Recent from talks

All channels

Be the first to start a discussion here.

Be the first to start a discussion here.

Be the first to start a discussion here.

Be the first to start a discussion here.

Welcome to the community hub built to collect knowledge and have discussions related to Amtrak.

Nothing was collected or created yet.

Amtrak

View on Wikipediafrom Wikipedia

Not found

Amtrak

View on Grokipediafrom Grokipedia

Amtrak, formally the National Railroad Passenger Corporation, is a federally chartered for-profit corporation responsible for operating intercity passenger rail services in the United States.[1] Created by the Rail Passenger Service Act of 1970 to relieve private freight railroads of their money-losing passenger operations, Amtrak commenced service on May 1, 1971, assuming control of most existing routes from carriers like Penn Central and Southern Railway.[2] Its network spans approximately 21,000 route miles, serving 524 stations across 46 states, the District of Columbia, and three Canadian provinces, with connecting Thruway bus services extending reach further.[2] Amtrak's services are divided into the high-speed Northeast Corridor (including the Acela brand), state-supported short-distance routes, and long-distance trains connecting major regions.[2] In fiscal year 2024, it carried a record 32.8 million passengers, up 15% from the prior year, driven by post-pandemic recovery and expansions like increased frequencies on routes such as the Capitol Limited.[3] The corporation employs around 17,000 workers and maintains infrastructure critical to the Northeast Corridor, where it owns tracks outright, while sharing freight-owned lines elsewhere.[4] Notable achievements include modernizing stations like New York's Moynihan Train Hall and achieving all-time ridership highs amid competition from automobiles and airlines.[5] Despite these gains, Amtrak has incurred operating losses every year since inception, posting a $1.8 billion deficit in fiscal year 2024, with long-distance routes alone contributing $635 million in shortfalls.[6] It depends on annual federal appropriations—totaling billions over decades—to cover deficits and capital needs, as ticket revenues fail to offset costs due to low load factors outside peak corridors and high infrastructure expenses.[7] Controversies persist over efficiency, with critics highlighting persistent subsidies exceeding $2 billion yearly in recent budgets and safety incidents like derailments on shared tracks, underscoring causal challenges from freight priority and deferred maintenance.[8] Amtrak's role endures as the sole national passenger rail provider, though debates continue on privatization or route rationalization to align with market realities.[9]

History

Private Rail Era Preceding Amtrak

![The Congressional train of the Pennsylvania Railroad][float-right] Intercity passenger rail service in the United States was operated exclusively by privately owned railroads from the mid-19th century until 1971.[10] These companies, numbering over 1,000 at their peak but consolidating into fewer Class I carriers by the 20th century, provided extensive networks connecting major cities and regions.[11] Passenger volumes reached a historical high during World War II due to gasoline rationing and aviation restrictions, but demand began eroding post-war as private automobiles, federally funded interstate highways, and commercial air travel offered faster, more flexible alternatives for most trips.[12] Rail passenger-miles, a measure of total distance traveled by passengers, plummeted from approximately 67 billion in the peak era to just 6.2 billion by 1970.[10] Non-commuter intercity travel specifically declined by 84 percent between 1945 and 1964, reflecting shifts in consumer preferences toward personal vehicles and planes.[13] By the 1950s, annual industry-wide losses on passenger operations exceeded $700 million, with a recorded deficit of $704.5 million in 1953 alone despite carrying 201 million passengers that year.[14][15] Commuter services fared similarly, dropping 80 percent from over 2,500 daily trains in the mid-1940s to far fewer by the 1960s, as urban sprawl and subsidized highways further eroded ridership.[14] Private railroads often subsidized unprofitable passenger trains to promote freight business or maintain mail contracts, but escalating deficits strained their finances amid rising labor, maintenance, and fuel costs.[11] The Interstate Commerce Commission (ICC) imposed strict regulations, frequently denying requests to discontinue money-losing routes despite evidence of chronic underutilization, exacerbating losses and contributing to insolvencies, particularly in the Northeast Corridor where carriers like the Pennsylvania Railroad and New York Central merged into the Penn Central in 1968 amid bankruptcy threats.[11][10] By the late 1960s, most passenger services operated at a deficit, with frequencies reduced from daily to tri-weekly on many lines and outright eliminations on others, prompting congressional intervention.[16] These mounting pressures culminated in the Rail Passenger Service Act of 1970, signed into law on October 30, 1970, which authorized the creation of the National Railroad Passenger Corporation (Amtrak) to assume intercity passenger operations from willing private carriers, relieving them of obligations while preserving a basic national network.[12][17] The Act reflected recognition that private enterprise could no longer sustain passenger rail without government involvement, given competitive disadvantages and regulatory burdens that had rendered it economically inviable for most operators.[18]Formation and Nationalization in 1971

By the late 1960s, U.S. private railroads faced mounting financial losses from intercity passenger services, exacerbated by competition from automobiles, subsidized highways, and airlines, leading to a decline in ridership that began after World War I.[12] In 1964 alone, the Pennsylvania Railroad reported passenger service losses of $34.8 million, reflecting broader industry trends where passenger operations subsidized freight but increasingly drained resources amid regulatory mandates to maintain unprofitable routes.[19] Congress responded with the Rail Passenger Service Act of 1970 (Public Law 91-518), signed by President Richard Nixon on October 30, 1970, which established the National Railroad Passenger Corporation (NRPC) as a for-profit entity to assume responsibility for most intercity passenger rail operations, relieving participating private railroads of their common carrier obligations for such services.[12] The Act allowed railroads to opt out by either joining the NRPC or paying a fee to exit passenger service entirely; of the 26 remaining passenger-operating railroads, most chose to discontinue, transferring operations to the new corporation by May 1, 1971.[1][20] Incorporated in the District of Columbia in early 1971, the NRPC—branded as Amtrak—commenced nationwide operations on May 1, 1971, initially running 21 routes across 43 states using equipment and tracks owned by private freight railroads under contract, without acquiring rights-of-way or infrastructure at inception.[1][21] This structure effectively consolidated fragmented, money-losing passenger services into a single quasi-public entity reliant on federal subsidies, marking a shift from private to nationalized management of intercity rail travel, though Amtrak operated independently rather than as a direct government agency.[12]1970s: Route Rationalization and Early Operations

Amtrak began intercity passenger rail operations on May 1, 1971, taking over most U.S. private railroad passenger services as mandated by the Rail Passenger Service Act of 1970. The initial network consisted of 21 key routes designated as the "basic system" by the Department of Transportation, operating roughly 180 daily trains across 43 states and the District of Columbia, serving more than 500 stations.[22] [23] The inaugural train, a commuter "Clocker" service numbered 235, departed New York Penn Station at 12:05 a.m. for Philadelphia.[24] Early operations depended on inherited rolling stock and crews from former private carriers, which frequently prioritized freight traffic, resulting in chronic delays and unreliable schedules. Equipment, often decades old and poorly maintained under previous owners burdened by unprofitable passenger deficits, suffered frequent breakdowns, exacerbating service disruptions. Amtrak's first-year ridership reached about 6.8 million passengers, yet operating losses exceeded $200 million, necessitating immediate route reviews to stem financial hemorrhage driven by low density outside major corridors and competition from automobiles and airlines.[25] Route rationalization commenced swiftly, with Amtrak seeking discontinuance approvals from the Interstate Commerce Commission for underperforming lines. By November 1971, after schedule adjustments in July and adoption of proprietary train numbering, numerous short branches and low-ridership extensions were curtailed, halving the effective route mileage from initial levels. This pruning concentrated service on high-volume axes like the Northeast Corridor between Washington and Boston, Chicago hub spokes, and select transcontinental paths such as New York to Florida and Chicago to Seattle.[26] Throughout the decade, incremental cuts continued amid persistent subsidies and congressional oversight; for instance, in 1979, six long-distance trains—including the Chicago-Miami Floridian and Washington-St. Louis National Limited—were eliminated to redirect funds toward viable segments, reflecting empirical assessments of patronage viability over political retention of marginal services. Operational enhancements included introduction of new motive power like the EMD SDP40F locomotives in 1973 for long-haul reliability, though freight dispatching conflicts and union work rules sustained performance issues, with on-time rates often below 70% on non-owned tracks.[27][26]1980s-1990s: Incremental Changes Amid Financial Strains

