Recent from talks

Nothing was collected or created yet.

Management accounting

View on Wikipedia| Part of a series on |

| Accounting |

|---|

|

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

Definition

[edit]

One simple definition of management accounting is the provision of financial and non-financial decision-making information to managers.[2] In other words, management accounting helps the directors inside an organization to make decisions. This is the way toward distinguishing, examining, deciphering and imparting data to supervisors to help accomplish business goals.[3] The information gathered includes all fields of accounting that educates the administration regarding business tasks identifying with the financial expenses and decisions made by the organization. Accountants use plans to measure the overall strategy of operations within the organization.[citation needed]

According to the Institute of Management Accountants (IMA), "Management accounting is a profession that involves partnering in management decision making, devising planning and performance management systems, and providing expertise in financial reporting and control to assist management in the formulation and implementation of an organization's strategy".[4]

Management accountants (also called managerial accountants) look at the events that happen in and around a business while considering the needs of the business. From this, data and estimates emerge. Cost accounting is the process of translating these estimates and data into knowledge that will ultimately be used to guide decision-making.[5]

The Chartered Institute of Management Accountants (CIMA) being the largest management accounting institute with over 100,000 members describes Management accounting as analysing information to advise business strategy and drive sustainable business success.[6]

The Institute of Certified Management Accountants (ICMA) has over 15,000 qualified professionals worldwide, with members in 50-countries. Its CMA postgraduate education program now is firmly established in 19 overseas markets, namely Bangladesh, Cambodia, China, Cyprus, Dubai, Hong Kong, India, Indonesia, Iran, Japan, Lebanon, Malaysia, Nepal, New Zealand, Papua New Guinea, Philippines; Singapore, Sri Lanka, Thailand and Vietnam.

To facilitate its educational objectives, the Institute has accredited a number of universities which have master's degree subjects that are equivalent to the CMA program. Some of these universities also provide in-house training and examinations of the CMA program. Accounting graduates can do CMA accredited units at these universities to qualify for CMA status. The ICMA also has a number of Recognised Provider Institutions (RPIs) that run the CMA program in Australia and overseas. The CMA program is also available online in regions where the face-to-face delivery of the program is not possible.

Scope, practice, and application

[edit]The Association of International Certified Professional Accountants (AICPA) states management accounting as a practice that extends to the following three areas:

- Strategic management — advancing the role of the management accountant as a strategic partner in the organization

- Performance management — developing the practice of business decision-making and managing the performance of the organization

- Risk management — contributing to frameworks and practices for identifying, measuring, managing and reporting risks to the achievement of the objectives of the organization

The Institute of Certified Management Accountants (CMA) states, "A management accountant applies his or her professional knowledge and skill in the preparation and presentation of financial and other decision oriented information in such a way as to assist management in the formulation of policies and in the planning and control of the operation undertaking".

Management accountants are seen as the "value-creators" amongst the accountants. They are more concerned with forward-looking and taking decisions that will affect the future of the organization; than in the historical recording and compliance (score keeping) aspects of the profession. Management accounting knowledge and experience can be obtained from varied fields and functions within an organization, such as information management, treasury, efficiency auditing, marketing, valuation, pricing, and logistics. In 2014 CIMA created the Global Management Accounting Principles (GMAPs).[7] The result of research from across 20 countries in five continents, the principles aim to guide best practice in the discipline.[8]

Financial versus Management accounting

[edit]This article needs additional citations for verification. (March 2017) |

Management accounting information differs from financial accountancy information in several ways:

- while shareholders, creditors, and public regulators use publicly reported financial accountancy, information, only managers within the organization use the normally confidential management accounting information

- while financial accountancy information is historical, management accounting information is primarily forward-looking[9][self-published source?];

- while financial accountancy information is case-based, management accounting information is model-based with a degree of abstraction in order to support generic decision making;

- while financial accountancy information is computed by reference to general financial accounting standards, management accounting information is computed by reference to the needs of managers, often using management information systems.

Focus:

- Financial accounting focuses on the company as a whole.

- Management accounting provides detailed and disaggregated information about products, individual activities, divisions, plants, operations and tasks.

