Recent from talks

Nothing was collected or created yet.

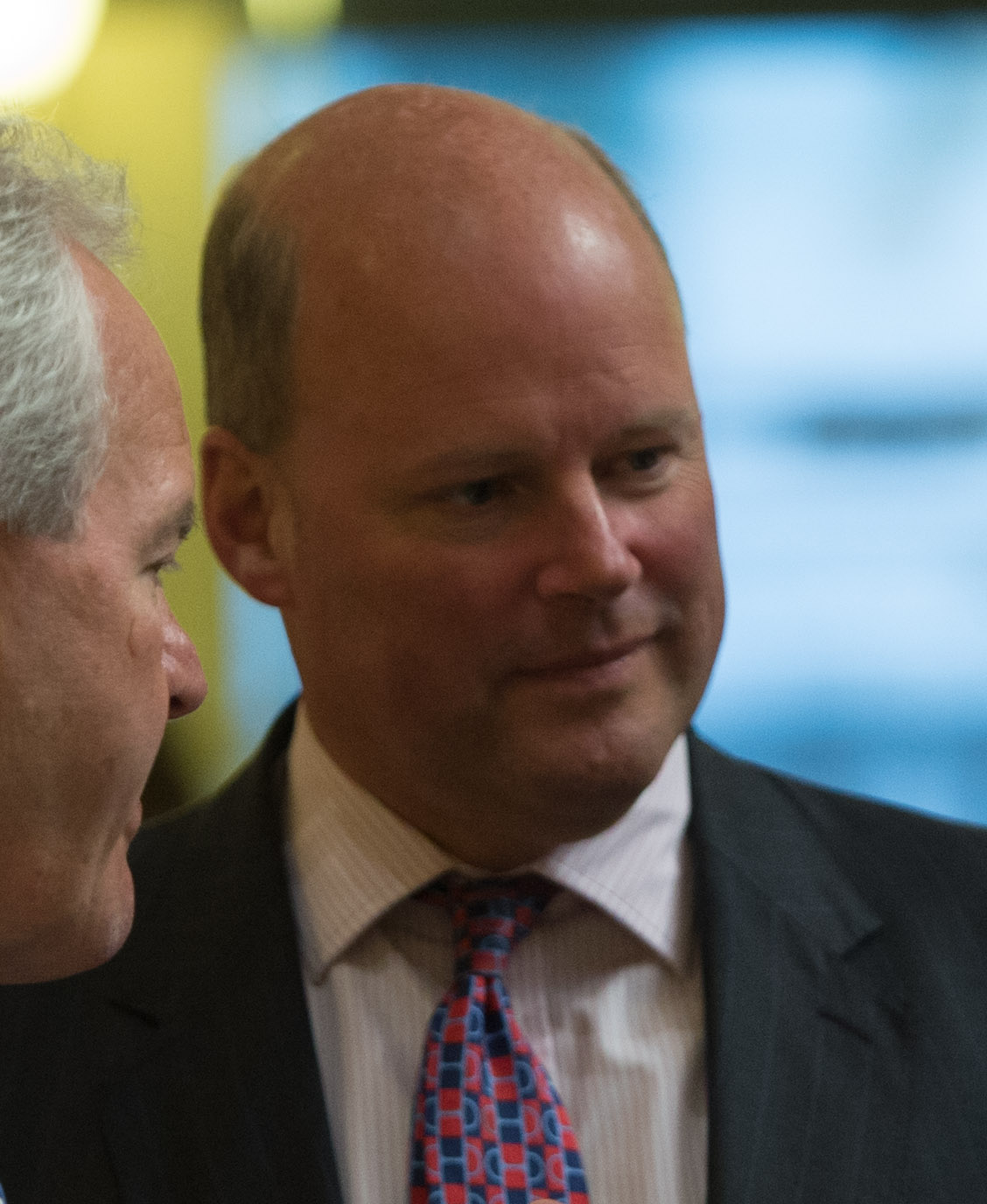

Stephen Hester

View on WikipediaThis article needs additional citations for verification. (August 2024) |

Sir Stephen Alan Michael Hester (born 14 December 1960)[2] is a British business executive and banker who has been serving as chairman of Nordea Abp since 2022 and chairman of easyJet since 2021. He is also the former chief executive of RSA Insurance Group and British Land.[3]

