Recent from talks

Nothing was collected or created yet.

Ecotricity

View on Wikipedia

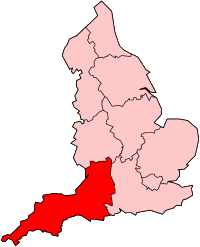

Ecotricity is a British energy company based in Stroud, Gloucestershire, specialising in selling green energy to consumers that it primarily generates from its 87.2 megawatt wind power portfolio.[2] It is built on the principle of heavily reinvesting its profit in building more of its own green energy generation.[3]

Key Information

The company was founded in 1995 by Dale Vince, who remains in control. As of 2025[update] the company has around 167,000 meter points on supply, comprising domestic and business customers. Ecotricity's initiatives included the creation of one of Britain's first electric vehicle charging networks, which was sold to Gridserve in 2021.

History

[edit]Ecotricity was started by Dale Vince in 1995 as Renewable Energy Company Limited,[4] with a single wind turbine he had used to power an old army truck in which he lived on a hill near Stroud.[5]

Vince later went on to build commercial wind-monitoring equipment, which the company still makes today, using the name Nexgen.[6] Ecotricity started generation with a 40-metre turbine in 1996, which at the time was the largest in the country.[7]

In 2007, Vince ran an advertisement on the back page of The Guardian newspaper inviting Richard Branson to his house to discuss solutions to climate change over a carbon-free breakfast. The ad ran the day after Branson appeared on TV with American former vice president Al Gore, who had managed to persuade Branson that climate change was an issue. The ad included Vince's personal mobile phone number.[8]

Ecotricity was a winner in the 2007 Ashden Awards for sustainable energy. The awards congratulated Ecotricity for its environmental contribution, saying: "The company's turbines are delivering 46 GW·h/yr of renewable electricity and avoiding around 46,000 tonnes of CO2 emissions a year. The installed capacity is expected to double by the end of 2007."[9]

In July 2009, Ecotricity started legal proceedings[10] against French power company EDF Energy for the alleged misuse of the green Union Flag logo, used to promote EDF's Team Green Britain campaign. Ecotricity had previously used a green Union flag in its own advertising and claimed confused customers had contacted it to ask why Ecotricity was co-operating with EDF.

In January 2012, it was announced that Ecotricity has invested in the development of Searaser pump-to-shore wave energy machines,[11] and in June said they were to be deployed in the autumn of that year.[12] In October 2014, Ecotricity and marine consultants DNV GL were moving from laboratory trials to sea trials.[13]

In 2013, Ecotricity's electricity supply became 100% renewable, rather than a mix.[14]

In October 2014, it was announced that Ecotricity had partnered with Skanska to build and finance new turbines, which added a further 100 MW to its existing 70 MW capacity,[15] The following month, the company decided not to attempt new planning applications in England because of the political climate, instead concentrating on Scotland.[16] It went on to spin its small turbine manufacturer out into a subsidiary called Britwind,[17] which, in collaboration with a local company, offered free electricity to crofters in return for installing a small turbine, keeping any excess power generated.[18]

In March 2015, Ecotricity announced it had refinanced its existing wind farms with the aim of using the extra capital to expand production to 100 megawatts by November 2016.[19]

In 2016, Ecotricity had approximately a 25% shareholding stake in competitor Good Energy, which has been sustained to 2020.[20][21]

In the 2017/2018 financial year the company had a turnover of £176 million, with a gross profit of £55 million and a loss on ordinary activities before tax of £4.9 million, but after charges and revaluation of investments had a "Total comprehensive (loss) for the year" of £9.5 million. It gave £416,000 to charity.[22][23]

In 2018, the UK government used a green union flag for a promotion, which lead Vince to file a lawsuit for copyright infringement due to the similarities to the logo of Ecotricity. The case was settled in 2020 and the government agreed to not use the flag again.[24]

By 2019, the company had 200,000 customers.[14] A corporate restructure in 2020 created Green Britain Group Limited;[25] the company's directors are Dale Vince and Kate Vince, and its subsidiaries include Ecotricity Limited and Forest Green Rovers Football Club Limited.[26]

In January 2021 the company agreed to buy 3 Megawatt-hours yearly from United Downs Deep Geothermal Power, the UK's first geothermal plant.[27][28] In summer 2021, Ecotricity made a bid to take over Good Energy, where it already owned 27% of the shares, which was rejected.[29][30]

In April 2022, Dale Vince stated an intention to sell the company. It was reported that the company planned to build a further 2,500 MW of renewable energy generation, which would require investment of some £2 billion.[31]

In May 2023, Asif Rehmanwala was appointed as the CEO of Ecotricity and the Green Britain Group.