During the 1980s, Amtrak confronted persistent financial deficits exacerbated by attempts from the Reagan administration to curtail federal subsidies. In fiscal year 1982, the administration proposed reducing Amtrak's operating subsidy to $669 million, a cut from prior levels, prompting Amtrak to request $716 million while facing immediate service reductions on several routes due to budget constraints.[28] [29] Congress ultimately preserved funding, but at levels insufficient to eliminate annual losses, which stemmed from revenues covering only a fraction of operating costs amid competition from automobiles and airlines.[10] Ridership, which had peaked at 21.2 million passengers in fiscal year 1980 carrying 4.6 billion passenger-miles, declined through the decade to stabilize around 20 million annually, reflecting broader economic shifts and limited route expansions.[30] Incremental operational enhancements provided modest relief. In 1985, Amtrak introduced bi-level Superliner cars on western long-distance routes, increasing seating capacity and improving amenities like upper-level lounges and dining areas to boost passenger appeal and revenue potential.[31] These changes, alongside efficiency measures, helped stabilize performance by the mid-1980s, though systemic issues such as aging infrastructure and freight rail priority on shared tracks continued to hinder reliability. Financial strains persisted, with deficits hovering around $700 million annually by the late 1980s, necessitating private borrowing to sustain operations.[32] Entering the 1990s, Amtrak pursued targeted infrastructure investments, particularly in the Northeast Corridor, where upgrades to electrification and signaling aimed to enhance speeds and service frequency for Metroliner trains.[25] However, these expenditures contributed to escalating debt, with losses reaching $1.18 billion by the mid-decade as subsidies failed to bridge the revenue-expense gap.[32] Ridership began recovering modestly in the early 1990s, driven by economic growth and marketing efforts, yet the corporation's dependence on federal aid underscored the absence of a viable path to profitability without fundamental restructuring.[33] Route rationalizations, including consolidations under brands like NortheastDirect in 1995, reflected ongoing efforts to prune unprofitable services amid fiscal pressures.[34]2000s-2010s: Post-9/11 Recovery and Infrastructure Push

Following the September 11, 2001, terrorist attacks, Amtrak experienced an initial surge in ridership as air travel declined sharply due to security concerns and grounded flights, with officials reporting nationwide passenger volumes 10% to 17% above normal levels in the immediate aftermath.[35][36] However, this boost proved temporary; September 2001 ridership fell 6.4% year-over-year, and the fiscal year 2001 total reached 23.5 million passengers, a modest increase from 23.0 million in fiscal year 2000 but amid mounting financial pressures.[37][38] Amtrak reported a record $1.1 billion operating loss for fiscal year 2001, exacerbated by reduced revenues from the recession and post-attack disruptions, prompting warnings of potential service shutdowns by mid-2002 without additional federal aid.[39][40] Congress responded with emergency appropriations, including debt restructuring and $3.5 billion in multiyear funding commitments, averting collapse but highlighting Amtrak's ongoing dependence on subsidies amid infrastructure deferred maintenance and freight priority on shared tracks.[41] Ridership stabilized and began recovering in subsequent years, climbing to 23.3 million in fiscal year 2002 and 24.6 million in 2003, driven by Northeast Corridor (NEC) growth and expanded state partnerships.[38] The launch of Acela Express on December 11, 2000, aimed to capitalize on demand for faster service between Washington, D.C., and Boston, achieving speeds up to 150 mph on upgraded segments, but early operations were hampered by mechanical failures, including brake rotor wear that sidelined the fleet in 2002 and 2005, as well as premature wheel degradation from the train's tilting mechanism on curved tracks.[42][43][44] These issues delayed full revenue potential, though Acela contributed to NEC ridership gains, with overall Amtrak passengers reaching 28.7 million by fiscal year 2008 before dipping to 27.2 million in 2009 amid the Great Recession.[45] A push for infrastructure investment intensified in the late 2000s, culminating in the Passenger Rail Investment and Improvement Act (PRIIA) of 2008, which reauthorized Amtrak through fiscal year 2013, authorized $15.4 billion in grants for capital improvements and state-supported services, and mandated better on-time performance metrics while shifting some short-distance operating costs to states.[46] PRIIA facilitated expansions like increased frequencies on state lines in Virginia and Maine's Downeaster, boosting regional ridership.[47] The American Recovery and Reinvestment Act (ARRA) of 2009 allocated approximately $450 million to Amtrak for NEC enhancements, including concrete tie replacements to improve track reliability and high-speed potential, alongside $8 billion nationwide for intercity rail development, though much of the latter funded planning rather than immediate builds.[48][49] Amtrak's 2010 NEC Infrastructure Master Plan outlined $52 billion in upgrades over decades to achieve true high-speed rail at 220 mph, prioritizing state-of-good-repair projects like bridge rehabilitations and electrification extensions, though funding constraints limited progress to incremental fixes amid shared use with commuter and freight operators.[50][51] By fiscal year 2010, ridership rebounded to about 28.7 million, reflecting sustained NEC dominance—accounting for over half of passengers—and state investments, setting the stage for records like 31.2 million in 2012 despite persistent subsidies covering 70-80% of operating costs.[52][53]2020s: Record Ridership, Upgrades, and Funding Battles