Key Information

Early life

[edit]Hester is the eldest son of Ronald, a chemistry professor at the University of York, and Dr Bridget Hester, a psychotherapist.[citation needed] He was born in Ithaca, NY, US but grew up primarily in the village of Crayke in North Yorkshire.[citation needed] He was educated at Easingwold School in North Yorkshire, a rural comprehensive school, and at Oxford where he studied at Lady Margaret Hall, and after chairing the Tory Reform Group, graduated with a first class honours degree in Philosophy, Politics and Economics.[3]

Career

[edit]

Hester has had an extensive business career including holding the chief executive position at three FTSE 100 companies over a 17 year period.[citation needed] He began his career in 1982 with investment bank Credit Suisse First Boston, where he started in corporate finance and then served a year as the chairman's assistant.[3] He was appointed a director in 1987 and a managing director in 1988 aged 27.[citation needed] Following stints as co-head European M&A and investment banking, in 1996 he was appointed to the Executive Board. Hester held the position of Chief Financial Officer and Head of Support Division, until May 2000.[citation needed] From May 2000 to September 2001, he was Global Head of the Fixed Income Division.[citation needed]

In May 2002, he joined Abbey National as Finance Director.[citation needed] The bank had significant financial problems stemming from its wholesale and life insurance activities.[citation needed] As part of its significant restructuring , he was given additional responsibilities as Chief Operating Officer for the wholesale and insurance arms of the bank as well as its support functions.[citation needed] The restructuring was successful and in 2004 the bank was sold at a significant gain to shareholders to Santander.[citation needed]

In November 2004, Hester was appointed chief executive British Land succeeding Sir John Ritblat, the company’s founder.[citation needed]

Hester was appointed non-executive deputy chairman Northern Rock by Chancellor of the Exchequer Alistair Darling in March 2008, a role which he resigned from in September 2008 to take a non-executive position on the board of Royal Bank of Scotland.[4][5]

Royal Bank of Scotland

[edit]In October 2008, RBS, then the biggest bank in the world by assets, was bailed out by UK taxpayers as part of the 2008 financial crisis.[citation needed] As part of that change, Hester was asked to leave British Land and replace Fred Goodwin as Chief Executive of the RBS Group.[citation needed]

The ensuing five years were ones of intense restructuring of RBS. Assets were reduced by some £720 billion and costs by c£4.2 billion.[citation needed] The task had been likened to defusing a financial bomb.[citation needed] In addition to restoring financial health the share price of RBS which had troughed at 90p equivalent, rose to 330p by the time he left the bank.[citation needed]

Hester was paid an annual salary of £1.1 million by RBS.[6] In 2012 he was offered a bonus of just under £1 million, but following some considerable pressure from politicians and the public, he declined the bonus.[7] Later in 2012, in June, he declined his bonus for the following year after RBS's computer problems.[8]

In June 2013 Royal Bank of Scotland announced that Hester would be stepping down as CEO in December 2013, after five years with the bank.[citation needed]

RSA Insurance

[edit]On 4 February 2014, Hester joined RSA Insurance Group, the FTSE100 insurer, as CEO.[citation needed] The company was also experiencing a financial crisis and Hester led significant restructuring efforts, streamlining and focusing the business, raising £750 million in a rights issue and changing management whilst cutting costs.[citation needed] The insurer responded well to these changes with substantial increases in earnings, dividends and share price.[citation needed] The Company accepted an all cash bid worth £7.2 bn in June 2021 from Intact of Canada and Tryg of Denmark. The 52% premium was a record for the sector.[citation needed]

Other appointments

[edit]In June 2016, Hester was appointed to the board of Centrica the FTSE 100 energy Group as Senior Independent Director which he stepped down from in June 2022.[citation needed]

2021 onwards

[edit]Hester joined the board of easyJet, the European airline, on 1 September 2021, becoming chair on 1 December 2021.[citation needed] He was appointed lead independent director of Kyndryl in November 2021.[citation needed] In April 2022 Hester joined the board of Nordea Bank abp as vice chair, and became chair on 1 October 2022.[citation needed]

Personal life

[edit]Hester married Canadian-born Barbara Abt in 1991, and they have two children together.[9][10] They met when both were working for Credit Suisse.[9][10] They separated and divorced in 2010.[9][11]

In September 2012, Hester married Suzy Neubert, a former banker and wealth manager for the fund manager J.O. Hambro. It was a second marriage for both of them.[12][13] The couple have four children.[2]

Hester bought the 400-acre (160 ha) Broughton Grange estate in Oxfordshire in 1992.[9] One of Hester's passions is said to be development of the gardens and arboretum at the property, part of which was designed by landscape architect Tom Stuart-Smith and includes pleached limes, formal beds and five of the first Australian Wollemi pines to be brought into the UK.[3] For nine years Hester was a trustee of the Foundation and Friends of the Royal Botanic Gardens, Kew.[14][15][16]

Hester enjoys tennis, running and shooting, as well as skiing, for which he owns a chalet in Verbier, Switzerland.[17][18] Hester also used to enjoy horse riding,[18] as his first wife was a master of fox hounds in Warwickshire.[19]

Hester has in the past donated to the Conservative Party.[20] In the 2024 New Year Honours Hester was appointed Knight Bachelor for services to Business and the Economy.[21]

References

[edit]- ^ "Business Events". Yorkshire Post. Retrieved 6 April 2018.