In December 2023, Ecotricity donated £1 million to the UK Labour Party.[32]

In October 2024, Ecotricity Group Limited took a controlling stake in regional airline Ecojet which was previously held by Dale Vince.[citation needed]

In July 2025, Ecotricity had around 167,000 customers.[33]

Generation

[edit]Before August 2013, Ecotricity ran a mix of fuels. Ecotricity's proportion of renewable energy rose from 24.1% in 2007 to 51.1% in 2011 (compared with a national average of 7.9%), with plans for a further increase to 60% by 2012.[34]

In the past, a substantial proportion of the electricity (25.9% in 2007) sold by Ecotricity to customers came from nuclear sources. This proportion had decreased to 16% by 2010, and 2.6% by 2011.[34] Ecotricity also provided a 100% renewable energy tariff called New Energy Plus, in which renewable energy was bought in from other suppliers to top up renewable energy produced by Ecotricity.[35]

Wind

[edit]At Conisholme in Lincolnshire on 8 January 2009, two of the blades of one of the company's turbines were damaged.[36] In February 2013 the go-ahead was given for Ecotricity to build its largest windfarm, a 66 megawatt, 22 turbine farm at Heckington Fen in Lincolnshire.[37] In February 2013, Ecotricity revealed a prototype 6 kW vertical axis wind turbine called the "urbine".[38] In October 2018, Ecotricity began operations at the Alveston wind farm in South Gloucestershire.[39] In May 2022, a partnership with ABB was announced for the installation of a grid scale battery energy storage system at the wind farm.[40]

Solar

[edit]Ecotricity also produces solar energy, with its first "sun park" opening in 2011.[41] In April 2016 it bought SunEdison's UK business supplying domestic solar panels.[42] In 2025, Ecotricity was granted planning permission for a solar park at Heckington Fen, Lincolnshire, which will provide 600MW of solar energy and 400MW of battery storage.[43]

Gas

[edit]In May 2010, Ecotricity became the first UK company to supply eco-friendly gas, produced in the Netherlands by anaerobic digestion of sugar beet waste.[1][44] In 2015, the company was planning to have its own digesters fed by locally sourced grass from marginal land of grade 3 or poorer by 2017. The first of these would have produced 78.8GWh a year from 75,000t of grass and forage rye silage.[45][46]

In August 2015, Ecotricity announced plans to build an anaerobic digester at Sparsholt College in Hampshire that would take grass cuttings from local farms and supply the resulting six megawatts[47] of gas to the grid[48] with the overall aim of training students in the technology. This joined the first announced in Gloucestershire in April[45] and was followed by a third three megawatt[49] plant announced in August in Somerset.[50]

On 25 April 2016, planning permission for the site at Sparsholt College was refused.[51] In July 2016, a new application was made to build the facility at the college site, which was approved in October 2016.[52] The new proposal included "[...] new and revised traffic data and assessment, new traffic plans to keep vehicle movements away from Sparsholt village and a commitment to protect local road infrastructure.". Also, "[Ecotricity] consulted representatives of the nearby parish councils and incorporated their requests, wherever possible into the routing plans and operational controls."[citation needed]

By the start of 2019, the company had not built any biogas plants but still intended to do so.[14]

Microtricity feed-in tariff

[edit]Ecotricity offers the Feed-in Tariff as a voluntary licensee[53] under the name "Microtricity", offering payments to people who generate and export electricity from low-carbon sources such as solar panels.

As of October 2024[update], Ecotricity does not offer a Smart Export Guarantee tariff to small low-carbon generators such as domestic solar panel systems.[54]

Side projects

[edit]Greenbird

[edit]Ecotricity is the sponsor of the Ecotricity Greenbird, a land yacht that set a new world land speed record for wind-powered vehicles on 26 March 2009 on the dry Lake Ivanpah.

Nemesis

[edit]Ecotricity has built an electric sports car called Nemesis that was built as a demonstration of what electric cars are capable of: an endurance trip from Land's End to John o' Groats is planned recharging only from electricity produced by wind power.[55] In September 2012 the car broke the UK electric land speed record reaching an average speed of 151 miles per hour (243 km/h).[56]

Vehicle recharging (2011 to 2021)

[edit]In July 2011, Ecotricity launched a free electric vehicle charging network, sited around the country at 14 of the Welcome Break Motorway service areas, linking London in the south with Exeter in the west and Edinburgh in the north.[57] The charging points were initially equipped with both a UK-standard 13-amp domestic socket and an IEC 62196 32-amp 3-phase socket. There were plans for charging points at RoadChef sites also.[7]

In October 2012, the company started to add 50 kW CHAdeMO fast charging stations, allowing compatible cars to recharge within 30 minutes.[58] In April 2014, it was announced that support for Combined Charging System connectors would be added,[59] and by September Ecotricity had over 120 chargers, branded as the Electric Highway. In May 2014, Ecotricity brought an interim High Court injunction against electric car manufacturer Tesla over its vehicle charging network;[60][61] this was resolved in an out of court settlement.[62]

In 2014, the Ecotricity vehicle charging network had sporadic software issues after the addition of a new connector which left some chargers not working or not connecting to specific cars.[63]

In December 2014, the network covered 90% of the UK's motorway service stations, with sites also at Land's End and John o' Groats.[64] By December 2015, it had 6,500 members using it once a week or more, and the network, which had hitherto been free to use, began to require payment.[65][66] From 11 July 2016, a 20-minute fast-charge cost £5, later changed to £6 for 30 minutes,[67] but charges remained free for customers of Ecotricity. Following feedback from users, a balance between the needs of EV drivers and PHEV drivers led to a £3 connection fee, waived for Ecotricity customers, and 17p per KWh.[68]

In 2018, the Ecotricity EV tariff on its motorway network was 30p/KWh for non-Ecotricity customers and half this for customers. Access was via a mobile phone app.[69] To help with using this, some of the charging points were fitted with short-range, restricted, WiFi to enable connection in poor mobile signal areas. By the start of 2019, Ecotricity had over 300 charging points.[14]