Traditional versus innovative practices

[edit]

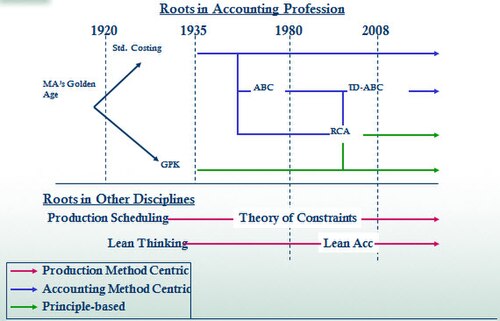

The distinction between traditional and innovative accounting practices is illustrated with the visual timeline (see sidebar) of managerial costing approaches presented at the Institute of Management Accountants 2011 Annual Conference.

Traditional standard costing (TSC), used in cost accounting, dates back to the 1920s and is a central method in management accounting practiced today because it is used for financial statement reporting for the valuation of income statement and balance sheet line items such as cost of goods sold (COGS) and inventory valuation. Traditional standard costing must comply with generally accepted accounting principles (GAAP US) and actually aligns itself more with answering financial accounting requirements rather than providing solutions for management accountants. Traditional approaches limit themselves by defining cost behavior only in terms of production or sales volume.

In the late 1980s, accounting practitioners and educators were heavily criticized on the grounds that management accounting practices (and, even more so, the curriculum taught to accounting students) had changed little over the preceding 60 years, despite radical changes in the business environment. In 1993, the Accounting Education Change Commission Statement Number 4[11] calls for faculty members to expand their knowledge about the actual practice of accounting in the workplace.[12] Professional accounting institutes, perhaps fearing that management accountants would increasingly be seen as superfluous in business organizations, subsequently devoted considerable resources to the development of a more innovative skills set for management accountants.

Variance analysis is a systematic approach to the comparison of the actual and budgeted costs of the raw materials and labour used during a production period. While some form of variance analysis is still used by most manufacturing firms, it nowadays tends to be used in conjunction with innovative techniques such as life cycle cost analysis and activity-based costing, which are designed with specific aspects of the modern business environment in mind. Life-cycle costing recognizes that managers' ability to influence the cost of manufacturing a product is at its greatest when the product is still at the design stage of its product life-cycle (i.e., before the design has been finalized and production commenced), since small changes to the product design may lead to significant savings in the cost of manufacturing the products.

Activity-based costing (ABC) recognizes that, in modern factories, most manufacturing costs are determined by the amount of 'activities' (e.g., the number of production runs per month, and the amount of production equipment idle time) and that the key to effective cost control is therefore optimizing the efficiency of these activities. Both lifecycle costing and activity-based costing recognize that, in the typical modern factory, the avoidance of disruptive events (such as machine breakdowns and quality control failures) is of far greater importance than (for example) reducing the costs of raw materials. Activity-based costing also de-emphasizes direct labor as a cost driver and concentrates instead on activities that drive costs, as the provision of a service or the production of a product component.

Other approach is the German Grenzplankostenrechnung (GPK) costing methodology. Although it has been in practiced in Europe for more than 50 years, neither GPK nor the proper treatment of 'unused capacity' is widely practiced in the U.S.[13]

Another accounting practice available today is resource consumption accounting (RCA). RCA has been recognized by the International Federation of Accountants (IFAC) as a "sophisticated approach at the upper levels of the continuum of costing techniques"[14] The approach provides the ability to derive costs directly from operational resource data or to isolate and measure unused capacity costs. RCA was derived by taking costing characteristics of GPK, and combining the use of activity-based drivers when needed, such as those used in activity-based costing.[14]

A modern approach to close accounting is continuous accounting, which focuses on achieving a point-in-time close, where accounting processes typically performed at period-end are distributed evenly throughout the period.

Role within a corporation

[edit]Consistent with other roles in modern corporations, management accountants have a dual reporting relationship. As a strategic partner and provider of decision based financial and operational information, management accountants are responsible for managing the business team and at the same time having to report relationships and responsibilities to the corporation's finance organization and finance of an organization.