The COVID-19 pandemic caused Amtrak's ridership to plummet, with fiscal year 2020 recording only 16.4 million passengers amid travel restrictions and economic shutdowns.[5] Federal relief through the CARES Act and subsequent appropriations, totaling billions in emergency funding, allowed Amtrak to maintain operations and avoid widespread service cuts.[54] By fiscal year 2023, ridership had recovered to near pre-pandemic levels, and in fiscal year 2024 (October 2023 to September 2024), Amtrak achieved an all-time record of 32.8 million passengers, a 15% increase from the prior year, driven primarily by strong demand on the Northeast Corridor (NEC) and state-supported routes.[5][55] Ticket revenues reached a historic $2.5 billion, up 9% year-over-year, reflecting sustained post-pandemic travel preferences for rail amid highway congestion and air travel frustrations.[5] Infrastructure upgrades accelerated in the early 2020s, bolstered by the Infrastructure Investment and Jobs Act (IIJA) of 2021, which allocated $66 billion in new funding for passenger and freight rail improvements, including significant portions for Amtrak's national network and NEC.[56] Key projects included the January 1, 2021, opening of Moynihan Train Hall in New York City as the primary terminus for Empire Service trains, enhancing capacity and passenger experience at Penn Station. Amtrak advanced rail yard modernizations in Boston, New York, and Washington, D.C., to support incoming Airo trainsets and Next Generation Acela high-speed trains, with design-build contracts awarded in 2025 to improve maintenance efficiency and reduce turnaround times.[57] Additional IIJA-funded initiatives encompassed $16.4 billion for 25 NEC projects in 2023, targeting track capacity, electrification, and reliability enhancements, alongside $126 million in 2024 grants for safety and infrastructure upgrades like bridge replacements and signal improvements.[58][59] Funding for these expansions faced challenges from freight railroad operators, who control much of Amtrak's long-distance trackage and prioritize their shipments under federal law, leading to persistent delays and opposition to proposed passenger priority reforms.[60] The IIJA's rail provisions, while bipartisan, encountered scrutiny in congressional oversight hearings, such as the 2023 House Transportation Committee session examining Amtrak's capital spending, operational efficiency, and growth plans amid calls for fiscal accountability.[61] Critics, including some policymakers advocating privatization, argued that Amtrak's reliance on annual subsidies—projected at $2.4 billion for fiscal year 2026—undermines long-term viability without structural reforms to address cost overruns and route profitability.[62] Nonetheless, the influx of federal dollars enabled Amtrak to triple its annual infrastructure investment by fiscal year 2025, focusing on NEC bottlenecks and national corridor expansions despite these tensions.[63] By mid-2025, ongoing projects under the NEC Commission underscored commitments to $105 billion in transformative investments, though full realization depends on continued appropriations and resolution of intermodal conflicts.[64]Governance and Leadership

Organizational Structure and Oversight

Amtrak is structured as a for-profit corporation under the National Railroad Passenger Corporation, with operations managed through a hierarchical executive leadership team reporting to a Board of Directors.[1] The board, consisting of 10 members including nine appointed by the President of the United States and confirmed by the Senate—among them the Secretary of Transportation or designee—sets corporate policy, oversees strategic direction, and evaluates financial and operational performance to fulfill Amtrak's statutory mandate under the Rail Passenger Service Act of 1970.[1][65] The President and CEO serves as a non-voting board member and leads day-to-day management, supported by executive vice presidents overseeing key functions such as finance, operations, marketing, and capital delivery.[66] Federal oversight is primarily exercised by the U.S. Department of Transportation (USDOT) through the Federal Railroad Administration (FRA), which administers grants, enforces safety regulations, and monitors compliance with performance metrics tied to annual appropriations.[1] Congress provides legislative oversight via the annual budgeting process, authorizing subsidies that covered approximately $2.4 billion in operating and capital needs for fiscal year 2023, while the Amtrak Office of Inspector General conducts independent audits and investigations to ensure accountability and detect inefficiencies.[67][68] This framework balances operational autonomy with public accountability, though FRA's grants management has faced criticism for lacking comprehensive metrics in prior evaluations.Board Composition and Key Executives

The Amtrak Board of Directors oversees the corporation's strategic direction and operations, with members nominated by the President of the United States and confirmed by the Senate for five-year terms, renewable until a successor qualifies.[65] The board comprises eight appointed directors, the Secretary of Transportation (or designee), and the chief executive officer as a non-voting member.[65] As of October 2025, the CEO position remains vacant after Stephen Gardner's resignation on March 19, 2025, amid administration transitions.[69][65] Current board members include:| Member | Role |

