Recent from talks

Nothing was collected or created yet.

Moving company

View on Wikipedia

This article needs additional citations for verification. (May 2017) |

A moving company, also known as a removalist or van line, is a company that specializes in assisting individuals and businesses with relocating their goods from one location to another. Moving companies may offer additional or all-inclusive services for relocations, like packing, loading, moving, unloading, unpacking, and arranging of items to be shifted. Additional services may include cleaning services for houses, offices or warehousing facilities.

Overview

[edit]According to the U.S. Census Bureau, in 2007, 40 million United States citizens had moved annually over the previous decade.[1] Of these movers, 84.5% relocated within their own state, 12.5% moved to another state, and 2.3% moved to another country.[2]

The U.S. Department of Defense is the largest household goods shipper in the world, with the Personal Property Program accounting for 20% of all moves.[3]

A 2020 OnePoll survey showed that 64% of participants consider their recent move to be one of the most stressful events they have ever encountered.[4]

Pricing and services

[edit]United States and Canada

[edit]In the U.S. and Canada, the cost for long-distance moves is generally determined by several factors:

- Weight of the items to be moved

- Distance between the original and new location

- Speed of the move

- Timing of the move, including the specific time of year or month

Some movers also offer consolidated shipping, which reduces costs by transporting several clients' items in the same shipment.

United Kingdom and Australia

[edit]In the United Kingdom and Australia, the price is based on the volume of the items rather than their weight. Some movers may offer flat rate pricing.

DIY moving

[edit]The use of truck rental services, or simply borrowing similar hardware, is referred to as DIY moving. Individuals or families may rent a truck or trailer large enough to transport their household goods. They may also acquire moving equipment such as dollies, furniture pads, and cargo belts to facilitate the move and protect their belongings.

Packing and materials

[edit]The moving process also involves finding or buying materials such as boxes, paper, tape, and bubble wrap with which to pack boxable and/or protect fragile household goods and to consolidate the carrying and stacking on moving day. Self-service moving companies offer another viable option: the person moving buys space on one or more trailers or shipping containers. These containers are then driven by professionals to the new location.

Legal regulations

[edit]The moving industry is governed by a dual framework of jurisdictional oversight designed to prevent unlicensed operations and ensure consumer safety. These regulations vary significantly based on whether a move is performed within a single state consider Intra-state , not to be confused with Interstate which is considered across state lines (interstate), or internationally.[1]

United States

[edit]In the United States, oversight is divided between federal and state agencies. Interstate moves are regulated by the Federal Motor Carrier Safety Administration (FMCSA), which mandates that carriers obtain a unique USDOT number and provide consumers with standardized documentation, such as the "Your Rights and Responsibilities When You Move" booklet.[5]

State-level oversight

[edit]Intrastate moves are governed by state-specific agencies, such as a Department of Transportation or a Public Utility Commission. While specific requirements vary by jurisdiction, most states utilize a standardized model for household goods (HHG) carriers:

- Licensing: Most jurisdictions require a "Common Carrier Certificate" or a state-specific permit. For example, in Louisiana, the Louisiana Public Service Commission (LPSC) requires a certificate under La. R.S. 45:164(E), while in Texas, movers must register with the Texas Department of Motor Vehicles.[6]

- Financial Security: Regulators typically mandate public liability (Form E) and cargo insurance (Form H). Minimum requirements often include specific liability thresholds and a mandatory surety bond, such as the $5,000 bond enforced in Louisiana to protect against unfair trade practices.[7]

- Advertising Compliance: To assist in identifying "rogue movers," many states require the display of license credentials in all marketing. Under LPSC General Order R-30507, carriers must list their legal name and certificate number on all websites and invoices.[8]

International variations

[edit]In Canada, moving services are regulated at the provincial level through consumer protection acts to prohibit "hostage load" tactics. In the United Kingdom and Australia, movers (often called "removalists") must adhere to national fair trading laws and transport safety standards.