In early 2021, Ecotricity and GRIDSERVE announced a partnership which would see the network expanded and contactless payment facilities added. Funding for the programme came from Hitachi Capital (UK), also a shareholder in GRIDSERVE.[70][71] In mid-2021, it was announced that GRIDSERVE had purchased the remaining stake from Ecotricity, taking full ownership of the charging network.[72]

Distributed energy storage

[edit]Around 2014, Ecotricity investigated supplying 100 houses with an internet-connected grid energy storage system that will take the homes off the grid at peak times.[73][74]

Mobile phone network

[edit]Ecotricity launched a mobile virtual network called Ecotalk in 2018;[75] plans had been discussed by Vince in 2013.[76] Money from customer's bills would be used to buy land for nature conservation, in part through a partnership with the RSPB.[77]

Small turbine manufacture

[edit]In May 2014, Ecotricity rescued Evance, a manufacturer of small (5 kW) wind turbines, from administration,[78] saving the company's 29 jobs.[79] Branded "Brit Wind", in January 2017 they announced £1 million of sales to Japan as well as sales to France, Norway, Denmark, the US and Belgium.[80]

Political donations

[edit]The company has donated to several political parties that support subsidies for renewable energy. In November 2013 it donated £20,000 to the Green Party.[81] In February 2015, Ecotricity announced that it would be donating £250,000 to the electoral fighting fund of the Labour Party.[82] This decision alienated some of its customers, in particular supporters of the Green Party, as they felt some Labour policies were at odds with Ecotricity's avowed green ethical stance.[83]

Ecotricity had already donated £120,000[81] to Labour in November 2014, including £20,000 to the local group in Stroud[81] which was trying (unsuccessfully) to unseat Neil Carmichael, an opponent of wind farms in Gloucestershire. In the six months before the 2015 general election Ecotricity donated a total of £380,000 to Labour.[81] The day after the election of 7 May 2015 the company donated £50,000[81] to the Liberal Democrats, including £20,000[81] to the group in the Kingston upon Thames constituency which had been lost by Ed Davey, the pro-renewables Secretary of State for Energy and Climate Change.

Ecotricity donated £20,000 to Keir Starmer's 2020 Labour Party leadership election campaign.[84]

Grid-level storage

[edit]At the end of 2017, Ecotricity was granted planning permission to build one of the UK's first grid-scale battery storage projects on its Alveston site in South Gloucestershire. The 10 megawatt project was intended to share the grid connection with the three new wind turbines there,[85] providing the company with peak-shaving capacity.

Virtual power plant

[edit]In May 2018[86] it was announced that Ecotricity would start building a virtual power plant to more efficiently use and manage electricity usage.[87]

Diamonds

[edit]In October 2020, Vince announced the company would make lab grown diamonds using carbon dioxide captured from the air, water and power from their own green supply.[88]

Zero-emissions airline

[edit]In July 2023, Dale Vince announced the launch of Ecojet, a zero-emissions airline based in Edinburgh.[89]

On 14 January 2026, and following several years of delays, Paul Dounis and Mark Harper from Opus Restructuring & Insolvency were appointed as provisional liquidators of Ecojet Airlines Limited.[90] The company had never operated commercial flights.

See also

[edit]References

[edit]- ^ a b "Ecotricity customers cooking on UK's first Green Gas". Ecotricity. Retrieved 1 March 2024.

- ^ "Green electricity". Ecotricity. Retrieved 1 March 2024.

- ^ Dale_Vince_part2. blip.tv. Archived from the original on 7 February 2009. Video interview of Dale Vince explaining why they invest in Wind power

- ^ "Ecotricity Limited". Companies House. Retrieved 19 April 2022.

- ^ Pagnamenta, Robin (15 December 2008). "Business big shot: Dale Vince of Ecotricity". Times Online. London. Archived from the original on 12 June 2011. Retrieved 6 June 2009.

- ^ "World Class products form the Wind Industry". nexgenwind.com. Retrieved 29 August 2017.

- ^ a b "Video Interview with Dale on Carpool 2 October 2009". Blip. Archived from the original on 19 June 2010.

- ^ "CEO uses full-page ad to give mobile number to Branson". campaignlive.co.uk. Retrieved 29 August 2017.

- ^ "Ecotricity - Ashden Award Winner 2014 - Ashden". ashdenawards.org. 16 May 2017. Archived from the original on 27 September 2011. Retrieved 29 August 2017.

- ^ "Exclusive: Ecotricity threatens legal action against EDF in green Union flag row". businessgreen.com. 6 July 2009. Retrieved 29 August 2017.

- ^ "Plans for sea energy device Searaser". BBC News. 23 January 2012. Retrieved 14 February 2012.

- ^ "Wave power 'will be cheaper than onshore wind', says Ecotricity founder". Utility Week. Archived from the original on 5 May 2013. Retrieved 13 December 2013.

- ^ "Ecotricity dips its toe into marine energy with innovative Searaser device". businessgreen.com. 27 October 2014. Retrieved 29 August 2017.

- ^ a b c d Marianne Brown (9 January 2019). "Where the gas is greener". The Ecologist.

- ^ Macalister, Terry (13 October 2014). "Ecotricity windfarm project hopes to power more than 50,000 homes a year". The Guardian. Retrieved 29 August 2017.