The activities management accountants provide inclusive of forecasting and planning, performing variance analysis, reviewing and monitoring costs inherent in the business are ones that have dual accountability to both finance and the business team. Examples of tasks where accountability may be more meaningful to the business management team vs. the corporate finance department are the development of new product costing, operations research, business driver metrics, sales management scorecarding, and client profitability analysis. (See financial planning.) Conversely, the preparation of certain financial reports, reconciliations of the financial data to source systems, risk and regulatory reporting will be more useful to the corporate finance team as they are charged with aggregating certain financial information from all segments of the corporation.

In corporations that derive much of their profits from the information economy, such as banks, publishing houses, telecommunications companies and defence contractors, IT costs are a significant source of uncontrollable spending, which in size is often the greatest corporate cost after total compensation costs and property related costs. A function of management accounting in such organizations is to work closely with the IT department to provide IT cost transparency.[15]

Given the above, one view of the progression of the accounting and finance career path is that financial accounting is a stepping stone to management accounting.[16] Consistent with the notion of value creation, management accountants help drive the success of the business while strict financial accounting is more of a compliance and historical endeavor.

Specific methodologies

[edit]Activity-based costing (ABC)

[edit]Activity-based costing was first clearly defined in 1987 by Robert S. Kaplan and W. Bruns as a chapter in their book Accounting and Management: A Field Study Perspective. They initially focused on the manufacturing industry, where increasing technology and productivity improvements have reduced the relative proportion of the direct costs of labor and materials, but have increased relative proportion of indirect costs. For example, increased automation has reduced labor, which is a direct cost, but has increased depreciation, which is an indirect cost.

Grenzplankostenrechnung

[edit]This section may lend undue weight to certain ideas, incidents, or controversies. (August 2018) |

Grenzplankostenrechnung (GPK) is a German costing methodology, developed in the late 1940s and 1960s, designed to provide a consistent and accurate application of how managerial costs are calculated and assigned to a product or service. The term Grenzplankostenrechnung, often referred to as GPK, has best been translated as either marginal planned cost accounting[17] or flexible analytic cost planning and accounting.[18]

The origins of GPK are credited to Hans Georg Plaut, an automotive engineer, and Wolfgang Kilger, an academic, working towards the mutual goal of identifying and delivering a sustained methodology designed to correct and enhance cost accounting information. GPK is published in cost accounting textbooks, notably Flexible Plankostenrechnung und Deckungsbeitragsrechnung[19] and taught at German-speaking universities.

Lean accounting (accounting for lean enterprise)

[edit]In the mid- to late-1990s several books were written about accounting in the lean enterprise (companies implementing elements of the Toyota Production System). The term lean accounting was coined during that period. These books contest that traditional accounting methods are better suited for mass production and do not support or measure good business practices in just-in-time manufacturing and services. The movement reached a tipping point during the 2005 Lean Accounting Summit in Dearborn, Michigan, United States. 320 individuals attended and discussed the advantages of a new approach to accounting in the lean enterprise. 520 individuals attended the 2nd annual conference in 2006 and it has varied between 250 and 600 attendees since that time.

Resource consumption accounting (RCA)

[edit]Resource consumption accounting (RCA) is formally defined as a dynamic, fully integrated, principle-based, and comprehensive management accounting approach that provides managers with decision support information for enterprise optimization. RCA emerged as a management accounting approach around 2000 and was subsequently developed at CAM-I,[20] the Consortium for Advanced Manufacturing–International, in a Cost Management Section RCA interest group[21] in December 2001.

Throughput accounting

[edit]The most significant recent direction in managerial accounting is throughput accounting; which recognizes the interdependencies of modern production processes. For any given product, customer or supplier, it is a tool to measure the contribution per unit of constrained resource.

Transfer pricing

[edit]Management accounting is an applied discipline used in various industries. The specific functions and principles followed can vary based on the industry. Management accounting principles in banking are specialized but do have some common fundamental concepts used whether the industry is manufacturing-based or service-oriented. For example, transfer pricing is a concept used in manufacturing but is also applied in banking. It is a fundamental principle used in assigning value and revenue attribution to the various business units. Essentially, transfer pricing in banking is the method of assigning the interest rate risk of the bank to the various funding sources and uses of the enterprise. Thus, the bank's corporate treasury department will assign funding charges to the business units for their use of the bank's resources when they make loans to clients. The treasury department will also assign funding credit to business units who bring in deposits (resources) to the bank. Although the funds transfer pricing process is primarily applicable to the loans and deposits of the various banking units, this proactive is applied to all assets and liabilities of the business segment. Once transfer pricing is applied and any other management accounting entries or adjustments are posted to the ledger (which are usually memo accounts and are not included in the legal entity results), the business units are able to produce segment financial results which are used by both internal and external users to evaluate performance.

