Recent from talks

Nothing was collected or created yet.

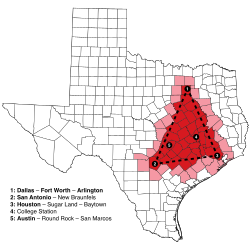

Texas Triangle

View on WikipediaThe Texas Triangle is a region of Texas that contains the state's five largest cities and is home to over half of the state's population. The Texas Triangle is formed by the state's four main urban centers, Austin, Dallas-Fort Worth, Houston, and San Antonio, connected by Interstate 45, Interstate 10, and Interstate 35. In 2025, the population of the Texas Triangle reached nearly 23 million following rapid growth across much of Texas.[1] The Texas Triangle is one of eleven megaregions in the United States, clusters of urban areas that share economic and cultural ties.

Key Information

In 2004, the Texas Triangle contained five of the 20 largest cities in the U.S. and was home to more than 70% of all Texans, with a population of 13.8 million.[4] In the next 40 years, the population of the Texas Triangle is projected to increase by more than 65%,[5] or 10 million people, and comprise 78% of all Texans.

Additional metropolitan areas in the region include Bryan–College Station, Killeen–Temple–Fort Hood, and Waco. Twelve micropolitan statistical areas are within the Triangle, which includes 66 counties.[6] Beaumont, located east of Houston, has been considered part of the Texas Triangle by numerous studies dating from 2000.[7][8][9][10][11] Burleson County is the center of the Texas Triangle.

Geography

[edit]The megaregion is defined in work by America 2050 initiative and others. Dr. Robert Lang of the Metropolitan Institute at Virginia Tech characterized Dallas–Fort Worth as one of the earliest recognized megapolitans. Although each city is distinct, Dallas and Fort Worth developed closely enough to form the urban area widely known as the Metroplex.

The 60,000-square-mile (160,000 km2) region contains most of the state's largest cities and metropolitan areas, and in 2008 had a total of 17 million people and by 2020 had grown to nearly 21 million,[1] nearly 75% of Texas's total population.[12] The region is comparable to Florida in population and comparable to Georgia in area, but the Texas Triangle comprises less than a quarter of Texas's total land area.

According to the University of Texas at Austin Center for Sustainable Development, "the Texas Triangle has three sides measuring 271, 198, and 241 miles in ground distance."[13]

Metropolitan areas

[edit]- Austin–Round Rock–San Marcos metropolitan statistical area

- Beaumont–Port Arthur metropolitan statistical area

- Bryan–College Station metropolitan statistical area

- Dallas–Fort Worth–Arlington metropolitan statistical area

- Killeen–Temple (also incl.–Fort Hood) metropolitan statistical area

- Houston–The Woodlands–Sugar Land metropolitan statistical area

- San Antonio–New Braunfels metropolitan statistical area

- Sherman–Denison metropolitan area

- Waco metropolitan statistical area

Micropolitan areas

[edit]- Brenham Micropolitan Statistical Area

- Corsicana Micropolitan Statistical Area

- Huntsville Micropolitan Statistical Area

Triangle counties

[edit]The Texas Triangle contains 65 counties. They are Anderson, Atascosa, Austin, Bandera, Bastrop, Bell, Bexar, Blanco, Bosque, Brazoria, Brazos, Burleson, Burnet, Caldwell, Chambers, Collin, Colorado, Comal, Coryell, Dallas, Denton, DeWitt, Ellis, Falls, Fayette, Fort Bend, Freestone, Galveston, Gonzales, Grimes, Guadalupe, Harris, Hays, Henderson, Hill, Houston, Jackson, Johnson, Kaufman, Kendall, Lampasas, Lavaca, Lee, Leon, Liberty, Limestone, Madison, McLennan, Medina, Milam, Montgomery, Navarro, Rockwall, Robertson, San Jacinto, Tarrant, Travis, Trinity, Victoria, Walker, Waller, Washington, Wharton, Williamson, and Wilson.

Politics

[edit]The Texas Triangle can be considered one of the more politically left-wing areas in Texas due to the anchoring cities of Houston, San Antonio, Dallas, Austin, and Fort Worth. All of these cities, and their respective counties of Harris, Bexar, Dallas, Travis, and Tarrant, moved towards Joe Biden in 2020, with Biden flipping Tarrant County, which had gone for Donald Trump in 2016. However in 2024, Trump flipped Tarrant county again, when he carried the state with a double-digit margin.