|---|---|

| Anthony R. Coscia | Chairman |

| Joel Szabat | Vice Chairman |

| Sean Duffy | Secretary of Transportation |

| Ronald Batory | Director |

| David Capozzi | Director |

| Lanhee Chen | Director |

| Elaine Clegg | Director |

| Christopher C. Koos | Director |

Operations

Route Network and Service Lines

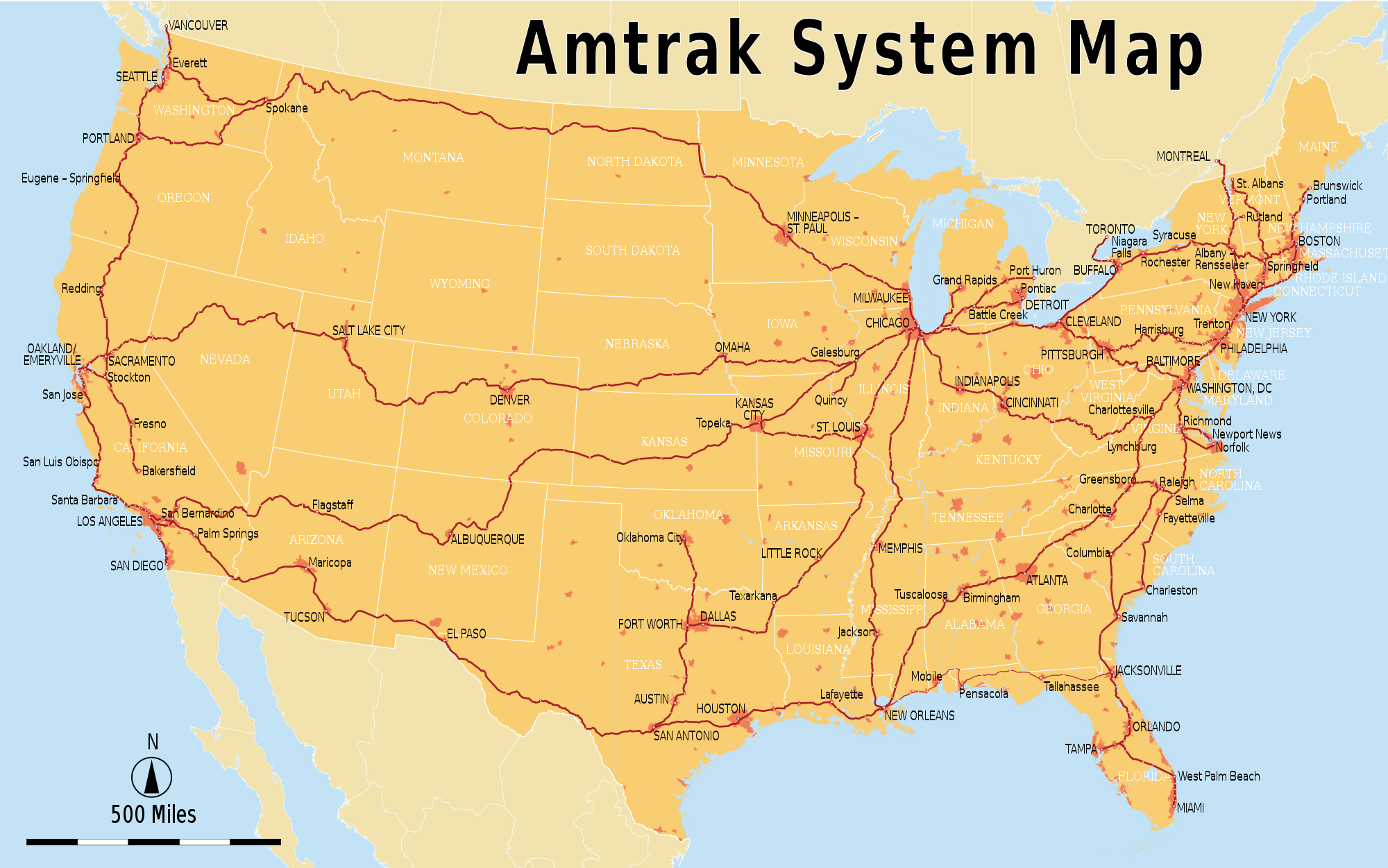

Amtrak's route network encompasses over 21,000 route miles across 46 states and the District of Columbia, plus service to three Canadian cities, connecting more than 500 stations with daily operations of approximately 300 trains.[72] The system is divided into three primary categories: the high-density Northeast Corridor (NEC), state-supported short- and medium-distance corridors, and long-distance national network routes. Amtrak owns roughly 457 miles of track, primarily the NEC from Washington, D.C., to Boston and the Keystone Corridor from Philadelphia to Harrisburg, Pennsylvania, while the remainder operates under trackage rights on privately owned freight railroads, which often results in shared usage and priority conflicts.[73] The NEC, Amtrak's busiest segment spanning 457 miles, hosts the Acela, providing express high-speed service between Boston and Washington, D.C., with top speeds of 150 mph on dedicated sections, and the Northeast Regional, offering more frequent stops across the same corridor plus extensions to Springfield, Massachusetts, and Virginia cities like Norfolk and Roanoke.[74][75] These services account for the majority of Amtrak's ridership, with over 12 million passengers annually on the NEC alone as of fiscal year 2023, though exact 2025 figures reflect continued post-pandemic recovery. Adjacent corridors include the Empire Corridor from New York to Niagara Falls via Albany and Buffalo, and the Keystone Service between New York and Harrisburg.[76] State-supported routes, funded through partnerships with over 20 states and the District of Columbia, comprise about 60% of Amtrak's short-distance services, including the Capitol Corridor (Auburn to San Jose, California), Hiawatha Service (Chicago to Milwaukee), and Pacific Surfliner (San Diego to San Luis Obispo, California). These typically operate multiple daily round trips over distances under 500 miles, emphasizing commuter-like connectivity in regions like the Midwest, Pacific Northwest, and California.[77] Expansions as of 2025 include extended service to new endpoints like Charlottesville, Virginia, on select Northeast Regional trains, driven by state investments under the Infrastructure Investment and Jobs Act.[73] Long-distance routes form the backbone of Amtrak's national network, with 15 daily trains linking distant cities over routes exceeding 750 miles, such as the California Zephyr (Chicago to Emeryville, California, serving San Francisco via bus connection), Coast Starlight (Seattle to Los Angeles), and Southwest Chief (Chicago to Los Angeles).[78] These services traverse scenic but freight-heavy lines, operating one daily round trip each, and connect to international destinations like Montreal via the Adirondack. Despite lower ridership compared to corridors—averaging under 1,000 passengers per train—these routes maintain cross-country connectivity, subsidized federally to preserve nationwide access absent profitable private alternatives.[79]| Service Category | Key Examples | Approximate Mileage | Daily Trains |

|---|---|---|---|

| Northeast Corridor | Acela, Northeast Regional | 457 miles (owned) | 160+ |

| State-Supported | Capitol Corridor, Hiawatha, Keystone | Varies (100-500 miles) | 100+ |

| Long-Distance | California Zephyr, Empire Builder, Southwest Chief | 1,700-2,800 miles | 30 (2 per route) |

On-Time Performance and Causes of Delays

Amtrak's on-time performance, defined as the percentage of customers arriving within a schedule tolerance (typically 15-30 minutes depending on route length), has historically lagged behind the Federal Railroad Administration's 80% standard for most operations outside the Northeast Corridor (NEC). In fiscal year 2023, system-wide on-time performance hovered around 75%, with notable improvements in select quarters reaching 78% but still falling short overall. Performance on the NEC, where Amtrak controls infrastructure, fares better: Acela Express achieved approximately 85% on-time arrivals in FY2023 quarters, while Northeast Regional services averaged 70-80%. In contrast, long-distance routes on shared freight tracks often record below 50%, as seen with the Empire Builder at 38% and the Southwest Chief at 42% for FY2023. State-supported corridors vary, with Washington's Amtrak Cascades at 55% for the year.[80][81][82] The predominant cause of delays stems from freight train interference on tracks owned by Class I railroads like BNSF and Union Pacific, which Amtrak shares for over 70% of its mileage outside the NEC. Freight carriers, prioritizing their profit-driven schedules, frequently fail to yield to Amtrak despite statutory preference granted by the 1973 Amtrak Improvement Act and reinforced in the 2008 Passenger Rail Investment and Improvement Act; this resulted in 850,000 minutes of passenger delay in 2024 alone, comprising the largest share of total delay minutes. Amtrak's host railroad report cards, issued annually, grade carriers on metrics like delay minutes per 10,000 train-miles, with most failing the 900-minute threshold correlated to 80% on-time arrivals; for instance, in the 2024 report, BNSF and CSX scored poorly on compliance incentives. Enforcement remains weak due to Amtrak's limited contractual leverage and reliance on voluntary agreements, though the 2021 Infrastructure Investment and Jobs Act introduced penalties up to $300 per minute for egregious violations starting in 2022.[83][84][85] Secondary factors include Amtrak's internal issues such as mechanical failures, crew shortages, and aging infrastructure like slow-speed signals and track curvature, which account for 20-30% of delays per Bureau of Transportation Statistics data through 2023. Weather-related disruptions, including winter storms on northern routes, and maintenance windows further compound problems, though these are less controllable than freight priority disputes. Department of Transportation Inspector General audits have identified statistically significant host-controllable delays, urging better data-sharing and arbitration mechanisms, yet systemic underinvestment in dedicated passenger tracks perpetuates the cycle. Efforts like positive train control implementation have mitigated some signal delays since 2020, but overall, freight dominance on shared rights-of-way—rooted in post-1971 deregulation favoring cargo—remains the causal bottleneck.[81][86][87]Ridership Patterns and Metrics

Amtrak's ridership metrics reveal a concentration in the Northeast Corridor (NEC), where high-frequency services like the Northeast Regional and Acela account for the majority of passengers, while long-distance routes contribute a smaller share despite covering vast distances. In fiscal year 2024 (FY24, ending September 30, 2024), Amtrak achieved a record 32.8 million passengers, marking a 15% increase from FY23's approximately 28.5 million and surpassing pre-pandemic peaks driven by recovering demand and service expansions.[5][88] This growth reflects broader post-COVID trends, with ridership rebounding from a 95% drop in spring 2020 to exceed 2019 levels by FY24, influenced by reduced air travel competition and urban density advantages in the NEC.[54][9] Historical patterns show steady NEC growth from the 1970s onward, with total ridership rising from 16.6 million in 1972 to around 21 million by 1981, stagnating in the 1980s-1990s amid financial constraints, then accelerating in the 2010s to pre-COVID records near 32 million in FY19.[5] Long-distance services, comprising about 12-15% of ridership, exhibit slower growth and higher vulnerability to economic downturns, fuel price fluctuations, and competition from automobiles and airlines, as these routes serve lower-density areas with longer travel times.[89] In contrast, NEC routes benefited from infrastructure investments, yielding load factors often exceeding 70% on peak services.[90] Key metrics highlight disparities: In FY23, Northeast Regional carried 9.16 million passengers and Acela 2.96 million, together over half of total ridership, while routes like the Sunset Limited managed only 76,937 passengers in FY24.[91][89] Busiest stations, such as New York Penn Station and Washington Union Station, handle millions annually, underscoring urban hub reliance, with FY24 ticket revenue reaching a record $2.5 billion largely from NEC premium services.[5] Seasonal peaks occur in summer and holidays, amplified by tourism, though overall patterns correlate with GDP growth and unemployment rates, with delays from freight congestion reducing reliability and thus repeat usage on non-NEC lines.[90][92]| Fiscal Year | Total Passengers (millions) | NEC Share (%) | Notes |