Resources and continuous learning

[edit]There are a variety of ways to keep current and continue to build one's knowledge base in the field of management accounting. Certified Management Accountants (CMAs) are required to achieve continuing education hours every year, similar to a Certified Public Accountant. A company may also have research and training materials available for use in a corporate owned library. This is more common in Fortune 500 companies who have the resources to fund this type of training medium.

There are also journals, online articles and blogs available. The journal Cost Management (ISSN 1092-8057)[22] and the Institute of Management Accounting (IMA) site are sources which include Management Accounting Quarterly and Strategic Finance publications.

Tasks and services provided

[edit]Listed below are the primary tasks/services performed by management accountants. The degree of complexity relative to these activities are dependent on the experience level and abilities of any one individual.

- Rate and volume analysis

- Business metrics development

- Price modeling

- Product profitability

- Geographic vs. industry or client segment reporting

- Sales management scorecards

- Cost analysis

- Cost–benefit analysis

- Cost-volume-profit analysis

- Life cycle cost analysis

- Client profitability analysis

- IT cost transparency

- Capital budgeting

- Buy vs. lease analysis

- Strategic planning

- Strategic management advice

- Internal financial presentation and communication

- Sales forecasting

- Financial forecasting

- Annual budgeting

- Cost allocation

Related qualifications

[edit]There are several related professional qualifications and certifications in the field of accountancy including:

- Management Accountancy Qualifications

- Other Professional Accountancy Qualifications

- Chartered Institute of Public Finance and Accountancy, CIPFA

- Chartered Certified Accountant (ACCA)

- Cost & Management Accountant (CMA)

- Chartered Accountant (CA)

- Chartered Professional Accountant (CPA - Canada)

- Certified Public Accountant (CPA - US)

- Certified Practicing Accountant (CPA Australia)

- Chartered Global Management Accountant

Methods

[edit]See also

[edit]References

[edit]- ^ Evaluating and Improving Costing in Organizations (International Good Practice Guidance). International Federation of Accountants. 2009. p. 7 c. ISBN 9781608150373.

- ^ (Burns, Quinn, Warren & Oliveira, Management Accounting, McGraw-Hill, London, 2013)

- ^ Laosiritaworn, Wimalin; Bhuapirom, Attapol (2016). "Ceramics Process Improvement with Material Flow Cost Accounting". Proceedings - International Conference on Industrial Engineering and Operations Management. IEOM Society International: 2601–2610.

- ^ "Definition of Management Accounting" (PDF). Institute of Management Accountants. 2008. Archived (PDF) from the original on 20 October 2016. Retrieved 4 December 2012.

- ^ "What is Management Accounting? - Definition - Meaning - Example". myaccountingcourse.com. Archived from the original on 6 October 2017. Retrieved 2 May 2018.

- ^ "How Management Accounting Drives Sustainable Success" (PDF). Chartered Global Management Accountant. Archived (PDF) from the original on 2015-02-26.

- ^ "Global Management Accounting Principles". 24 October 2014. Archived from the original on 2015-04-23. Retrieved 2015-04-16.

- ^ King, I. "New set of accounting principles can help drive sustainable success". ft.com. Retrieved 28 January 2015.

- ^ Ladda, R. L. BASIC CONCEPTS OF ACCOUNTING. Lulu.com. ISBN 9781312161306.[self-published source]

- ^ van der Merwe, Anton (7 September 2011). Presentation at IMA's annual conference - Managerial Costing Conceptual Framework Session. Orlando, FL: Unpublished.

- ^ Accounting Education Change Commission (1993). "Positions and Issues". Issues Statement Number 4: Improving the Early Employment Experience of Accountants. Sarasota, FL: American Accounting Association. Archived from the original on 27 April 2012. Retrieved 2 November 2011.