- ^ Hopson, Christopher (26 November 2014). "Ecotricity to shun England for onshore wind over policy". Recharge. Retrieved 1 March 2024.

- ^ "Ecotricity spins out Britwind in bid to shake up small turbine market". businessgreen.com. 13 November 2014. Retrieved 29 August 2017.

- ^ "Ecotricity offers free electricity through small wind turbines". orendaenergy.com. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ Tisheva, Plamena (27 March 2015). "Ecotricity agrees GBP-70m wind-and-solar portfolio refinancing". seenews.com. seenews. Retrieved 29 March 2015.

- ^ Timperley, Jocelyn (27 October 2016). "Ecotricity acquires major stake in rival Good Energy". BusinessGreen. Retrieved 8 October 2020.

- ^ "Securities in Issue". Good Energy. 18 August 2020. Retrieved 8 October 2020.

- ^ Merrell, Andrew (15 January 2019). "Firm's accounts reveal £50 million increase in turnover". Punchline Gloucester.com. Retrieved 24 October 2019.

- ^ Audited accounts to April 2018, retrieved 2 January 2019

- ^ "Ecotricity green flag legal row settled". BBC News. 17 January 2020. Retrieved 14 May 2025.

- ^ "Green Britain Group Limited". Companies House. Retrieved 19 April 2022.

- ^ "Green Britain Group Limited: Annual report and consolidated financial statements". Companies House. 30 April 2021. Retrieved 19 April 2022.

- ^ "Sold! The UK's first geothermal electricity to the grid". Cornish Stuff. 4 January 2021. Archived from the original on 4 January 2021.

- ^ "Ecotricity seals 10-year agreement to take geothermal power from Cornish plant". Energy Live News. 7 January 2021. Retrieved 15 March 2021.

- ^ Armitage, Jim; Watts, Robert (28 November 2021). "Ecotricity boss slams Good Energy over wind farms sell-off". The Sunday Times. London. Retrieved 27 December 2021.

- ^ Arthur, Andrew (1 December 2021). "Ecotricity boss Dale Vince criticises Good Energy over plans to sell renewable assets". BusinessLive. Retrieved 27 December 2021.

- ^ Lempriere, Molly (1 April 2022). "Dale Vince steps down from Ecotricity as he looks for new owner". Current. Retrieved 19 April 2022.

- ^ "View donation - the Electoral Commission".

- ^ Pickard, Jim (11 July 2025). "Ecotricity founder Dale Vince: 'There's got to be a bigger purpose in life'". Financial Times. Retrieved 21 August 2025.

- ^ a b "Our Fuel Mix - Our Green Energy". ecotricity.co.uk. Retrieved 29 August 2017.

- ^ "Our Tariffs - For Your Home". ecotricity.co.uk. Archived from the original on 3 July 2017. Retrieved 29 August 2017.

- ^ Addley, Esther (9 January 2009). "UFO puzzle: it was the Guardian wot done it". The Guardian.

- ^ "Secretary of State gives the go-ahead for 22-turbine wind farm at Heckington Fen". Sleaford Standard. 8 February 2013. Retrieved 13 December 2013.

- ^ Dale Vince (4 December 2012). "Monopoly Money | Energy". Zerocarbonista. Archived from the original on 17 August 2016. Retrieved 13 December 2013.

- ^ "Ecotricity banks Alveston wind". reNews. 19 October 2018. Retrieved 14 May 2025.

- ^ "ABB, Ecotricity Partner on 10 MW UK Battery Storage Project". T&D World. 19 May 2022. Retrieved 14 May 2025.

- ^ "Sun Park Map - Our Green Energy - Ecotricity". ecotricity.co.uk. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ Murray, James (21 April 2016). "Ecotricity snaps up SunEdison's UK solar business". Business Green. Retrieved 22 April 2016.

- ^ Williment, Chloe (28 January 2025). "How Ecotricity Will Power 200k Homes with Renewable Energy". energydigital.com. Retrieved 14 May 2025.

- ^ Murray, James S (1 June 2010). "Exclusive: Ecotricity delivers UK's first 'green gas'". BusinessGreen. Archived from the original on 5 June 2010. Retrieved 9 October 2024.

- ^ a b Mathiesen, Karl (20 April 2015). "Grass-to-gas plant could be UK's answer to fracking, says Ecotricity". The Guardian. Retrieved 29 August 2017.

- ^ Spackman, Paul. "Farm sites wanted for gas to grid project". Farmers Weekly. Archived from the original on 22 July 2015. Retrieved 21 May 2015.

- ^ Phillips, James (21 August 2015). "Ecotricity and Sparsholt College announce plans to build Green Gas Mill". BusinessGreen. Retrieved 9 October 2024.

- ^ "UK college to train renewables workforce as Green Gas plans revealed". ecotricity.co.uk. Retrieved 29 August 2017.

- ^ Phillips, James (27 August 2015). "Ecotricity announces plans for third Green Gas Mill". BusinessGreen. Retrieved 9 October 2024.

- ^ "Ecotricity's 'revolution' continues with third gas from grass mill". eaem.co.uk. Archived from the original on 29 August 2017. Retrieved 29 August 2017.

- ^ "Villagers celebrate after controversial energy plant plans thrown out". Daily Echo. 26 April 2016. Retrieved 29 August 2017.