|---|---|---|---|

| 1972 | 16.6 | N/A | Inception baseline[5] |

| 1981 | 21.0 | N/A | Early growth peak[5] |

| FY19 | ~31.8 | ~60 | Pre-COVID record[9] |

| FY23 | 28.5 | ~55 | Post-COVID recovery[88] |

| FY24 | 32.8 | ~60 | All-time high[5] |

Equipment and Rolling Stock

Locomotive and Car Inventory

Amtrak's locomotive inventory comprises diesel-electric units for the majority of its national network and electric units confined to the electrified Northeast Corridor. As of October 2023, the active diesel fleet totaled 320 locomotives, including 168 GE P42DC models serving as the primary power for long-distance trains, 45 Siemens ALC-42 units introduced as replacements for aging P40s and P42s, 16 GE P32-8BWH locomotives for state-supported services, 11 GE P40PH units in limited use, 18 P32AC-DM dual-mode locomotives for transitions between electrified and non-electrified tracks, and 62 state-owned Siemens SC-44 Charger locomotives deployed on routes like the Amtrak Cascades and Heartland Corridor.[93] The electric fleet consisted of 66 Siemens ACS-64 locomotives powering Acela and other NEC services, alongside 6 older Bombardier HHP-8 units retained for secondary duties.[93] Deliveries of additional ALC-42 locomotives continued into 2024 and 2025 to phase out older Genesis-series units amid reliability concerns and emissions standards.[93]| Locomotive Type | Builder | Quantity (Oct 2023) | Primary Use |

|---|---|---|---|

| GE P42DC | GE | 168 | Long-distance diesel |

| Siemens ALC-42 | Siemens | 45 | Long-distance replacement |

| GE P32-8BWH | GE | 16 | State corridors |

| GE P40PH | GE | 11 | Limited service |

| P32AC-DM | GE | 18 | Dual-mode NEC |

| Siemens SC-44 | Siemens | 62 (state-owned) | State-supported routes |

| Siemens ACS-64 | Siemens | 66 | NEC electric |

| Bombardier HHP-8 | Bombardier/Alstom | 6 | NEC backup |

| Car Type | Quantity (Oct 2023) | Configuration | Primary Routes |

|---|---|---|---|

| Amfleet I | 445 | Single-level | NEC/Regional |

| Amfleet II | 135 | Multi-level | NEC |

| Superliner I/II | 380 | Bi-level | Long-distance West |

| Viewliner I/II | 143 | Single-level | Long-distance East |

| Horizon | 56 | Single-level | Midwest |

| Other (Acela, state cars) | 365 | Varied | Specialized |

Fleet Modernization Efforts

Amtrak's fleet modernization efforts focus on replacing decades-old locomotives and passenger cars with equipment that improves reliability, passenger comfort, energy efficiency, and emissions compliance, driven by federal funding from the Infrastructure Investment and Jobs Act of 2021. These initiatives address the operational limitations of inherited rolling stock from the 1970s and 1980s, such as frequent mechanical failures and incompatibility with modern infrastructure. The overall program includes procurement of new trainsets for high-speed, regional, and long-distance services, alongside supporting infrastructure upgrades at maintenance facilities.[94][95] On the Northeast Corridor, Amtrak launched NextGen Acela service on August 28, 2025, utilizing advanced trainsets designed for speeds up to 160 mph, with 27% more seating capacity, upgraded interiors including larger windows and improved Wi-Fi, and enhanced safety features like automatic train control integration. These trains, developed in partnership with Alstom and Siemens, replace the original Acela Express fleet introduced in 2000, aiming to boost on-time performance amid growing ridership. Concurrently, the Amtrak Airo fleet—comprising 83 trainsets from Siemens—began phased rollout in 2025 for Northeast Regional, Empire Service, and state-supported routes like Amtrak Cascades, featuring ergonomic seating for up to 440 passengers per set, spacious restrooms, and a redesigned café car, with top speeds of 125 mph and reduced fuel consumption compared to Amfleet cars.[96][97][98] Locomotive upgrades emphasize diesel-electric models for non-electrified routes. In June 2022, Amtrak ordered 50 additional ALC-42 Charger locomotives from Siemens Mobility, building on a prior 75-unit contract; each delivers 4,400 horsepower, achieves 125 mph, and complies with EPA Tier 4 emissions standards, reducing nitrogen oxide output by 89% relative to predecessors like the GE Genesis series. These units support both Airo trainsets and long-distance operations, with deliveries ongoing into the late 2020s to phase out units averaging over 20 years in service.[99] Long-distance fleet replacement targets the obsolescence of Superliner bi-level cars (introduced 1979–1990s) and Viewliner single-level sleepers (1990s–2000s), which suffer from corrosion, outdated HVAC systems, and limited accessibility. Amtrak initiated procurement in 2023 for new sleeping, lounge, and diner cars, with plans to issue requests for proposals for single-level replacements in 2025 and select a bi-level Superliner successor vendor by 2026; the program envisions modular designs for easier maintenance and potential biofuel compatibility, funded by over $1 billion in targeted appropriations. To accommodate these assets, Amtrak awarded contracts in August 2025 for yard modernizations in Boston, New York, and Washington, D.C., enhancing capacity for high-speed train servicing and reducing turnaround times.[100][57]Passenger Services

Classes of Service and Amenities

Amtrak offers tiered classes of service including Coach, Business, Acela First Class, and private sleeping accommodations on long-distance routes, with amenities scaled to enhance comfort, convenience, and privacy based on fare paid and train type.[101] Coach serves as the baseline economy option across nearly all routes, while premium classes provide added space, meals, and priority access. Sleeping cars function as mobile hotels with included meals and attendant support, primarily on overnight trains. Free Wi-Fi is available on most services, though bandwidth may vary, and power outlets are standard in seating areas.[102] Coach Class features wide, reclining seats measuring about 23 inches across with up to 39 inches of legroom, no middle seats on reserved trains, fold-down tray tables, individual reading lights, and 120V outlets at each seat. Restrooms occupy ends of cars, and on routes exceeding 2.5 hours, a cafe car sells snacks, sandwiches, and hot meals via cashless payment. Bicycles can be accommodated in designated racks or boxes on select trains. This class accommodates the majority of passengers, emphasizing affordability over luxury.[103][104][101] Business Class, provided on regional corridors like the Keystone Service, Empire Service, and non-Acela Northeast routes, upgrades seating with deeper recline, extra legroom exceeding Coach, and larger windows for better views. Amenities include complimentary soft drinks, coffee, tea, and light snacks served at seats, plus priority boarding where offered. It targets short-to-medium hauls under 500 miles, bridging economy and premium without full meal service.[105][106] Acela First Class operates solely on the Northeast Corridor's high-speed Acela trains between Boston and Washington, D.C., offering leather seats with enhanced cushioning and recline, at-seat power, USB ports, and complimentary Wi-Fi. Passengers receive multi-course meals with options like salads, entrees, and desserts, plus alcoholic beverages including wine pairings introduced in July 2025, delivered via lounge car or at-seat service. Access to the Metropolitan Lounge at stations such as New York and Philadelphia provides pre-boarding refreshments and workspaces, alongside priority boarding and deboarding. This class emphasizes efficiency for business travelers, with quieter cabins and larger overhead bins.[107][108][109] Private sleeping rooms, deemed First Class on long-distance trains like the California Zephyr or Empire Builder, utilize Superliner double-deck cars in the West and Viewliner single-level cars in the East and on the Auto Train. Roomettes convert two facing seats into upper and lower berths for one or two passengers, with shared restrooms and showers at car ends; Bedrooms add a sofa, armchair, private restroom, and vanity sink, accommodating up to three with a larger shower. Family and Accessible Bedrooms cater to groups or mobility needs with wider layouts and roll-in showers. A dedicated sleeping car attendant handles bedding setup, luggage assistance, and coordinates meals—full breakfast, lunch, dinner included from the dining car menu, deliverable to rooms. Fresh towels, linens, and toiletries are provided, with access to lounge cars featuring panoramic windows on select trains. These accommodations mitigate overnight travel discomforts, though availability fluctuates with demand and seasonal adjustments.[110][111]