- ^ Clinton, B.D.; Matuszewski, L.; Tidrick, D. (2011). "Escaping Professional Dominance?". Cost Management (Sep/Oct). New York: Thomas Reuters RIA Group.

- ^ Clinton, B.D.; Van der Merwe, Anton (2006). "Management Accounting - Approaches, Techniques, and Management Processes". Cost Management (May/Jun). New York: Thomas Reuters RIA Group.

- ^ a b "International Good Practice Guidance: Evaluating and Improving Costing in Organizations". New York: International Federation of Accountants. July 2009. p. 24. Archived from the original on 4 April 2012. Retrieved 10 November 2011.

- ^ * "Taking Control of IT Costs". Nokes, Sebastian. London (Financial Times / Prentice Hall): March 20, 2000. ISBN 978-0-273-64943-4

- ^ "Cima P1 Exam Questions". Archived from the original on 2016-11-14. Retrieved 14 Nov 2016.

- ^ Friedl, Gunther; Hans-Ulrich Kupper; Burkhard Pedell (2005). "Relevance Added: Combining ABC with German Cost Accounting". Strategic Finance (June): 56–61.

- ^ Sharman, Paul A. (2003). "Bring On German Cost Accounting". Strategic Finance (December): 2–9.

- ^ Kilger, Wolfgang (2002). Flexible Plankostenrechnung and Deckungsbeitragsrechnung. Updated by Kurt Vikas and Jochen Pampel (12th ed.). Wiesbaden, Germany: Gabler GmbH.

- ^ "Consortium for Advanced Management International CAM-I". www.cam-i.org. Archived from the original on 7 October 2017. Retrieved 2 May 2018.

- ^ Cost Management Section RCA interest group Archived 2008-12-07 at the Wayback Machine

- ^ "Cost Management". Thomson Reuters. 2011. Retrieved November 12, 2011.

Further reading

[edit]- Kurt Heisinger and Joe Hoyle, Managerial Accounting, ISBN 978-1-4533452-9-0.

- James R. Martin, Ph.D., CMA, Management And Accounting Web.

External links

[edit]- CAM-I Consortium for Advanced Manufacturing–International

- AICPA Financial Management Center – resource for CPAs working in business, industry and government

- Institute of Management Accountants – resource for management accountants (CMAs) working in industry

- Chartered Institute of Management Accountants

- International Federation of Accountants

- The Accounting Adventurista Management Accounting

- The Institute of Cost Accountants of India

Management accounting

View on GrokipediaIntroduction

Definition

Management accounting is a profession that involves partnering in management decision making, devising planning and performance management systems, and providing expertise in financial reporting and control to assist management in the formulation and implementation of an organization's strategy.[8] This process encompasses the identification, measurement, analysis, interpretation, and communication of financial and non-financial information tailored for internal use by managers to support decision-making, planning, and control within the organization.[8] Key principles of management accounting emphasize its internal focus, providing relevant, timely, and reliable information that is forward-looking to aid strategic foresight, while allowing flexibility in reporting formats to meet diverse managerial needs and integrating seamlessly with broader business strategy for value creation.[9] These principles include influential communication that delivers actionable insights, relevance of information aligned with objectives, analysis of value impacts through scenario evaluations, and stewardship that fosters trust via ethical and sustainable practices.[9] Core elements of management accounting include cost management to determine and optimize product or service costs for pricing and profitability analysis, performance measurement to evaluate outcomes against targets, budgeting to set and control resource allocations, and forecasting to generate predictive insights for future planning.[9] Management accounting originated from the need for internal financial information distinct from external reporting requirements, emphasizing non-GAAP metrics to better evaluate operational performance without the constraints of standardized external rules.[4] As a supportive function for managerial decisions, it enables organizations to adapt dynamically to internal challenges and opportunities.[8]Historical Development