See also

[edit]References

[edit]- ^ Stellin, Susan (2007-07-29). "The Movers Are Here. Have You Done Your Homework?". New York Times. Retrieved 2008-12-07.

- ^ "American Moving & Storage Association -- Industry Fact Sheet" (PDF). American Moving & Storage Association. American Moving & Storage Association. 2012. Archived from the original (PDF) on 2016-03-07. Retrieved May 9, 2015.

- ^ Gresik, Dylan; Shane III, Leo (2020-03-20). "Sudden halt on military moves due to coronavirus could cripple industry, officials warn". Military Times. Retrieved 2020-12-11.

- ^ "Americans say moving is more stressful than divorce, having children, survey claims". foxnews.com. 2020-09-30. Retrieved 2024-06-14.

- ^ "Protect Your Move". FMCSA. Retrieved 2026-01-19.

- ^ "Louisiana Revised Statute 45:164". Louisiana State Legislature. Retrieved 2026-01-19.

- ^ "Application for Household Goods Carriers (Form T-77)" (PDF). Louisiana Public Service Commission. Retrieved 2026-01-19.

- ^ "Regulatory Credentials and Licensing Compliance". Atmosphere Movers. Retrieved 2026-01-19.

LPSC #6892-B; USDOT #1043891

Moving company

View on GrokipediaDefinition and Industry Overview

Core Services and Role

A moving company, also known as a household goods carrier, is a business that specializes in transporting personal or commercial belongings from one location to another, including the processes of loading, unloading, and providing temporary storage when needed.[1] These companies are typically registered motor carriers that own or operate trucks and employ staff to handle the physical aspects of relocation directly, distinguishing them from brokers who merely arrange services. The core services offered by moving companies revolve around efficient and secure relocation. Primary among these is transportation via specialized trucks or vans designed for household goods, ensuring items are moved point-to-point with minimal disruption. Additional fundamental services include loading and unloading belongings at origin and destination sites, as well as basic packing and handling to protect items during transit; many also provide disassembly and reassembly of furniture to facilitate navigation through doorways and tight spaces. Temporary storage is another key offering, allowing goods to be held securely in warehouses for short periods if timing conflicts arise during a move.[4][5] In the broader logistics sector, moving companies play a specialized role focused on full-service, end-to-end relocation for individuals and businesses, emphasizing personalized handling of household or office contents rather than bulk commodity transport. Unlike freight shipping services, which primarily deal with commercial cargo in less-than-truckload (LTL) or full-truckload shipments across supply chains, moving companies prioritize the careful, direct transfer of personal effects, often including white-glove treatment for fragile or high-value items to minimize damage risks.[6] This distinction positions them as integral to personal and corporate mobility, supporting transitions like job relocations or home changes without the scalability of general freight operations. Key statistics highlight the scale of these services in the United States, where long-distance moves—defined as interstate relocations—typically cover an average distance of about 569 miles, based on industry migration reports. Such moves represent a significant portion of annual relocations, with millions of households relying on professional movers each year for distances exceeding 100 miles to ensure safe and efficient transport.[7]Market Size and Economic Impact

The global moving services market, encompassing residential, commercial, and international relocations, is estimated at USD 110.97 billion in 2025 and is projected to reach USD 143.18 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.23%, driven primarily by urbanization and increasing population mobility in emerging economies.[8] In the United States, which represents one of the largest regional markets, the industry generated approximately USD 23.4 billion in revenue in 2025.[2] These figures highlight the sector's scale, with North America accounting for a significant portion of global activity due to high domestic migration and real estate dynamics.[9] Employment in the moving industry in the United States supports job creation, with direct employment estimated at approximately 112,000 people as of 2025.[3] This workforce contributes to broader economic stability by facilitating labor mobility and supply chain efficiency. The industry's economic impact extends to GDP contributions in developed economies, where it accounts for roughly 0.1-0.3% of total output via direct and multiplier effects; for instance, in the US, total economic activity from moving and storage reached USD 92.2 billion as of 2021, supporting USD 12.8 billion in wages and USD 10.6 billion in taxes.[10] Key drivers of the industry's growth include population migration rates and real estate turnover, which directly influence demand for relocation services. Globally, urbanization has accelerated internal and international moves, with over 50% of the world's population now residing in urban areas, fueling a projected 5% annual increase in household relocations in developing regions.[8] In the US, approximately 8.1% of the population (about 27 million people) moved in 2023, though recent home turnover rates have declined to a low of 2.8% in 2025 amid high interest rates and housing market constraints, tempering but not halting demand.[11][12] These factors underscore the moving sector's role in supporting economic expansion through enhanced workforce redistribution and property market liquidity.Historical Development