Digital and Accessibility Features

Amtrak provides digital services primarily through its official website and mobile application, enabling passengers to book tickets, manage reservations, and access real-time travel information. The Amtrak app, available for iOS and Android devices, allows users to search and purchase tickets, view upcoming trips, make changes or cancellations, and receive push notifications for delays or schedule updates.[112] [113] An update in March 2025 enhanced the app by displaying train status and schedule changes directly on the reservation screen for trips within 24 hours, improving usability for imminent travel.[114] Electronic tickets (eTickets) are issued as barcodes via email, PDF, or the app, facilitating contactless boarding by scanning at gates or by conductors, with one eTicket covering groups of up to eight passengers.[115] Free basic Wi-Fi service is available on select Amtrak trains and at certain stations, intended to support passenger connectivity during journeys.[116] However, service quality varies significantly; user reports and technical analyses indicate frequent intermittency, weak signals due to train movement, tower handoffs, and coverage gaps in rural areas or tunnels, often rendering it unreliable for sustained use like streaming.[117] [118] Amtrak has pursued upgrades, including potential 5G integration along tracks, but as of 2025, passengers commonly rely on personal mobile hotspots for consistent internet access.[119] For accessibility, Amtrak complies with the Americans with Disabilities Act (ADA) through features such as reserved spaces for mobility aids in sleeping cars and coaches, accessible restrooms with 60-inch turning radii, grab bars, and touchless fixtures in newer equipment.[120] [121] Passengers with disabilities receive fare discounts, extendable to one companion, and can request assistance like boarding ramps or priority seating via the website or app during booking.[122] Amtrak issues biannual ADA progress reports detailing infrastructure improvements, such as enhanced station ramps and tactile signage, with full system compliance targeted for 2029.[123] Despite these efforts, advocacy groups and passenger complaints highlight persistent barriers, including unrampered steps, narrow doorways, and inconsistent staff training, leading to a 2025 settlement requiring formalized ADA education for customer-facing employees and better communication of service disruptions.[124] [125] [126] Amtrak's self-reported advancements contrast with empirical evidence of delays in remediation, attributable to the age of much of its rolling stock and infrastructure inherited from pre-1971 private railroads.Baggage Policies and Limited Cargo

Amtrak permits passengers one personal item not exceeding 25 pounds (11 kg) or dimensions of 14 x 11 x 7 inches (36 x 28 x 18 cm), which must fit under the seat, along with two carry-on bags each up to 50 pounds (23 kg) and 28 x 22 x 14 inches (71 x 56 x 36 cm), storable in overhead racks or designated areas.[127][128] Excess carry-on items beyond these limits incur a $20 fee per bag, with a maximum of two additional bags allowed.[127] Passengers must manage their own carry-on baggage, as onboard storage space is finite, and enforcement varies by train capacity and crew discretion, though policies aim to prevent overloading.[127] Checked baggage service is available only on select routes and at staffed stations equipped for handling, requiring passengers to verify availability in advance.[129] Each traveler may check up to four bags: the first two free if under 50 pounds (23 kg) and 75 linear inches (length + width + height, or 191 cm), with two additional bags at $20 each under the same limits; oversized bags (76-100 linear inches) add another $20 fee.[130][131] Bags exceeding 50 pounds or requiring special equipment may be rejected if staff cannot safely lift them, prioritizing passenger and employee safety over accommodation.[132] Certain items face restrictions or prohibitions to mitigate safety risks and liability. Firearms and ammunition are permitted solely in checked baggage, provided they are unloaded, encased in a locked hard-sided container, declared at least 24 hours prior to travel, and meet size/weight limits; carry-on transport is forbidden.[133] Prohibited baggage items include corrosives, dangerous chemicals, hoverboards, non-service animals, and bulky valuables such as antiques, appliances, artwork, furniture, or machinery, which Amtrak declines due to handling impracticalities and potential damage claims.[131][134] Special items like bicycles, skis, or strollers may require fees or packaging but are accepted with prior arrangement at participating stations.[131] Amtrak's capacity for non-passenger cargo remains severely limited following the permanent discontinuation of its Amtrak Express Shipping service around 2021, which previously allowed up to 500 pounds daily in 50-pound increments for freight like parcels or mail on certain trains.[135] Although statutory authority for mail and express handling persists, the service has been suspended indefinitely as of 2025, with no active general cargo operations; passengers seeking alternatives must use third-party shippers for pre-sending luggage.[136] This retreat reflects operational priorities favoring passenger transport amid freight competition from trucking and dedicated rail carriers, reducing Amtrak's role in small-scale logistics.[135]Financial Sustainability

Revenue Streams and Operating Losses

Amtrak's primary revenue stream consists of ticket sales for intercity passenger services, which accounted for $2.452 billion in fiscal year 2024 (ending September 30, 2024), representing a record high and comprising the majority of its passenger-related income.[7] Food and beverage sales on board trains contributed a minor portion, totaling $63 million in the same period.[7] Additional operating revenues include payments from states for supported routes, amounting to approximately $586 million in FY2024, which subsidize specific services but are distinct from federal appropriations.[7] Revenues from mail and express services, once more significant, have diminished to negligible levels in recent years, with no material breakdown reported in current financials.[137] Total operating revenues reached $3.836 billion in FY2024, a 7% increase from $3.573 billion in FY2023, driven largely by higher ridership and ticket pricing on the Northeast Corridor.[7] However, these figures exclude federal operating subsidies, reflecting only earned and contractual income. Passenger revenues covered approximately 44% of total operating expenses in FY2024, underscoring structural imbalances outside high-density routes.[9]| Revenue Category (FY2024) | Amount ($ millions) |