Prior to 2008, with the exception of Austin/Travis and San Antonio/Bexar (the latter a former bellwether/swing county and the former a liberal stronghold), all of these cities/counties were conservative strongholds, having voted for Republican presidential candidates from the 1960s through 2004.

This culminated with Barack Obama flipping Dallas, Harris, and Bexar counties to the Democratic party in 2008.[14] Despite the five biggest cities in Texas being within the Triangle, there are also a great number of rural, conservative counties in the Triangle. It is in these counties that Republicans poll their best.

Transportation

[edit]The Texas triangle has also been the subject of rail feasibility studies in particular for high speed rail.[15][16][17]

See also

[edit]References

[edit]- ^ a b c "Growth Challenges and Opportunities in the Texas Triangle | TNE". texasup.org.

- ^ "GDP by State". GDP by State | U.S. Bureau of Economic Analysis (BEA). Bureau of Economic Analysis. Retrieved April 10, 2022.

- ^ "What is the Texas Triangle? Exploring the State's Urban Megaregion", hillwoodcommunities.com

- ^ "The Simple Economics of the Texas Triangle - Houston Business, Jan. 2004 - FRB Dallas". Archived from the original on February 2, 2004. Retrieved July 12, 2014.

- ^ "Reinventing The Texas Triangle - UTexas CSD - 2009" (PDF). utexas.edu. Retrieved March 25, 2014.

- ^ "Triangle Census – Megas, Metros & Micros". Archived from the original on July 6, 2011. Retrieved December 8, 2009.

- ^ "MegaRegions +MetroProsperity". Houston Tomorrow and America 2050. August 4, 2009. Retrieved November 8, 2014.

- ^ Kent Butler, Sara Hammerschmidt, Frederick Steiner and Ming Zhang. "REINVENTING THE TEXAS TRIANGLE Solutions for Growing Challenges" (PDF). The University of Texas at Austin School of Architecture Center for Sustainable Development. pp. 6, 10. Archived from the original (PDF) on September 30, 2011. Retrieved November 8, 2014.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Dan Seedah and Robert Harrison (September 2011). "Megaregion Freight Movements: A Case Study of the Texas Triangle" (PDF). Center for Transportation Research University of Texas at Austin (Form DOT F 1700.7 (8-72)). pp. 37–38. Retrieved November 8, 2014.

- ^ Michael Neuman and Elise Bright (May 2008). "TEXAS URBAN TRIANGLE Framework for future growth" (PDF). Texas Transportation Institute Texas A&M University System College Station, Texas 77843-3135. pp. 4–6. Retrieved November 8, 2014.

- ^ Ming Zhang, Frederick Steiner, Kent Butler (April 4, 2007). "Connecting the Texas Triangle: Economic Integration and Transportation Coordination" (PDF). The Healdsburg Research Seminar on MegaRegions. p. 31. Retrieved March 11, 2018.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Neuman, Michael; Elise Bright (May 2008). "Texas Urban Triangle: Framework for Future Growth". SWUTC/08/167166-1. Texas A&M University System. Archived from the original on July 6, 2009. Retrieved June 21, 2009.

- ^ Kent Butler; Sara Hammerschmidt; Frederick Steiner; Ming Zhang (2009). "Defining The Region" (PDF). Reinventing the Texas Triangle. Center for Sustainable Development, School of Architecture, The University of Texas at Austin. p. 5. Archived from the original (PDF) on September 30, 2011. Retrieved July 25, 2011.

- ^ Ratcliffe, R.G. "Obama campaign lends a hand to Texas Democrats". Chron.

- ^ "DEMAND FOR HIGH SPEED RAIL IN THE TEXAS TRIANGLE & BEYOND" (PDF).

- ^ Rojas, Gabriel (May 2007). "Maglev high speed ground transportation for the Texas Triangle : a technology assessment".

- ^ "Texas triangle high speed rail study" (PDF).

External links

[edit]- Research on the Texas Triangle, University of Texas at Austin

- TexasTriangle.org

.jpg/250px-Austin_August_2019_19_(skyline_and_Lady_Bird_Lake).jpg)

.jpg/2000px-Austin_August_2019_19_(skyline_and_Lady_Bird_Lake).jpg)