Early Origins and Evolution

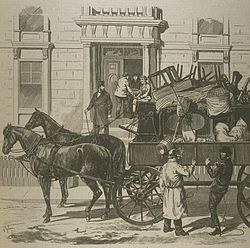

Before the 19th century, organized moving services were largely informal and relied on individual labor and basic animal-powered transport for local relocations in urban centers. In ancient Rome, merchants and affluent individuals transported household goods and luggage over short distances using two-wheeled carts or four-wheeled wagons drawn by oxen, donkeys, or mules, while porters manually carried smaller items to warehouses along harbors and city streets.[13][14] Similarly, in medieval Europe, urban dwellers depended on porters for carrying belongings on foot or employed horse-drawn carts and wagons for heavier loads during relocations within growing towns, though such services remained ad hoc and unregulated.[15] The emergence of professional moving companies occurred in the mid-19th century amid industrialization in the United States and United Kingdom, coinciding with the expansion of rail networks that enabled longer-distance relocations. In the US, early firms appeared in the 1840s–1860s as secondary services offered by wagon and drayage operators near railroads, using pack animals and carts to transfer household goods from rail depots to final destinations.[16] In the UK, similar developments followed the rapid growth of railways from the 1830s, with independent haulers providing relocation services in industrializing cities like London and Manchester, often integrating rail-assisted transport for efficiency.[17] One of the earliest documented specialized movers, Bekins Van Lines, began operations in 1891 in Sioux City, Iowa, with horse-drawn vans dedicated to household goods.[18] Key innovations during this period included the introduction of enclosed horse-drawn vans in the late 19th century, which protected furniture and belongings from weather during urban and short-haul moves, marking a shift from open carts to more secure, purpose-built vehicles.[18] This evolution from manual loading by porters to mechanized horse teams reduced damage and sped up the process, laying groundwork for standardized services.[16] In the social context of the era, these early moving practices supported the US westward expansion, where pioneer families formed wagon trains to transport possessions across vast distances, with haulers assisting rail-to-wagon transfers for migrants heading to the frontier.[16] In Europe, the services facilitated urban growth driven by industrialization, enabling rural-to-city migrations as workers relocated to factory centers, with horse vans handling the increasing volume of household moves in expanding metropolises.[19]20th Century Expansion and Regulation