|---|---|

| Ticket Sales | 2,452 |

| Food and Beverage | 63 |

| State-Supported Routes | 586 |

| Other Operating | ~735 (remainder to total) |

| Total Operating Revenues | 3,836 |

Historical Federal Subsidies and Appropriations

Amtrak, established under the Rail Passenger Service Act of 1970 and commencing operations on May 1, 1971, has relied on federal subsidies from its creation to offset operating losses and fund infrastructure, as passenger revenues have never covered full costs. Initial appropriations were limited, totaling $40 million across fiscal years 1971 and 1972, but escalated rapidly to $651.2 million in FY 1976 and exceeded $1 billion annually by FY 1978.[139] These early funds primarily supported operations amid the transition from private railroads, which had been discontinuing unprofitable routes.[8] Funding patterns fluctuated in subsequent decades, dipping below $600 million in the mid-1980s before stabilizing around $800-900 million through the 1990s, with a spike to $1.686 billion in FY 1998 due to inclusion of Northeast Corridor Improvement Project expenditures totaling $3.937 billion from 1976-1998.[139] The Passenger Rail Investment and Improvement Act of 2008 (PRIIA) shifted emphasis toward capital grants, assuming state contributions for non-Northeast Corridor operating shortfalls, while the Fixing America's Surface Transportation (FAST) Act of 2015 formalized separate accounts for Northeast Corridor ($2.45 billion authorized over FY 2016-2020) and National Network funding.[139] By FY 2016, annual appropriations reached $1.385 billion, reflecting a blend of operating and capital support.[139]| Fiscal Year Range | Average Annual Appropriation (millions) | Notes |

|---|---|---|

| 1971-1980 | ~$600 | Primarily operating subsidies; rapid growth phase |

| 1981-2000 | ~$900 | Fluctuations; includes NEC project spikes |

| 2001-2016 | ~$1,200 | Increasing capital focus post-2008 PRIIA |

| 2017-2019 | ~$1,775 | FAST Act structure; pre-pandemic baseline |

| 2020-2024 | ~$3,000 | Elevated by CARES Act ($3B+ in 2020-2021) and IIJA ($66B rail total, including Amtrak) |

Debates on Economic Viability and Alternatives

Amtrak's national network has sustained operating losses exceeding $700 million annually in recent years, despite record ridership of 28.6 million passengers in fiscal year 2024 and total operating revenues of $3.6 billion.[5] The Northeast Corridor generated an operating surplus, but long-distance routes posted a $635 million deficit in FY2024, necessitating federal appropriations of approximately $2.4 billion to cover capital and operating shortfalls.[6] Adjusted for non-cash expenses like $966 million in depreciation and project-related costs, true annual losses approach $2 billion, undermining claims of nearing self-sufficiency.[141] Critics of Amtrak's model, including congressional oversight committees, argue that its persistent deficits reflect structural inefficiencies, such as high labor costs, outdated infrastructure, and competition from air and highway travel, which capture over 90% of intercity trips in low-density regions.[6] They contend that treating subsidies as operational revenue and excluding depreciation inflates recovery ratios—reported at 84% for FY2024—creating a deceptive narrative of progress toward viability without addressing causal factors like geographic sprawl and post-1950s auto-centric development.[142] Supporters, often from transportation advocacy groups, counter that rail yields non-monetary benefits like reduced highway congestion and rural access, justifying subsidies as investments in national resilience, though empirical data shows cost recovery below 50% for most routes outside dense corridors.[143] Proposed alternatives emphasize market-oriented reforms over indefinite public funding. Privatization advocates, drawing from partial European models, suggest competitive concessions could incentivize efficiency and route optimization, potentially halving subsidies by prioritizing profitable segments like the Northeast Corridor while allowing private bids for others.[144] Detractors, including Amtrak's own analyses, warn that U.S.-specific challenges—such as freight-owned tracks and vast distances—would likely result in service abandonment for unprofitable long-distance lines, mirroring pre-1971 private rail failures without subsidies.[145] Other options include defunding national routes to reallocate funds toward high-speed rail expansions or enhancing intermodal alternatives like subsidized bus services, which achieve higher load factors at lower public cost per passenger-mile.[40] Government Accountability Office reviews have historically highlighted these viability risks, recommending cost containment and performance metrics to evaluate subsidy efficacy against alternatives.[146]Labor Relations

Union Dynamics and Workforce Composition

Amtrak's workforce consists of approximately 22,400 active employees as of the close of fiscal year 2024, with roles spanning train operations, maintenance, customer service, and administrative functions.[2] The majority of these employees are represented by labor unions, organized primarily by craft or job classification under the Railway Labor Act, which governs collective bargaining in the rail industry.[147] This structure divides representation among multiple unions, including the SMART Transportation Division for conductors and engineers, the Transport Workers Union (TWU) for onboard service personnel, the Transportation Communications Union/IAM (TCU/IAM) for clerks and dispatchers, UNITE HERE for food and beverage workers, and others such as the Brotherhood of Locomotive Engineers and Trainmen (BLET) and Brotherhood of Maintenance of Way Employees Division (BMWED).[148][149][150] Union dynamics at Amtrak are characterized by frequent negotiations over wages, benefits, and working conditions, often resulting in significant cost increases that contribute to the company's operating deficits. For instance, in July 2024, the TWU secured a seven-year contract for onboard workers providing a compounded 34% wage increase from July 2022 through December 2028, along with paid family leave—the largest such raise in Amtrak's history for that group.[151] Broader national rail labor disputes have also disrupted Amtrak operations; in September 2022, a tentative agreement between freight railroads and unions averted a strike that would have halted long-distance Amtrak trains due to shared track usage, following demands for better sick leave and pay amid stalled talks covering over 100,000 workers.[152][153] These negotiations, conducted under federal mediation, typically yield multi-year contracts with wage hikes of 24% or more over five years, reflecting unions' leverage in a sector with limited labor mobility and statutory protections against strikes without exhaustion of bargaining processes.[154] Workforce composition emphasizes operational crafts, with union-represented employees forming the core of train crews, mechanics, and track maintenance teams, while non-union management handles oversight and strategy. Amtrak's annual diversity reports indicate that in fiscal year 2023, over 12,500 of 22,658 total employees were classified as diverse, including incremental gains in Black (1.2% increase) and Hispanic/Latino (0.3% increase) representation among unionized staff, though these figures stem from company initiatives focused on recruitment and promotion targets.[155][156] Union strength has historically resisted operational flexibility, such as scheduling changes for efficiency, contributing to elevated labor expenses—estimated at over 40% of Amtrak's operating costs—amid critiques that rigid craft rules hinder adaptation to ridership demands.[147]Recent Disputes, Layoffs, and Fraud Cases

In September 2024, a federal court ruled that an arbitrator had incorrectly decided a labor dispute between Amtrak and its signalmen's union, finding that Amtrak violated its collective bargaining agreement by assigning work inside a maintenance facility to non-union contractors rather than union members.[157] The case stemmed from union allegations that Amtrak bypassed bargaining obligations, highlighting ongoing tensions over work jurisdiction and outsourcing practices.[157] Separately, in early 2024, Amtrak settled a racial discrimination lawsuit filed by a Black employee who claimed the company and the SMART-TD union conspired to block her advancement in union leadership roles, though specific settlement terms were not disclosed.[158] Amtrak announced plans in May 2025 to eliminate 450 positions, primarily in management and white-collar roles within its Capital Delivery department, as part of a broader cost-reduction strategy targeting $100 million in annual savings.[159] [160] This followed an adjusted operating loss of $705 million for the fiscal year ended September 30, 2024, despite a 15% ridership increase to 32.8 million passengers.[159] [161] The cuts, combined with a hiring freeze and promotion pauses, affected roughly 2-3% of Amtrak's workforce and were attributed to post-pandemic overstaffing in certain areas, though critics noted the timing amid record ridership recovery.[162] [163] Amtrak's Office of Inspector General uncovered a major health care fraud scheme in 2025 involving over 100 current and former employees across seven states, who conspired with medical providers to submit $11-12 million in false claims to Amtrak's health plan for unnecessary treatments and procedures.[164] [165] In May 2025, five employees pleaded guilty to their roles in the conspiracy.[166] By July and August 2025, additional pleas and sentences followed, including a 25-month prison term for one former employee and convictions for others like Gregory Richardson, who admitted to related health care fraud.[167] [168] Separately, in July 2025, another ex-employee received over two years in prison for stealing nearly $1 million in COVID-19 unemployment benefits while employed.[167] These cases marked the largest employee criminal conspiracy identified by Amtrak's OIG, exposing vulnerabilities in benefit oversight.[164]Environmental Considerations

