsements have further propelled the revival through exclusive vinyl releases that leverage fan-driven economies. Billie Eilish's 2021 album Happier Than Ever was offered as a limited-edition golden yellow vinyl exclusively through her official store, creating scarcity and boosting direct sales to supporters.[30] Similarly, BTS capitalized on fan loyalty with limited-edition vinyl singles like the 2021 Butter 7-inch release, which sold out rapidly and tied into broader merchandise strategies to engage their global audience.[31] Technological advancements in vinyl production have enhanced quality and accessibility, enabling high-fidelity masters suitable for modern releases. Contemporary lathe-cutting techniques, such as Direct Metal Mastering (DMM), allow for precise groove engraving that preserves audio detail without the surface noise common in older methods, using advanced lathes like the Neumann VMS series upgraded for digital integration. Additionally, manufacturers like Audio-Technica introduced affordable turntables starting around 2010, with models like the AT-LP60 series seeing price reductions to under $100 through economies of scale, making playback equipment widely available to new consumers.[32][33][34] The expansion of distribution networks has scaled the revival by improving access to vinyl products. Discogs, founded in 2005, evolved into a premier online marketplace for buying and selling records, facilitating global transactions among collectors and labels with its comprehensive database. By 2015, Amazon redesigned its vinyl section to highlight new releases and promotions, including giveaways that drew in mainstream shoppers and integrated vinyl seamlessly into e-commerce logistics. These platforms have collectively broadened reach, supporting both independent and major label distributions.[35][36]Market Analysis and Sales

Global and Regional Sales Data

The global vinyl record market reached a valuation of $1.9 billion in 2024, marking continued expansion as the format accounted for the majority of physical music sales worldwide.[37] According to the International Federation of the Phonographic Industry (IFPI), vinyl revenues grew by 4.6% that year, achieving 18 consecutive years of increases amid a broader recorded music industry revenue of $29.6 billion.[38] Projections for 2025 indicate a slight dip in growth due to economic pressures, with early data showing moderated unit sales in key markets.[20] The United States maintained dominance in the vinyl sector, selling 43.6 million units in 2024 and comprising a dominant share of global totals.[3] In 2023, U.S. vinyl shipments totaled 43.2 million units, generating $1.35 billion in revenue per the Recording Industry Association of America (RIAA).[3] For the first half of 2025, the RIAA reported 22.1 million units sold, a 1% decline from 22.3 million in the same period of 2024, reflecting early signs of stabilization.[5] In Europe, the United Kingdom led with 6.7 million vinyl units sold in 2024, the highest volume in three decades and up 9.1% year-over-year according to the British Phonographic Industry (BPI).[39] Germany recorded about 3 million vinyl LP sales that year, while France exceeded 5 million units, bolstered by European Union-supported reissue initiatives.[40][41] Other regions showed varied but promising trends, with Asia's Japan achieving roughly 2.7 million vinyl units in 2023 based on 6.3 billion yen in revenue, per the Recording Industry Association of Japan.[42] Emerging markets like Brazil exhibited 20% annual growth in physical formats, predominantly vinyl, contributing to a 21% rise in overall recorded music revenues during the first half of 2024.[43][44]| Region | 2024 Units Sold (millions) | Key Source |

|---|---|---|

| United States | 43.6 | RIAA |

| United Kingdom | 6.7 | BPI |

| Germany | ~3 | BfM |

| France | ~5.5 (2023 est.) | SNEP |

| Japan (2023) | ~2.7 | RIAJ |

_02.jpg/250px-Feria_del_Disco_de_Coleccionista_en_Barcelona_(Abril_2016)_02.jpg)

_02.jpg/1500px-Feria_del_Disco_de_Coleccionista_en_Barcelona_(Abril_2016)_02.jpg)