- ^ a b Treanor, Jill (14 April 2021). "Interview: Stephen Hester, the Square Mile survivor". The Sunday Times. Retrieved 28 May 2024.

- ^ a b c d Davidson, Andrew (7 January 2007). "Towering task for British Land boss". London: The Sunday Times. Retrieved 13 October 2008.

- ^ "Stephen Hester appointed to Northern Rock board". Reuters. 18 February 2008. Archived from the original on 15 October 2008. Retrieved 13 October 2008.

- ^ Russell, Jonathan (13 October 2008). "Stephen Hester moves back to banking as new head of RBS". London: The Telegraph. Retrieved 13 October 2008.

- ^ Treanor, Jill (11 February 2013). "RBS chairman defends Stephen Hester's 'modest' pay". The Guardian. London.

- ^ Peston, Robert (30 January 2012). "RBS boss Stephen Hester rejects £4m bonus". London: bbc.co.uk. Retrieved 31 January 2012.

- ^ Treanor, Jill (29 June 2012). "RBS chief Stephen Hester gives up bonus over computer meltdown". The Guardian. London. Retrieved 29 June 2012.

- ^ a b c d "Stephen Hester: the first name on every headhunter's hitlist". independent.co.uk. 29 August 2015. Archived from the original on 25 May 2022. Retrieved 6 April 2018.

- ^ a b "Profile: RBS boss Stephen Hester". BBC News. 6 April 2018. Retrieved 6 April 2018.

- ^ Dailyrecord.co.uk (4 June 2010). "RBS boss splits with wife of 20 years as pressure of saving bank takes toll". dailyrecord.co.uk. Retrieved 6 April 2018.

- ^ Walsh, Kate (4 March 2012). "Prufrock: For Hester, this is Cupid's bonus". Retrieved 6 April 2018 – via www.thetimes.co.uk.

- ^ Fournier, Elizabeth (13 June 2013). "Impossible job was too hard for Hester to finish". cityam.com. Retrieved 6 April 2018.

- ^ "Profile: Stephen Hester". efinancialnews.com. 13 October 2008. Retrieved 13 October 2008.

- ^ "Support Kew – Kew Foundation Board of Trustees". Royal Botanic Gardens, Kew. Archived from the original on 6 January 2014. Retrieved 24 July 2013.

- ^ Jenkins, Patrick (7 June 2013). "Lunch with the FT: Stephen Hester". Financial Times. Retrieved 24 July 2013.

- ^ Jenkins, Patrick (5 February 2014). "Stephen Hester: the Mr Fixit of financial services". Financial Times. Retrieved 28 May 2020.

- ^ a b "Profile: Stephen Hester". The Scotsman. 16 January 2010. Retrieved 28 May 2020.

- ^ Eden, Richard (14 November 2009). "Hunting ban comes into force for Labour's banker Stephen Hester". ISSN 0307-1235. Retrieved 28 May 2020.

- ^ "Profile: Stephen Hester". scotsman.com. 6 January 2010. Retrieved 5 May 2024.

- ^ "No. 64269". The London Gazette (Supplement). 30 December 2023. p. N2.

External links

[edit]Stephen Hester

View on GrokipediaEarly Life and Education

Upbringing and Family Influences

Stephen Hester was born in 1960 in Ithaca, New York, where his British father served as a chemistry professor at Cornell University and his American mother worked as a psychotherapist.[15] [11] He spent his first eight years in the United States before his family relocated to the United Kingdom.[11] The family settled in North Yorkshire, where Hester attended Easingwold School, a local comprehensive institution, graduating in 1978.[16] [17] His upbringing occurred in unremarkable middle-class circumstances, without evident financial privilege or hardship, as a product of state education rather than elite preparatory schooling.[2] Parental professions likely contributed to an environment valuing academic achievement and analytical thinking, with his father's scholarly role modeling intellectual discipline and his mother's therapeutic work exposing early insights into interpersonal dynamics, though Hester has not elaborated publicly on direct causal influences shaping his career trajectory.[15]Academic and Initial Professional Formation

