Recent from talks

Nothing was collected or created yet.

Base load

View on Wikipedia

The base load[2] (also baseload) is the minimum level of demand on an electrical grid over a span of time, for example, one week. This demand can be met by unvarying power plants[3] or dispatchable generation,[4] depending on which approach has the best mix of cost, availability and reliability in any particular market. The remainder of demand, varying throughout a day, is met by intermittent sources together with dispatchable generation (such as load following power plants, peaking power plants, which can be turned up or down quickly) or energy storage.

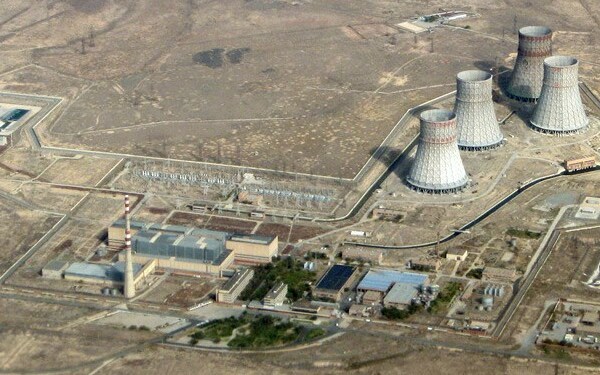

Power plants that do not change their power output quickly, such as some large coal or nuclear plants, are generally called baseload power plants.[3][5][6] In the 20th century most or all of base load demand was met with baseload power plants,[7] whereas new capacity based around renewables often employs flexible generation.[8]

Description

[edit]Grid operators take long and short term bids to provide electricity over various time periods and balance supply and demand continuously.[9] The detailed adjustments are known as the unit commitment problem in electrical power production.[citation needed]

While historically large power grids used unvarying power plants to meet the base load, there is no specific technical requirement for this to be so. The base load can equally well be met by the appropriate quantity of intermittent power sources and dispatchable generation.[4][10]

Unvarying power plants can be coal, nuclear, combined cycle plants, which may take several days to start up and shut down,[11] hydroelectric, geothermal,[12] biogas, and biomass.

The desirable attribute of dispatchability applies to some gas plants and hydroelectricity. Grid operators also use curtailment to shut plants out of the grid when their energy is not needed.[13][14]

Economics

[edit]

Grid operators solicit bids to find the cheapest sources of electricity over short and long term buying periods.[15]

Traditionally, nuclear and coal plants had high fixed costs, high plant load factor[16] but low marginal costs.[citation needed] On the other hand, peak load generators, such as natural gas, had low fixed costs, low plant load factor and high marginal costs.[17]

Some coal and nuclear power plants do not change production to match power consumption demands since it is sometimes more economical to keep operating them at constant production levels than to reduce output during times of power price below marginal cost, and not all power plants are designed for it. The IEA has suggested that coal power plants should not run as baseload, because that emits a lot of carbon dioxide, which causes climate change.[18] Some nuclear power stations, such as those in France, are physically capable of being used as load following power plants and do alter their output, to some degree, to help meet varying demands.[19][moved resource?][20][moved resource?]

Some combined-cycle plants usually fuelled by gas, can provide baseload power,[21][need quotation to verify][obsolete source] as well as being able to be cost-effectively cycled up and down to match more rapid fluctuations in consumption.

According to National Grid plc chief executive officer Steve Holliday in 2015, and others, baseload is "outdated".[8][6] By 2019, Steve Holliday had left his position as CEO of National Grid plc and went on the record to say that, "It’s hard to conceive that nuclear does not have an important role to play".[22]

See also

[edit]References

[edit]- ^ Szondy, Borbála; Bodnár, Balázs; Grossetête, Alain; Gain, Thibaut; Aszódi, Attila (2024). "Review of solutions developed for improving maneuvering flexibility in German, French and Russian PWRs targeting to explore future possibilities for the new VVER-1200 nuclear power plant units in Hungary". Nuclear Engineering and Design. 419 112965. Bibcode:2024NuEnD.41912965S. doi:10.1016/j.nucengdes.2024.112965.

- ^ "Definition of "baseload"". www.merriam-webster.com. Merriam Webster Dictionary. Retrieved 2018-12-02.