Management accounting emerged in the late 19th century amid the Industrial Revolution, evolving from cost accounting techniques developed in England to address the complexities of mass production and resource allocation in growing factories.[10] Pioneers in cost accounting laid the groundwork by emphasizing detailed tracking of production costs, which influenced early management practices focused on efficiency.[11] In the 1910s, Frederick Taylor's scientific management principles further shaped the field by promoting time-motion studies and standardized processes to optimize labor and material costs, integrating analytical tools into managerial decision-making.[12] A pivotal event occurred in 1919 with the formation of the National Association of Cost Accountants (NACA), now known as the Institute of Management Accountants (IMA), which became a central organization for advancing professional standards and knowledge in the discipline.[13] During the mid-20th century, particularly post-World War II, management accounting expanded significantly; for instance, DuPont Corporation pioneered return on investment (ROI) metrics in the 1920s, which gained widespread adoption through the 1950s as a tool for evaluating divisional profitability and resource allocation.[14] By the 1960s, responsibility accounting emerged as a key milestone, emphasizing divisional performance measurement by holding managers accountable for controllable costs and revenues in decentralized organizations.[15] The 1980s and 2000s marked a shift toward more sophisticated approaches, driven by limitations in traditional volume-based costing amid increasing product diversity and overheads; this led to the development of activity-based costing (ABC) by Robin Cooper and Robert Kaplan in 1987, which allocated costs based on activities to provide more accurate product profitability insights.[16] In the 2010s to 2025, management accounting integrated big data and AI-driven analytics for predictive forecasting and real-time decision support, with enterprise resource planning (ERP) systems like SAP's updates enhancing data integration and automation.[17] Additionally, post-Paris Agreement in 2015, sustainability metrics gained prominence, incorporating environmental impact tracking into performance evaluations to align with global climate goals.[18] These advancements reflect ongoing adaptation to technological and regulatory changes, extending historical emphases on efficiency into broader strategic roles.[19]Distinctions from Other Accounting Fields

Financial Accounting vs. Management Accounting

Financial accounting and management accounting serve distinct roles within the broader field of accounting, with financial accounting primarily aimed at providing reliable information to external stakeholders for assessing an entity's economic performance and position. According to the Financial Accounting Standards Board (FASB), the objective of general-purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity, focusing on historical data for compliance and transparency.[20] In contrast, management accounting is designed to support internal decision-making by managers, involving the identification, measurement, analysis, and communication of financial and nonfinancial information to aid in planning, controlling operations, and ensuring accountability toward the organization's goals.[8] A key distinction lies in the users and regulatory standards applied to each. Financial accounting information is directed toward external parties such as investors, creditors, regulators, and the public, and it adheres to standardized frameworks like U.S. Generally Accepted Accounting Principles (GAAP) established by the FASB or International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), which require mandatory external audits to ensure accuracy and consistency.[21] Management accounting, however, is tailored for internal use by executives and managers, making it voluntary, organization-specific, and free from uniform standards or external audits, allowing flexibility to incorporate nonfinancial metrics and custom analyses.[8] The temporal focus further differentiates the two disciplines. Financial accounting is inherently backward-looking, recording and reporting past transactions to reflect historical financial position and performance through verifiable events.[22] Management accounting, by comparison, is forward-oriented, emphasizing projections such as budgets, forecasts, and scenario analyses to guide future strategies and resource allocation.[8] Reporting formats also vary significantly to suit their purposes. Financial accounting generates standardized external reports, including balance sheets, income statements, cash flow statements, and statements of changes in equity, prepared in accordance with GAAP or IFRS to facilitate comparability across entities.[21] Management accounting produces customized internal outputs like performance dashboards, variance reports, and cost analyses, often integrating operational data for tactical insights.[22]| Aspect | Financial Accounting | Management Accounting |

|---|---|---|

| Purpose | Compliance and historical reporting for external evaluation of financial health.[20] | Decision support, planning, and control using financial and nonfinancial data.[8] |

| Users | External stakeholders (investors, creditors, regulators).[20] | Internal managers and executives.[8] |

| Standards | Mandatory adherence to GAAP/IFRS with external audits.[21] | Voluntary, customized, no standardized rules or audits.[8] |

| Time Orientation | Backward-looking (past transactions).[22] | Forward-looking (budgets, forecasts).[8] |

| Reporting | Standardized statements (e.g., balance sheet, income statement).[21] | Ad-hoc reports, dashboards, and analyses.[22] |

| Legal Requirements | Subject to regulations like U.S. SEC filings (e.g., Form 10-K) for public companies.[23] | No legal mandates or external reporting obligations.[8] |