- ^ "Ecotricity's Green Gasmill at Sparsholt College gets go-ahead". ecotricity.co.uk. Retrieved 13 December 2016.

- ^ "FIT licensee contact details". Ofgem. 1 April 2018.

- ^ "Solar power export". Ecotricity. Retrieved 4 March 2022.

- ^ "Wind Car". Zerocarbonista. Archived from the original on 7 March 2012. Retrieved 14 February 2012.

- ^ Adam Vaughan (27 September 2012). "'Nemesis' breaks electric car land speed record". The Guardian. London. Retrieved 13 December 2013.

- ^ Johnston, Keith (24 July 2011). "connEVted: UK's 'first electric highway' announced". Connevted.blogspot.com. Retrieved 14 February 2012.

- ^ "Nissan and Ecotricity launch fast, free EV charging in central England". EAEM. 1 October 2012. Archived from the original on 20 July 2013. Retrieved 13 December 2013.

- ^ "News of M6 toll sparks renewed calls for state ownership". fleetworld.co.uk. 15 February 2016. Retrieved 29 August 2017.

- ^ "Tesla in row over 'raid' on Ecotricity charging posts". standard.co.uk. 22 May 2014. Retrieved 29 August 2017.

- ^ Green, Chris (12 June 2014). "Misdirected email sparks electric car war between Tesla and Ecotricity". The Independent. London.

- ^ Bennett, Peter. "Tesla and Ecotricity reach out of court settlement over Electric Highways dispute". next energy news. Archived from the original on 18 June 2015. Retrieved 18 June 2015.

- ^ Merrill, Jamie (4 January 2015). "Are e-cars the future of motoring? Find out on a long, but not long enough, drive up the Electric Highway". The Independent. London.

- ^ Blackhurst, Chris (16 December 2014). "The Headline Interview". London Live. London. Archived from the original (Video) on 21 December 2014. Retrieved 18 December 2014.

- ^ "Electric Highway tariffs will still undercut petrol or diesel, says Ecotricity". EV Fleet World. 10 December 2015. Retrieved 29 August 2017.

- ^ "#46: Dale Vince meets Sustainababble". Sustainababble. 6 March 2016.

- ^ "Ecotricity hits EV drivers with £5 fee for 20 minute charge". motoringresearch.com. 11 July 2016. Retrieved 29 August 2017.

- ^ "For The Road - Ecotricity". ecotricity.co.uk. Retrieved 5 October 2017.

- ^ "Electric Highway App". Ecotricity. Retrieved 5 June 2019.

- ^ "Ecotricity and GRIDSERVE announce new partnership to power up the Electric Highway". 12 March 2021. Retrieved 12 March 2021.

- ^ "Ecotricity and GRIDSERVE announce new partnership to power up the Electric Highway". www.ecotricity.co.uk. Retrieved 12 March 2021.

- ^ Warrick, Jack (9 June 2021). "Gridserve acquires Ecotricity Electric Highway EV charging network". Autocar. Retrieved 2 February 2025.

- ^ fullychargedshow (22 May 2014). "Dale VInce Ecotricity - Fully Charged" (video). Archived from the original on 19 December 2021. Retrieved 29 August 2017 – via YouTube.

- ^ Butcher, Mike (14 September 2013). "He's Electric — Will A Revolutionary Black Box Turn Dale Vince Into Europe's Elon Musk?". TechCrunch. Retrieved 9 October 2024.

- ^ "Ecotricity launching new mobile phone network". Ecotricity. 26 June 2018. Retrieved 26 January 2020.

- ^ "He's Electric — Will A Revolutionary Black Box Turn Dale Vince Into Europe's Elon Musk?". TechCrunch. 14 September 2013. Retrieved 26 January 2020.

- ^ "Our Story". Ecotalk. Retrieved 4 October 2022.

- ^ "Ecotricity rescues wind turbine company Evance from administration". Business Green. 14 May 2014.

- ^ "FRP engineers rescue deal for Evance Wind Turbines". Insider Media Ltd. 14 May 2014. Retrieved 29 August 2017.

- ^ "Windmill maker Britwind sells £1m of turbines to Japan | Blog". southwestbusiness.co.uk. Retrieved 20 March 2017.

- ^ a b c d e f "Welcome to our registers search site". Electoral Commission. Retrieved 5 September 2015.

- ^ "Ecotricity backs 'Green Labour' - News - Ecotricity". ecotricity.co.uk. Retrieved 29 August 2017.

- ^ ClickGreen staff (10 February 2015). "Ecotricity faces social media backlash after £250k Labour Party donation". reskin-cg.class-media.co.uk. Archived from the original on 11 February 2015. Retrieved 29 August 2017.

- ^ "Register of Members' Financial Interests" (PDF). UK Parliament. April 2020. Retrieved 17 April 2020.

- ^ "Utility Week – Ecotricity blasts government policy on onshore wind". utilityweek.co.uk. 8 December 2017. Archived from the original on 14 December 2017. Retrieved 14 December 2017.

- ^ "Ecotricity selects Next Kraftwerke's NEMOCS to build Virtual Power Plant". www.next-kraftwerke.com. Retrieved 2 April 2020.

- ^ "Virtual Power Plant - Ecotricity". www.ecotricity.co.uk. Archived from the original on 17 April 2020. Retrieved 2 April 2020.

- ^ "Ecotricity founder to grow diamonds 'made entirely from the sky'". The Guardian. 30 October 2020. Retrieved 23 November 2020.