The early 20th century marked a significant boom in the moving industry, driven by the post-World War I adoption of motor trucks that facilitated long-distance household relocations previously limited by rail dependency. Paved roads expanded during the war effort, enabling trucks to replace horse-drawn wagons and trains for more efficient, door-to-door service.[16][20] This era saw the establishment of major firms, such as United Van Lines, founded in 1928 in Cleveland, Ohio, as Return Loads Service, Inc., to coordinate return shipments among independent movers and reduce empty hauls.[21] World War II profoundly influenced the industry through a surge in military relocations, as the U.S. armed forces required the transportation of household goods and personal property for personnel changing stations, leading to increased government contracts and the development of standardized practices for secure handling and documentation.[22] Although fuel and truck shortages temporarily forced some reversion to rail, the demand from troop movements and war-related civilian shifts prompted innovations in logistics coordination.[16] Mid-century regulations formalized oversight to ensure safety and fair competition. In the United States, the Motor Carrier Act of 1935 extended Interstate Commerce Commission (ICC) authority to interstate motor carriers, including those transporting household goods, mandating licensing, rate approvals, and operational standards for movers operating across state lines.[23] Similar developments occurred in Europe; for instance, the UK's Road and Rail Traffic Act 1933 required licenses for goods vehicles, regulating road haulage to balance competition with rail and prevent unsafe practices.[24] These frameworks addressed growing interstate and cross-border volumes by prioritizing consumer protection and infrastructure strain. The late 20th century saw further regulatory changes with the Motor Carrier Act of 1980, which deregulated the trucking industry, including household goods movers, by easing entry requirements, allowing more flexible pricing, and reducing ICC oversight. This led to increased competition, lower costs for consumers, and industry growth, though it also raised concerns about safety and labor standards. By the late 20th century, globalization expanded the industry into international relocations, bolstered by containerization innovations in the 1970s that standardized overseas shipments of household goods, reducing costs and damage risks through intermodal transport.[25] This shift enabled moving companies to handle transoceanic moves more efficiently, integrating with global shipping networks and supporting expatriate and corporate transfers.[26]Types of Moving Services

Residential and Local Moves

Residential and local moves involve the relocation of household goods within a short distance, typically under 100 miles and often within the same city or metropolitan area, allowing for same-day completion in many cases. These services cater specifically to individual or family households transitioning between residences, and may also apply to local commercial moves, though longer-distance or larger-scale commercial relocations often require additional planning. According to industry sources, a local move is typically defined as any transport not crossing state lines and within a 50 to 100 mile radius, though some specify 50 miles or less, enabling movers to use smaller fleets and complete jobs in a single day.[27][28][29] The process for a residential local move begins with an on-site or virtual survey conducted by the moving company to assess the volume of items, layout challenges, and specific needs, providing an accurate estimate and customized plan. Customers then choose between full-service packing, where professionals handle all wrapping and boxing using specialized materials, or self-packing, allowing individuals to prepare their belongings while movers focus on loading and transport to save costs. Loading involves securing furniture and boxes onto the truck using dollies for wheeled transport, ramps for elevation changes, and straps to prevent shifting, followed by unloading at the destination where crews place items in designated rooms and may perform basic assembly or setup of essentials like beds. This streamlined approach ensures safety and speed, with common challenges addressed through tools designed for urban environments, such as stair-climbing dollies for multi-level apartments.[30][31][32][33] Typical scenarios for local residential moves include transitions from apartments to houses, often involving navigating tight spaces and parking constraints, or seasonal relocations for college students moving between dorms and off-campus housing. For a standard 2-bedroom home, the entire process averages 5 to 8 hours with a crew of 2-4 movers, depending on factors like floor access and item volume. Equipment commonly used includes box trucks ranging from 10 to 26 feet in length to accommodate household loads without excess capacity, paired with specialized tools like appliance dollies and furniture pads for handling stairs or elevators in high-rise buildings.[34][35][36]Commercial and Long-Distance Moves