Energy Use and Emissions Profile

Amtrak's energy consumption derives mainly from diesel fuel for the majority of its routes, which lack electrification, and electricity for the Northeast Corridor. In fiscal year 2020, the system used 63 million gallons of diesel and 351 million kilowatt-hours of electricity for train operations.[169] Diesel accounts for the bulk of propulsion energy outside the electrified segments, with conversion factors establishing 137,381 British thermal units (Btu) per gallon for diesel and 3,412 Btu per kilowatt-hour for electricity, though the latter excludes grid transmission losses.[170] Energy intensity metrics indicate Amtrak averages 1,535 Btu per passenger-mile systemwide, reflecting efficiencies from high-capacity rail but tempered by variable load factors, particularly on long-distance diesel routes with occupancy often below 50%.[171] This outperforms domestic air travel at 2,341 Btu per passenger-mile and automobiles at roughly 3,500 Btu per passenger-mile (accounting for typical 1.5 occupants), though comparisons assume average utilization; solo driving or low-occupancy scenarios widen rail's relative advantage.[171] Diesel routes exhibit higher intensity than electric ones due to engine inefficiencies and idling, with overall reductions tied to fleet modernizations and route optimizations.[170] Greenhouse gas emissions profile centers on Scope 1 (direct, primarily diesel combustion, comprising 89% of Scope 1 and 2 totals) and Scope 2 (purchased electricity from regional grids like PJM, which include fossil fuels).[172] Annual CO2 output approximates 700,000 metric tons against 6.1 billion passenger-miles, equating to about 110 grams CO2 equivalent per passenger-mile.[173] Diesel-specific segments reach 127 grams per passenger-mile (0.28 pounds), while electrified operations emit less depending on grid carbon intensity, often 50-70% below diesel equivalents.[174] Per-passenger-mile emissions exceed short-haul flights in low-load scenarios but undercut long-haul air (94-160 grams per passenger-mile economy class) and solo cars (170+ grams per passenger-km equivalent); carpooling or buses can match or surpass rail under high occupancy.[175][171] From 2010 to 2019, emissions fell 20%, driven by fuel efficiency gains, though pandemic-era drops were service-related rather than structural.[176] Amtrak targets 40% Scope 1 and 2 reductions by 2030 (from 2010) and net-zero by 2045, emphasizing electrification and biofuels, but progress hinges on infrastructure investments amid variable independent verification of load-adjusted metrics.[177]Critiques of Sustainability Claims

Critics contend that Amtrak's assertions of superior environmental efficiency—such as trains being 46% more energy-efficient than automobiles and 34% more efficient than air travel per passenger-mile—are undermined by the carrier's heavy reliance on diesel locomotives for the majority of its routes, which emit higher greenhouse gases than electrified systems. Outside the Northeast Corridor, where catenary wires enable electric propulsion, Amtrak's long-distance and regional services predominantly use diesel engines, consuming 63 million gallons of fuel in 2019 alone and generating about 640 kilotons of carbon emissions from those operations.[178] This diesel dominance contrasts with Amtrak's promotional materials, which often aggregate figures across electric and diesel modes without disaggregating the less efficient latter, potentially inflating overall sustainability metrics.[179] Low occupancy rates further erode per-passenger efficiency, as Amtrak's long-distance trains frequently operate at load factors around 50% or below, diluting the emissions benefits of rail's scale economies. Diesel-powered passenger cars on Amtrak achieve roughly 2.6 miles per gallon, far below intercity buses at 6 miles per gallon, and when adjusted for half-empty consists, this translates to higher CO2 output per traveler than claimed averages suggest.[180] [181] An EPA draft assessment pegged Amtrak diesel routes at 0.28 pounds of CO2 per passenger-mile, a figure that critics argue competes unfavorably with optimized air travel on long hauls once real-world occupancy and routing inefficiencies are factored in.[174] For extended journeys, such as cross-country routes, empirical comparisons reveal Amtrak's emissions can surpass those of nonstop flights; one analysis of a New York to San Francisco trip found rail generating 13% to 35% more CO2 per passenger than flying, due to prolonged travel times, detours, and diesel inefficiency over thousands of miles.[171] [175] Such critiques highlight that while short-haul electric services may align with green claims, Amtrak's broader network—subsidized yet underutilized—often fails to displace higher-emission modes at scale, as low ridership and fixed infrastructure amplify lifecycle impacts without proportional modal shifts.[182] This discrepancy is attributed by skeptics to overreliance on system-wide averages that mask route-specific variances, rather than granular, load-adjusted data.[175]Safety Record

Incident History and Major Derailments

Amtrak's incident history includes numerous derailments, collisions, and other accidents since its founding in 1971, with the National Transportation Safety Board (NTSB) attributing many to factors such as track defects, human error, and insufficient safety technologies like Positive Train Control (PTC).[183] While Amtrak's overall fatality rate per passenger-mile remains lower than that of automobiles or general aviation, major derailments have exposed vulnerabilities in shared freight rail infrastructure, where Amtrak trains operate on tracks primarily maintained by private carriers like BNSF and CSX.[184] NTSB reports emphasize that track geometry issues and overspeed events on curves have been recurrent causes, often exacerbated by delayed implementation of mandated safety systems.[185] The first fatal Amtrak derailment occurred on June 10, 1971, near Tonti, Illinois, when the City of New Orleans passenger train derailed due to a fractured rail on the Illinois Central Gulf track, killing 11 people and injuring 163 others.[186] This incident, Amtrak's inaugural fatal accident shortly after taking over intercity services, highlighted early challenges with inherited aging infrastructure from private railroads.[187] A particularly deadly event was the September 22, 1993, derailment of the Sunset Limited near Mobile, Alabama, after a towboat mistakenly entered the Big Bayou Canot bridge span, misaligning it and causing the track to fail under the train; 47 passengers and crew died, and 105 were injured when cars plunged into the water.[184] The NTSB cited navigational errors by the barge crew and inadequate bridge protection as primary causes, underscoring vulnerabilities at water crossings on shared routes.[183]| Date | Location | Train | Primary Cause | Fatalities/Injuries |

|---|---|---|---|---|

| May 12, 2015 | Philadelphia, PA | Northeast Regional 188 | Overspeed on curve (102 mph vs. 50 mph limit) due to engineer distraction from police radio; PTC not installed | 8 dead, 200+ injured[188][189] |

| December 18, 2017 | DuPont, WA | Cascades 501 | Overspeed on curve (80 mph vs. 30 mph limit) from engineer disorientation and inadequate route familiarization training; PTC failure | 3 dead, 62 injured[185][190] |

| September 25, 2021 | Joplin, MT | Empire Builder 7 | Track defects including worn rail, vertical deflection, subgrade instability, and misalignment on BNSF track | 3 dead, 50 injured[191][192] |