- ^ Lawson, Alex (16 July 2023). "Green energy tycoon to launch UK's first electric airline". The Guardian. ISSN 0261-3077. Retrieved 26 October 2024.

- ^ Perry, Dominic. "Liquidation looms for Ecojet as green airline fails to get off the ground". Flight Global. Retrieved 28 January 2026.

External links

[edit]Ecotricity

View on GrokipediaFounding and History

Establishment and Early Operations (1995–2000)

Ecotricity was founded in 1995 by Dale Vince, a former New Age traveller who had lived off-grid in a converted truck powered by wind and solar energy, as the world's first green energy supplier dedicated exclusively to renewable sources. Vince established the company, initially named the Renewable Energy Company, amid Britain's electricity market liberalization, which allowed independent generators to supply customers directly and circumvent monopolistic utilities that offered low prices for wind-generated power. Motivated by frustration over unfair pricing from regional monopolies like Midlands Electricity Board (MEB), Vince pioneered an "embedded supply" model that matched local renewable generation—primarily wind—to nearby customers via the existing distribution grid, bypassing long-distance transmission losses and costs.[6][7][8] In 1995, Vince initiated the construction of the company's inaugural wind turbine at Lynch Knoll near Nympsfield, Gloucestershire, following years of planning and regulatory battles to enable local green supply. The 60-meter turbine's blades began rotating on December 13, 1996, marking the start of continuous power generation that has produced over 15 million kilowatt-hours to date. Prior to its activation, Ecotricity delivered its first unit of green electricity on April 1, 1996, sourced from landfill gas, establishing the company as the pioneer in supplying 100% renewable energy to commercial clients. This embedded approach allowed direct billing to businesses, emphasizing proximity between generation and consumption to maximize efficiency and environmental benefits.[7][9][10] Early operations focused on securing contracts with businesses seeking sustainable energy, including innovations like Merchant Wind Power agreements that guaranteed purchase of output from on-site or nearby turbines. By the late 1990s, Ecotricity had expanded to supply major clients such as Thames Water, the Millennium Dome, and The Body Shop, employing around 15 staff and quadrupling turnover to £50 million through the Thames partnership alone, which utilized green energy from sewerage and landfill sites. In 1998, the company constructed the UK's first multi-megawatt wind turbine at the Ecotech Centre in Swindon—a 70-meter structure generating three times the power of conventional models—further scaling generation capacity. These developments positioned Ecotricity as a niche player in renewable supply, though limited to non-domestic customers until later years, amid a UK market where renewables comprised less than 3% of electricity.[8][11][7]Growth and Infrastructure Development (2001–2010)

In 2001, Ecotricity installed the United Kingdom's first on-site commercial wind turbine at Sainsbury's distribution depot in East Kilbride, Scotland.[12] This project marked an early expansion into tailored renewable infrastructure for corporate clients. In May 2002, the company commenced construction on its inaugural multi-turbine wind farm in Lincolnshire, signifying a shift toward larger-scale generation assets.[13] By 2003, Ecotricity extended its green electricity supply to residential households for the first time, broadening its customer base beyond commercial entities.[7] Throughout the early 2000s, the firm implemented its "bills into mills" approach, channeling customer revenues directly into funding additional wind turbine developments, including installations at Ford's Dagenham facility.[7] By 2004, Ecotricity managed seven operational wind parks and was advancing an eighth in partnership with the Co-operative Group, while serving around 5,000 customers and allocating £7 million—approximately half its annual turnover—to turbine expansions.[14] The company supplied major organizations such as The Body Shop, Sainsbury's, and a significant portion of Co-operative Financial Services' premises, with plans to double generation capacity the following year.[14] Projects like the near-complete wind turbines in London, including at Green Park, further exemplified this infrastructure push.[15] In 2010, Ecotricity introduced green gas to its portfolio, pioneering the UK's first fully renewable dual-fuel tariff and enhancing its supply infrastructure.[7] This decade saw sustained investment in onshore wind assets, leveraging reinvested profits to scale generation amid growing demand for renewable energy.[7]Expansion and Challenges (2011–2025)