- ^ a b Donald G. Fink, H. Wayne Beatty (ed), Standard Handbook for Electrical Engineers, Eleventh Edition, Mc-Graw Hill, 1978 ISBN 9780070209749, pp. 12-16 through 12-18

- ^ a b Peters, Roger, Cherise Burda (2007-09-01). "The Basics on Base Load: Meeting Ontario's Base Load Electricity Demand with Renewable Power Sources" (PDF). Pembina Institute. Retrieved 2018-05-16.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "Energy Dictionary - Baseload plant". EnergyVortex.com. Archived from the original on 2009-02-15. Retrieved 2008-08-03.

- ^ a b July 10; Alum, 2017 Kevin Steinberger-Alum Miles Farmer- (10 July 2017). "Debunking Three Myths About "Baseload"". NRDC. Retrieved 2022-01-29.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "The Baseload Fallacy". Energy Global. 2023-08-02. Retrieved 2024-04-07.

- ^ a b Karel Beckman (11 September 2015). "Steve Holliday CEO National Grid: baseload is outdated". EnergyPost.eu. Archived from the original on 10 September 2016. Retrieved 6 October 2016.

- ^ Maurer, Luiz T.A., Luiz A. Barroso (2011). Electricity Auctions: An Overview of Efficient Practices (PDF). World Bank Publications. ISBN 978-0-8213-8822-8.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Archer, Cristina L.; Jacobson, Mark Z. (November 2007). "Supplying Baseload Power and Reducing Transmission Requirements by Interconnecting Wind Farms" (PDF). Journal of Applied Meteorology and Climatology. 46 (11): 1701–1717. Bibcode:2007JApMC..46.1701A. CiteSeerX 10.1.1.475.4620. doi:10.1175/2007jamc1538.1. ISSN 1558-8424.

- ^ Nelder, Chris. "Why baseload power is doomed". ZDNet. Retrieved 2018-12-02.

- ^ "Scaling Geothermal for Reliable Baseload Power". renewableenergyworld.com. 2007-10-05. Archived from the original on 2018-07-01. Retrieved 2008-08-03.

- ^ Bird, Lori; Lew, Debra; Milligan, Michael; Carlini, E. Maria; Estanqueiro, Ana; Flynn, Damian; Gomez-Lazaro, Emilio; Holttinen, Hannele; Menemenlis, Nickie (November 2016). "Wind and solar energy curtailment: A review of international experience". Renewable and Sustainable Energy Reviews. 65: 577–586. Bibcode:2016RSERv..65..577B. doi:10.1016/j.rser.2016.06.082. hdl:10197/9090. ISSN 1364-0321.

- ^ GIMON, ERIC, ROBBIE ORVIS AND SONIA AGGARWAL (2015-03-23). "Renewables Curtailment: What We Can Learn From Grid Operations in California and the Midwest". Green Tech Media. Retrieved 2018-05-16.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Johnston, David Cay (2014-05-29). "OPINION: How electricity auctions are rigged to favor industry". Al Jazeera. Retrieved 2018-05-16.

- ^ "What is Generation Capacity?". Energy.gov. Retrieved 2022-06-18.

- ^ Ronald J. Daniels (1996). Ontario Hydro at the Millennium: Has Monopoly's Moment Passed?. Montreal and Kingston: McGill-Queen's University Press. ISBN 9780773514300. Retrieved 2008-08-03.

- ^ "Accelerating Just Transitions for the Coal Sector – Analysis". IEA. 2024-03-19. Retrieved 2024-04-06.

- ^ Nuclear Development, June 2011, page 10 from http://www.oecd-nea.org/

- ^ "Nuclear Development". www.oecd-nea.org. Nuclear Energy Agency. Retrieved 2018-12-02.

- ^ "A user's guide to natural gas power plants". Utility Dive. Retrieved 2022-06-18.

- ^ Stanley Reed (7 January 2019). "For Wales, Nuclear Plant Would Mean New Jobs. For the U.K., It May Mean More". New York Times.