Hester attended Easingwold Comprehensive School in North Yorkshire before pursuing higher education at Lady Margaret Hall, Oxford University, where he read Philosophy, Politics, and Economics (PPE).[11][2] He graduated in 1982 with a first-class honours degree (BA Hons).[12][15] Following university, Hester entered investment banking directly, joining Credit Suisse First Boston (CSFB) in London in corporate finance.[2][15] This marked the start of his professional career in finance, where he initially focused on mergers and acquisitions advisory roles, building foundational expertise in deal structuring and corporate transactions amid the era's burgeoning global M&A activity.[2] Within his first year at CSFB, he was appointed personal assistant to the firm's chairman, gaining early exposure to senior leadership and strategic decision-making.[4] These initial positions at CSFB laid the groundwork for his rapid ascent in investment banking, emphasizing analytical rigor and client-facing operations derived from his PPE training in economic policy and philosophical reasoning.[17]Pre-RBS Banking Career

Roles at Credit Suisse

Hester began his banking career at Credit Suisse First Boston (CSFB) in 1982, immediately after graduating from Oxford University with a degree in philosophy, politics, and economics.[2] Initially employed in corporate finance, he spent one year as assistant to the chairman before advancing through various senior positions over two decades.[15] By the mid-1990s, Hester had risen to significant leadership roles within CSFB's operations. From 1996 to 2000, he served as chief financial officer and head of the support division at Credit Suisse First Boston LLC, overseeing financial strategy and operational support functions amid the firm's expansion in global markets.[18] He also held the position of global head of fixed income, managing the division's trading, sales, and structuring activities in bonds, derivatives, and related instruments, which contributed to CSFB's prominence in debt markets during a period of volatile interest rates and emerging market exposures.[12] In the early 2000s, Hester's responsibilities expanded to broader executive oversight at Credit Suisse, including finance chief duties across fixed income operations. Appointed to head a key division in summer 2000 following his CFO tenure, he navigated internal challenges such as trader dissatisfaction but maintained the firm's competitive edge in fixed income awards from Euromoney.[19] His tenure emphasized risk management and profitability in high-volume trading desks, though specific performance metrics like revenue growth in fixed income under his direct leadership remain tied to broader market cycles rather than isolated attribution. Hester departed Credit Suisse in 2002 to join Abbey National as finance director, concluding a 20-year association with the institution that honed his expertise in investment banking and fixed income.[3]Tenure at British Land

Stephen Hester was appointed chief executive designate of British Land Company PLC effective 1 December 2004, assuming the full role on 1 January 2005, succeeding founder Sir John Ritblat.[20] His tenure, spanning 2004 to 2008, focused on restructuring the property investment firm amid a shifting commercial real estate market.[12] Hester, previously chief operating officer and finance director at Abbey National, brought banking expertise to manage the company's portfolio of office, retail, and mixed-use developments primarily in London.[2] Under Hester's leadership, British Land underwent significant operational changes, including a conversion to a real estate investment trust (REIT) structure in 2007, which mandated distributing 95% of rental income as dividends and aimed to enhance tax efficiency and investor appeal.[21] He oversaw a dramatic restructuring, emphasizing portfolio optimization through selective asset disposals to strengthen the balance sheet.[22] As the 2007-2008 credit crunch intensified, Hester directed the sale of nearly £4 billion in properties, reducing gearing (debt-to-equity ratios) to mitigate liquidity risks and maintain financial stability amid falling valuations and tightened lending conditions.[23] These disposals included high-profile assets, contributing to a net asset value decline in periods of market stress, such as a £572 million loss in the first quarter of one year during his tenure compared to prior profits.[24] Despite challenges, the strategy preserved operational continuity, with the company reporting robust rental income from core holdings like Broadgate and Paddington Basin. Hester's final full year (to March 2008) saw him compensated £2.1 million in base pay, bonuses, and benefits, reflecting performance amid pre-crisis growth.[25] Hester departed British Land in October 2008 to join the Royal Bank of Scotland board, later assuming its CEO role amid the global financial crisis, leaving Lucinda Bell as interim chief before Chris Grigg's permanent appointment.[1] His exit followed successful deleveraging efforts that positioned the firm to navigate the downturn, earning industry recognition for crisis management.[23]Royal Bank of Scotland Leadership