In 2011, Ecotricity launched the Electric Highway, establishing one of the United Kingdom's first nationwide networks of electric vehicle charging points to support early adoption of battery-powered cars, with initial installations along major motorways.[16] This initiative expanded the company's footprint beyond traditional energy supply into transport infrastructure, partnering with automakers like Nissan to enable long-distance EV travel when public charging was scarce.[16] By 2021, amid growing EV demand, Ecotricity sold the network to GRIDSERVE while retaining a supply partnership to provide renewable power, reflecting a strategic shift toward specialization in generation rather than operations.[16] Throughout the 2010s and into the 2020s, Ecotricity pursued aggressive expansion in renewable generation capacity, constructing additional wind parks to reach 74 turbines across 24 sites by 2024, capable of powering approximately 56,000 homes annually and displacing over 128,000 tonnes of CO2 emissions.[17] Solar development accelerated with the addition of grid-scale "sun parks," including plans for two new facilities totaling 16 MW in 2024 and an expansion at Fen Farm in Lincolnshire announced in 2025, adding capacity to serve 6,000 homes while integrating with existing wind infrastructure.[18][19] Complementary projects included green gas production from grass via anaerobic digestion and battery storage systems to mitigate intermittency, with multiple sites underway by 2021 to store excess renewable output for grid stability.[20] In 2022, the company proposed the Eco Park development adjacent to Forest Green Rovers' stadium, aiming to create over 5,000 green technology jobs and generate £150 million in annual economic value through integrated renewable manufacturing and energy production.[21] These expansions coincided with rising operational challenges, including volatile energy markets exacerbated by the 2022 global crisis, which strained smaller green suppliers through hedging requirements and price fluctuations. Ecotricity's revenue peaked at £544 million for the year ending April 30, 2023, but declined to £457.6 million the following year amid higher wholesale costs and regulatory pressures.[22][23] Pre-tax profits at the parent group fell sharply to £5.1 million in the year to early 2025, down from £44.7 million the prior year, attributed to increased investment in capital-intensive projects like batteries and solar amid softening energy prices post-crisis.[24] Despite no major legal disputes, the company navigated planning hurdles for onshore wind and solar expansions, where local opposition and grid connection delays—common in the UK renewable sector—slowed deployment timelines, though generation output hit near-record highs in 2023 and 2024.[25] Overall, Ecotricity's growth relied on sustained capital outlays exceeding £22.6 million in EBITDA for 2024, underscoring the tension between ambitious scaling and profitability in a subsidy-sensitive, weather-dependent market.[23]Leadership and Ownership

Dale Vince's Role and Background

Dale Vince was born in 1961 in Great Yarmouth, Norfolk, and left school at age 15 without formal qualifications, subsequently adopting an off-grid lifestyle as a New Age traveller for approximately a decade. During this period, he lived nomadically in converted vehicles, developing self-sufficiency skills such as generating personal electricity from small wind turbines and adapting engines to run on waste vegetable oil. In the late 1980s, while working at the Glastonbury Festival towing vehicles, Vince launched Windphones, an early venture providing windmill-powered mobile phone charging using a 1 kW turbine and repurposed scrapyard batteries.[7][8] Motivated by concerns over climate change and frustrated by unfavorable pricing from the local electricity monopoly for his planned wind turbine near Stroud, Vince founded Ecotricity in 1995 as the world's first dedicated green energy supplier, initially under the name Renewable Energy Company. He oversaw the construction of the company's inaugural wind turbine, which became operational in December 1996, and launched customer green electricity supply on April 1, 1996, pioneering the "embedded supply" model that connected local renewable generation directly to nearby consumers via the existing grid infrastructure, bypassing traditional large-scale transmission. This innovation allowed Ecotricity to match supply with demand at a local level, establishing a template for decentralized green energy distribution.[7][6][8] As founder and majority owner, Vince has maintained a central leadership role in Ecotricity, directing its strategy to reinvest profits into renewable infrastructure rather than distributing dividends, with the company achieving milestones such as 100% green electricity supply by 2013 under his guidance. Lacking formal training in energy or business, his approach emphasized practical experimentation and systemic change toward low-carbon energy, influencing subsequent expansions like green gas offerings in 2010 and the UK's first motorway electric vehicle charging network in 2011. Vince continues to shape the company's advocacy for rapid decarbonization, while his personal net worth, derived primarily from Ecotricity's growth, exceeds £100 million as of 2024 estimates.[7][6][8]Corporate Structure and Governance

Ecotricity's corporate structure centers on a holding company model, with Green Britain Group Limited as the ultimate parent entity, incorporated on 11 February 2020 and registered in Stroud, Gloucestershire. This group owns 100% of Ecotricity Group Limited, which functions as an intermediate holding company focused on head office activities.[26][27][28] Ecotricity Group Limited, a private limited company incorporated on 3 March 1998, holds subsidiaries such as Ecotricity Limited, the operational entity responsible for energy supply and generation. The sole shareholder of Ecotricity Limited is Ecotricity Group Limited, maintaining centralized control within the group.[28][29][30] Governance is directed by the board of Ecotricity Group Limited, which as of 2023 includes founder Dale Vince (appointed since inception), CEO Asif Rehmanwala (appointed December 1976 birth year noted), Anita Yandell-Jones, Alistair Harrison (appointed 11 November 2020), and Andrew Hibberd (appointed 1 May 2023). Dale Vince retains significant influence as the controlling shareholder through Green Britain Group Limited.[31][32][33] As a privately held group, Ecotricity discloses limited governance details publicly, adhering to UK Companies Act requirements rather than full stock exchange standards. In 2021, during a failed acquisition attempt of Good Energy Group PLC, the target company's board criticized Ecotricity's structure for lacking independent shareholder oversight and transparency on post-merger operations, attributing this to its private status. Ecotricity countered by highlighting governance concerns at Good Energy but provided no detailed rebuttal on its own practices.[34][35]Core Business Operations

Energy Generation Sources

Ecotricity generates electricity primarily through onshore wind turbines and solar photovoltaic arrays, with a total installed capacity of approximately 104.7 MW as of 2024.[36][3] The company's wind portfolio consists of 24 onshore wind parks housing 74 turbines, delivering a combined capacity of 87.2 MW, sufficient to power the equivalent of over 60,000 average UK homes annually.[36] These facilities produced 150 GWh of electricity in the year ending October 2024.[37] Solar generation is smaller in scale, with three operational solar parks providing 17.5 MW of capacity.[3] These installations, often co-located with wind assets in hybrid configurations, contribute to Ecotricity's direct renewable output, though specific annual yields are not publicly detailed beyond overall portfolio performance. While the company's fuel mix disclosure includes hydro-electric and offshore wind sources to achieve 100% renewable supply, Ecotricity does not own significant hydro facilities or offshore assets, relying instead on certified procurement for those components.[38] Ongoing developments include additional solar parks adding up to 16 MW and hybrid wind-solar projects, but these remain in planning or construction phases as of 2025.[3]Energy Supply Model and Customer Base