External links

[edit]Base load

View on GrokipediaDefinition and Fundamentals

Core Concept and Characteristics

Base load constitutes the minimum, continuous level of electric power demand on a grid over an extended period, such as a day, week, or year, requiring steady supply to prevent blackouts and ensure operational reliability.[5] [6] This baseline demand, typically 35-40% of a system's peak load, stems from unchanging essential uses like industrial processes, refrigeration, and baseline residential needs that operate around the clock.[3] Grids must match this irreducible load with generation that operates without significant interruptions, as shortfalls would destabilize frequency and voltage controls fundamental to power delivery.[2] Characteristics of base load power emphasize reliability and efficiency under prolonged, high-utilization conditions rather than flexibility for demand fluctuations. Base load units, such as large-scale nuclear or fossil fuel plants, run continuously at or near full capacity except for scheduled maintenance, achieving capacity factors often above 80% to minimize per-unit costs given their high capital investments.[6] [2] These sources exhibit low marginal operating costs once online, favoring steady output over rapid start-stop cycles that could increase wear or emissions.[6] Inflexibility in ramping—typically limited to gradual adjustments—distinguishes them from peaking resources, as base load prioritizes causal stability in supply to match the grid's inherent physics of real-time balance between generation and consumption. Empirical grid data underscores that base load underpins system inertia and reserve margins, with deviations risking cascading failures, as evidenced by historical outages where under-supply of this foundational layer amplified vulnerabilities.[6] Sources suited to base load must demonstrate dispatchable control, enabling operators to sustain output predictably amid variable renewables' intermittency, which cannot inherently fulfill this role without extensive, costly storage to emulate continuous dispatchability.[2]Distinction from Peaking and Intermediate Loads

Base load power generation refers to the continuous supply of electricity to meet the minimum, steady demand on the grid, typically provided by plants with high capacity factors exceeding 50-90%, such as nuclear or coal facilities that operate nearly around the clock with limited flexibility for rapid changes in output.[6][7] These plants prioritize efficiency and reliability at constant production levels but have slow startup times, often taking hours or days to reach full capacity, making them unsuitable for responding to demand fluctuations.[2] In contrast, intermediate load (or load-following) generation bridges the gap between base and peak demands, operating during periods of moderate variability with capacity factors generally ranging from 15% to 50%, allowing for ramping up or down to match gradual changes in consumption.[8] Examples include combined-cycle natural gas plants, which can adjust output more readily than base load units while maintaining higher efficiency than pure peakers.[9] Peaking load power addresses short-term spikes in demand, such as during extreme weather or evening hours, using plants with low capacity factors under 15% that run infrequently, often only a few hundred hours per year.[6][10] These facilities, typically simple-cycle gas turbines or internal combustion engines, emphasize rapid startup (minutes) and shutdown capabilities to handle sudden surges, but at the cost of lower thermal efficiency and higher fuel consumption per unit of electricity produced due to frequent cycling.[10][11] The economic distinction lies in marginal costs: base load plants achieve low levelized costs through high utilization, intermediate plants balance flexibility with moderate costs, and peaking plants incur high operating expenses justified only by their role in grid stability during rare high-demand events.[12]| Aspect | Base Load | Intermediate Load | Peaking Load |

|---|---|---|---|

| Capacity Factor | >50-90%[6] | 15-50%[8] | <15%[10] |

| Operational Pattern | Continuous, 24/7 with minimal ramping[2] | Variable to follow daily/seasonal changes[9] | Infrequent, for short spikes only[6] |

| Flexibility | Low (slow startup/shutdown)[7] | Medium (ramping capability)[8] | High (rapid response)[10] |

| Examples | Nuclear, coal[2] | Combined-cycle gas[9] | Simple-cycle gas turbines[11] |