Appointment Amid Financial Crisis

In the midst of the 2008 global financial crisis, the Royal Bank of Scotland (RBS) faced imminent collapse primarily due to its £49 billion acquisition of Dutch bank ABN AMRO in 2007, a deal executed with limited due diligence amid deteriorating market conditions and subprime mortgage exposures.[26] The consortium-led purchase, totaling around €71 billion, strained RBS's capital base as asset values plummeted, culminating in a projected £24 billion loss for the year and a severe liquidity crunch that threatened systemic instability.[27] On October 11, 2008, CEO Fred Goodwin resigned amid criticism of his aggressive expansion strategy, which had transformed RBS into one of the world's largest banks by assets—over $2.2 trillion—but left it vulnerable without adequate risk buffers.[28] The UK government intervened decisively on October 13, 2008, announcing a £37 billion recapitalization package across major banks, including up to £20 billion in preference shares for RBS in exchange for a controlling stake of around 60 percent, later formalized at 58 percent ordinary shares by November.[29] This infusion, part of a broader £500 billion liquidity support framework, averted RBS's failure but positioned the state as the majority owner, with total support eventually reaching £45.5 billion by 2009 and peaking at an 84 percent stake.[30] In this context, Stephen Hester, then CEO of British Land where he had navigated property sector turbulence, was appointed RBS group chief executive in late October 2008 to oversee restructuring and value preservation for taxpayers.[2] His selection emphasized expertise in risk management from prior roles at Credit Suisse First Boston, aligning with the government's mandate for operational stabilization over expansion.[31]Restructuring Initiatives and Operational Reforms

Upon assuming the role of Group Chief Executive in November 2008, Stephen Hester initiated a comprehensive five-year turnaround plan for the Royal Bank of Scotland (RBS), formally outlined in February 2009, emphasizing risk reduction, balance sheet deleveraging, and a strategic refocus on core UK retail and commercial banking operations while winding down non-core and high-risk activities.[32][33] The plan divided the bank's assets into a "Core" segment for sustainable franchises and a "Non-Core" division to manage disposals and run-offs, initially transferring £240 billion in funded assets and additional exposures to the latter for orderly liquidation.[34] This restructuring complied with the European Commission's state aid requirements, mandating divestitures such as RBS branches in England and Wales and NatWest branches in Scotland, with agreements targeted for completion by 2011.[33] Key operational reforms included stringent cost controls and workforce reductions to enhance efficiency, with headcount dropping from 199,800 in 2008 to 183,700 by year-end 2009—a reduction of 16,100 positions—followed by announcements of an additional 9,000 cuts in April 2009 aimed at £2.5 billion in annual savings by 2011, and further 3,700 in November 2009.[33][35][36] By 2012, cumulative job losses under Hester exceeded 33,000, including 3,500 in investment banking as part of a broader contraction of global markets operations, rebranded as Markets and International Banking to prioritize conservative funding and client-focused services over proprietary trading.[37][38] These measures improved the Core Bank's cost-to-income ratio from 66.2% in 2008 to 53.5% in 2009, targeting below 55% group-wide by 2013, alongside enhanced risk frameworks such as tighter credit approvals and increased liquidity reserves from £89.8 billion to £170.7 billion.[33] Balance sheet shrinkage formed the plan's backbone, with total assets contracting by £696.2 billion (31%) to £1,522.5 billion in 2009 alone through asset run-offs and sales, including a 4.26% stake in Bank of China for HKD 18.4 billion in January 2009 and a 50% stake in Linea Directa.[33] The Non-Core portfolio, starting at £251 billion, saw £122 billion (36%) disposed or reduced in 2009, with a 2013 run-off target of £258 billion; overall, RBS's balance sheet was reduced by approximately £712 billion (44%) from peak levels by the early 2010s via ongoing disposals of non-strategic units like RBS Sempra Commodities (sold for $1.7 billion in February 2010, with RBS's share ~$0.8 billion).[33][39] Loans to customers fell £135.6 billion (19%), and the group loan-to-deposit ratio improved from 154% to 135%, reflecting a shift away from wholesale funding reliance.[33]| Key Restructuring Metrics (2008-2009) | 2008 | 2009 | Change |

|---|---|---|---|

| Total Assets (£ billion) | 2,401.7 | 1,696.5 | -31% |

| Headcount | 199,800 | 183,700 | -8% |

| Cost Savings Achieved (£ billion) | N/A | 1.3 | Target: 2.5 by 2011 |

| Non-Core Assets Reduced (£ billion) | N/A | 122 | From initial £251 |