Ecotricity's energy supply model emphasizes the provision of 100% green electricity, sourced exclusively from renewable generation including onshore and offshore wind, solar, and hydroelectric power. The company reinvests customer bill revenues into developing additional renewable capacity, such as wind farms and solar installations, rather than distributing profits to shareholders, with the aim of increasing the overall supply of clean energy to the national grid.[38][39] Electricity supplied to customers is matched to this renewable output through purchases and direct investments, though all UK suppliers deliver power via the interconnected grid system.[40] For gas supply, Ecotricity offers a blend of carbon-neutralized natural gas and biomethane produced from grass at its UK-based green gas mills, positioning it as a low-carbon alternative while transitioning toward fuller renewability. This model supports the company's claim of being Britain's greenest energy provider, certified as such through fuel mix disclosures, though critics note that green claims in the energy sector often rely on certificates like Renewable Energy Guarantees of Origin (REGOs) rather than physical tracing of electrons.[41][38] The customer base includes both domestic households and businesses across the UK, with tailored offerings for small and medium-sized enterprises (SMEs) as well as larger commercial users requiring green energy solutions. Business customers, defined as micro-businesses using under 100,000 kWh of electricity annually or equivalent gas thresholds, receive dedicated support including bespoke tariffs and generation advice. Domestic supply focuses on fixed and variable tariffs, such as those for electric vehicle owners, appealing to environmentally conscious consumers seeking certified green and vegan energy options.[42][43][44]Technological Innovations and Efficiency Claims

Ecotricity has developed small-scale wind turbine technology through its sister company Britwind, focusing on horizontal-axis models suitable for domestic, farm, and business use. The Britwind H15 15kW turbine, launched around 2015, is described by the company as "super efficient" with maintenance costs low enough to generate electricity at nearly half the cost of its predecessor, the R9000 model.[45][46] The R9000, a best-selling small turbine, produces approximately 13,700 kWh annually under average UK wind conditions.[47] Larger models like the 5kW turbine claim annual outputs of 9,000 to 21,000 kWh depending on site wind speeds, emphasizing robust design for integration with solar or off-grid systems.[48][49] In biogas production, Ecotricity pioneered the UK's first commercial green gasmill in Reading, operational since around 2018, which converts grass silage into biomethane via anaerobic digestion. The facility is projected to produce sufficient gas for 4,170 homes, equivalent to displacing about 4,000 tonnes of CO2 annually, with the company asserting carbon neutrality as grass regrows and reabsorbs emissions.[41] However, independent analysis by Biofuelwatch highlights inefficiencies, including a 45% CO2 release during biogas upgrading to biomethane and potential methane leaks that could undermine net carbon savings, alongside scalability issues requiring up to 59% of UK agricultural land to replace domestic natural gas demand.[50] Ecotricity has expanded into solar with two new parks totaling 16.5 MW capacity adjacent to existing wind sites in Leicestershire, utilizing advanced panel technology to complement intermittent generation.[51] Additional innovations include Real Time REGOs, launched in 2025, which provide hourly matching of customer consumption to specific renewable generation sources for enhanced transparency, and pilot grid-scale battery storage to address peak demand variability from wind parks.[52][17] Efficiency claims center on environmental metrics rather than detailed engineering capacities. The company's 74 windmills across 24 parks are stated to power over 56,000 homes while saving 28,000 tonnes of CO2 yearly, with bird mortality at 0.27 per GWh compared to 9.4 per GWh for fossil fuels.[17] These figures derive from company operations and referenced studies, though broader critiques note that small turbines like Britwind's often achieve capacity factors below 20-25% in variable UK winds, limiting economic viability without subsidies. Green gas efforts face scrutiny for overstated feasibility, as land-intensive processes may conflict with food production and biodiversity without verified net efficiency gains over alternatives like direct electrification.[50] Ecotricity maintains these technologies support its model of reinvesting profits into new renewable capacity, generating about 10% of supplied electricity onsite with the balance from certified sources.[36]Financial Performance and Subsidies

Revenue Streams and Profitability

Ecotricity's core revenue arises from retailing green electricity and gas to domestic and business customers, with the company matching customer demand through a combination of self-generated renewable output and wholesale market purchases. For the financial year ended 30 April 2024, total revenue totaled £457.6 million, predominantly from energy sales: £390.3 million in electricity (£273.3 million domestic, £117.0 million business) and £67.3 million in gas (£24.0 million domestic, £43.3 million business), plus £1.0 million from ancillary sources such as connection fees or trading.[23]| Revenue Category | Amount (£ million) | Domestic (£ million) | Business (£ million) |

|---|---|---|---|

| Electricity Sales | 390.3 | 273.3 | 117.0 |

| Gas Sales | 67.3 | 24.0 | 43.3 |

| Other | 1.0 | - | - |

| Total | 457.6 | - | - |