Historical Development

Origins in Early Electrification

The establishment of centralized electric generating stations in the late 19th century marked the inception of continuous power supply practices that underpin the base load concept. Prior to widespread electrification, power was generated locally and intermittently, but the advent of commercial central stations introduced reliable, round-the-clock operation to meet emerging urban demands, primarily for incandescent lighting. These early facilities, fueled by coal-fired steam engines, operated at steady output levels to capitalize on high capital costs and low marginal fuel expenses, laying the groundwork for distinguishing sustained baseline generation from variable loads.[13] Thomas Edison's Pearl Street Station in New York City, commissioned on September 4, 1882, exemplified this shift as the world's first permanent commercial central power plant. Equipped with six "jumbo" direct-current dynamos—each rated at approximately 100 kilowatts and driven by coal-burning reciprocating steam engines—the facility generated up to 600 kilowatts to serve an initial 59 customers, powering around 400 lamps with plans for continuous 24-hour operation across a one-square-mile district. This design prioritized uninterrupted supply to ensure system reliability, as lighting loads, though peaking in evenings, required baseline capacity to avoid blackouts in the nascent grid. The station's operations highlighted the economic rationale for steady generation, running at near-full capacity when demand allowed to amortize fixed investments.[14] Parallel developments in hydroelectric generation reinforced continuous power provision. The Vulcan Street Plant in Appleton, Wisconsin, activated in 1882, became the first hydroelectric facility in the United States, harnessing the Fox River to drive a dynamo for steady output to a local paper mill and nearby homes, demonstrating water-powered baseload feasibility without fossil fuels. By the mid-1890s, alternating-current systems enabled scaled-up continuous supply; the Niagara Falls hydroelectric project, operational from 1895 under Westinghouse Electric, produced 11,000 horsepower (about 5 megawatts initially) for transmission over 20 miles, supplying baseline industrial and urban loads with high-capacity, low-variability output. These innovations transitioned electrification from isolated DC setups to interconnected networks reliant on plants optimized for persistent, minimum-demand fulfillment.[15][13]Expansion in the 20th Century

In the early 20th century, the expansion of base load power was driven by the development of large-scale central steam turbine plants, which enabled economies of scale and reliable continuous generation to meet growing urban demand. Samuel Insull, operating through Commonwealth Edison in Chicago, invested heavily in oversized generating units—often four times larger than contemporary norms—to serve as baseload providers, interconnecting local systems into regional networks that minimized waste from fluctuating loads.[16][17] By the 1910s, these plants, primarily coal-fired, achieved capacities up to 10 MW per unit, supporting the shift from small, isolated generators to monopolistic utilities optimized for steady output.[13] Hydroelectric facilities further expanded base load capacity during the 1920s and 1930s, leveraging abundant water resources for dispatchable, low-fuel-cost generation. The Hoover Dam, completed in 1936, initially provided 1,345 MW of firm power, serving as a cornerstone for baseload in the southwestern United States through regulated river flows.[18] In the U.S., New Deal programs under President Roosevelt boosted hydropower to 40% of total electricity by the late 1930s, with projects like Grand Coulee Dam (operational from 1941, expanding to over 6,000 MW) enabling large-scale, continuous supply across interconnected grids.[18] Globally, hydroelectric output grew alongside coal, contributing to electricity generation rising from 66 terawatt-hours (TWh) in 1900 to thousands of TWh by mid-century, as transmission advancements allowed remote plants to underpin urban base load.[19] Post-World War II industrialization accelerated coal plant construction, with U.S. capacity surging as steam turbine efficiencies improved from under 20% in 1900 to around 30% by the 1950s, favoring baseload operation over peaking.[20] Nuclear power emerged as a premium baseload technology in the 1950s, with the first grid-connected reactor at Obninsk, USSR, in 1954 (5 MW), followed by Shippingport, USA, in 1957 (60 MW), designed explicitly for high-capacity-factor, continuous fission-based generation independent of fuel combustion variability.[21][22] By the 1970s, nuclear capacity expanded rapidly—reaching 100 GW globally by the late decade—complementing coal and hydro as utilities prioritized plants with load factors exceeding 80% to match inelastic demand growth.[22] This era solidified base load as the foundation of interconnected grids, with fossil and nuclear sources dominating due to their technical suitability for round-the-clock dispatch.[23]Shifts in the Late 20th and Early 21st Centuries