Commercial moves encompass the relocation of business facilities, such as offices and retail spaces, where specialized services are essential to maintain operational continuity; these can occur locally or over longer distances. These relocations often involve careful handling of sensitive IT equipment, including servers, computers, and networking hardware, typically managed by certified technicians who disconnect, pack, transport, and reconnect systems to prevent data loss or damage.[37] To minimize business downtime, movers schedule operations during off-peak hours, weekends, or phased over multiple days, allowing employees to continue work with minimal interruption.[38] Fleet coordination plays a key role, with professional companies deploying multiple trucks and teams to efficiently transport furniture, files, and inventory across potentially large volumes.[39] Long-distance moves extend beyond local boundaries and can apply to both residential and commercial relocations, involving cross-state or international transport using semi-trucks for domestic interstate hauls or shipping containers for overseas shipments. These services ensure secure transit of bulky items like office machinery, retail displays, or household furniture, often requiring customs clearance and specialized packaging for international destinations.[40] Timelines for such moves generally range from 1 to 4 weeks, depending on distance, mode of transport, and any interim storage needs, with cross-country domestic relocations averaging 10 to 20 days from pickup to delivery.[41] Key logistics elements in commercial and long-distance moves include meticulous route planning to optimize fuel efficiency, avoid delays, and comply with traffic regulations, often leveraging GPS and software for real-time adjustments.[42] Secure storage facilities may be utilized en route for temporary holding of goods, particularly in phased relocations or when destinations are not immediately ready. Additionally, compliance with hazardous materials transport regulations is critical, especially for office chemicals like solvents or cleaning agents, requiring proper labeling, packaging, and carrier certification under federal guidelines to prevent environmental or safety risks.[43] To illustrate scale, relocating a 50-employee office might involve coordinating the transport of 20 to 50 pallets containing desks, filing cabinets, and electronics, demanding comprehensive inventory tracking and multi-vehicle logistics, whereas an individual long-haul household move typically handles far fewer items in a single truckload.[44] This contrast highlights the increased complexity and resource demands of commercial operations compared to personal relocations.International and Specialized Moves

International moves involve relocating goods across national borders, requiring compliance with customs regulations, import/export documentation, and often specialized shipping methods such as ocean freight or air cargo. These services handle both residential and commercial needs, including duties, quarantines, and destination delivery, with timelines varying from weeks to months depending on the countries involved.[45] Specialized moving services focus on unique or fragile items, such as pianos, artwork, antiques, vehicles, or laboratory equipment, using custom crating, climate-controlled transport, and expert handling to ensure safety. These may be local, long-distance, or international and are distinct from standard household or office moves due to the need for tailored equipment and insurance.[46] Furniture removal services, provided by many moving companies, involve the transport, rearrangement, disposal, or donation of furniture items as a standalone service, separate from comprehensive household or commercial relocations. These services are often utilized during home renovations, downsizing, or estate clearances, and may include eco-friendly disposal options to minimize environmental impact.[47][48][49]Pricing Structures and Contracts

Cost Factors and Estimation

The cost of hiring a moving company is primarily determined by the distance traveled, the volume or weight of the items being moved, and access challenges at the origin and destination locations. Distance is a key driver, with local moves (typically under 100 miles) charged hourly or by a flat rate, while long-distance or interstate moves are often priced based on mileage plus weight or volume. Volume is commonly estimated in cubic feet, where a standard one-bedroom apartment requires approximately 250 to 350 cubic feet, calculated by measuring the dimensions of furniture and boxes (length × width × height in feet). Access issues, such as flights of stairs, elevators, long carry distances, or limited parking, can increase costs by requiring additional time, equipment, or labor.[50][51][52] Additional factors include seasonal demand, which peaks in summer months (May through September), leading to higher rates due to limited availability and increased competition for mover services; off-peak moves in winter can reduce costs by 20-30%. Special items like pianos, safes, or aquariums often incur extra charges for specialized handling, such as cranes or disassembly, potentially adding hundreds of dollars. Labor requirements also play a role, with most jobs involving 2 to 4 movers, billed hourly for local moves, where each additional hour or crew member escalates the total.[51][53][52] The estimation process begins with a survey to assess the shipment, which can be conducted in-home for precision or virtually via video calls and inventory lists to accommodate remote clients. During a virtual survey, customers should ask key questions to ensure accurate estimation and transparency, including:- Do you hold a valid moving company license and insurance?

- What specific moving services do you offer?

- How do you calculate the cost of the move (e.g., by weight, volume, distance, or hourly rates)?

- Are your movers professionally trained and background-checked?

- What types of estimates do you provide (binding, non-binding, or not-to-exceed)?

- Are there any potential hidden fees or additional charges?

- What is your policy on liability and protection for items?

- How do you handle special or fragile items?