The partial meltdown at the Three Mile Island nuclear reactor in Pennsylvania on March 28, 1979, marked a turning point for nuclear power development in the United States, leading to heightened regulatory scrutiny, public opposition, and a sharp decline in new plant orders.[24] No nuclear reactors were ordered after 1978, and between 1979 and 1988, 67 planned projects were canceled amid escalating construction costs and delays.[25] The 1986 Chernobyl disaster in the Soviet Union further eroded confidence in nuclear technology globally, contributing to moratoriums on new builds and a focus on safety retrofits rather than expansion, with U.S. nuclear capacity growth stalling after peaking in the early 1990s.[26] Deregulation of electricity markets, accelerated by the U.S. Public Utility Regulatory Policies Act of 1978 and the Energy Policy Act of 1992, shifted incentives toward independent power producers and competitive generation, favoring plants with shorter construction times and lower upfront costs over traditional coal or nuclear baseload facilities.[27] This restructuring encouraged the deployment of efficient natural gas combined-cycle turbines, which could be built in 2-3 years compared to a decade for nuclear or large coal plants, transforming gas from a peaking resource into a viable baseload option by the late 1990s.[28] The advent of hydraulic fracturing and horizontal drilling in the early 2000s unlocked abundant, low-cost shale gas, displacing coal as the dominant baseload fuel in the U.S. Between 2000 and 2005, 191,745 MW of natural gas capacity was added, surpassing coal additions and enabling gas to run at higher capacity factors akin to baseload operation.[29] Coal-fired generation, which had served as baseload mainstay, peaked at around 2,000 TWh in 2007 but fell to one-third of that level by 2023, driven by gas price advantages (falling to under $3/MMBtu in the 2010s) and environmental regulations like the EPA's Mercury and Air Toxics Standards in 2011.[23] Over 100 coal plants were converted or replaced by natural gas between 2011 and 2019, reflecting economic pressures that prioritized dispatchable, lower-emission thermal sources.[30] The proliferation of subsidized variable renewables, spurred by state renewable portfolio standards from the 1990s and federal tax credits like the Production Tax Credit (extended in 1992 and renewed periodically), introduced intermittency that challenged the rigid baseload model reliant on continuous operation of large thermal units.[31] Wind and solar capacity grew from negligible shares in 1990 to over 10% of U.S. generation by 2020, necessitating greater flexibility in remaining baseload plants—such as increased ramping and cycling of coal and gas units—which reduced their efficiency and lifespan while exposing grid reliability risks without adequate firm backup.[23] Proponents of high-renewable penetration argued for a paradigm shift away from dedicated baseload toward a "flexible" system with storage and demand response, though empirical data from early integrations showed elevated curtailment and backup needs, underscoring that renewables alone could not replicate the dispatchable reliability of traditional sources without complementary technologies.[32]Technologies for Base Load Power

Traditional Sources

Coal-fired power plants have historically served as a primary traditional source for base load electricity generation, utilizing steam turbines driven by coal combustion to produce consistent, high-volume output suitable for continuous operation.[6] These plants achieve capacity factors often exceeding 50% when optimized for base load, though U.S. averages fell to about 43% in recent years due to competition from cheaper natural gas and regulatory pressures.[33] Coal's abundance and low marginal fuel costs enabled its dominance in early grid systems, powering base load demand from the mid-20th century onward, with U.S. coal generation peaking at over 2,000 terawatt-hours annually around 2007 before declining to roughly one-third of that level by 2023.[23] Natural gas-fired plants, particularly combined-cycle gas turbine (CCGT) facilities, emerged as another key traditional base load technology, combining gas turbines with steam recovery for efficiencies up to 60% and capacity factors around 50-60% in base load roles.[11] These plants burn natural gas to generate electricity continuously, offering flexibility over coal while maintaining steady output; U.S. natural gas generation more than doubled from 2007 to 2023, displacing coal in many base load applications due to lower emissions and fuel price advantages post-fracking boom.[23] Historically, natural gas supplemented coal from the 1970s onward, with policies like the Fuel Use Act initially favoring coal but later shifts enabling gas's rise in the 1990s and 2000s.[9] Both technologies provide dispatchable power with minimal ramping needs, essential for matching the constant minimum demand in power systems, though coal's higher emissions and waste have prompted phase-outs in regions like the U.S. and Europe.[2] Oil-fired plants, while occasionally used, rarely qualify as true base load sources due to high fuel costs and lower efficiency, limiting them to peaking or backup roles.[6]Dispatchable Clean Sources

Dispatchable clean sources encompass low-carbon technologies capable of reliable, controllable output to meet base load demands, including nuclear fission, reservoir-based hydroelectricity, and geothermal energy. These differ from variable renewables by offering high capacity factors—typically above 80%—and operational flexibility without reliance on weather conditions.[34] Nuclear power plants dominate this category globally, providing steady electricity through controlled fission reactions in reactors. In 2024, worldwide nuclear generation reached a record 2667 terawatt-hours, with an average capacity factor of 83%, reflecting efficient utilization for continuous operation.[35] In the United States, nuclear facilities operated at 92% capacity factor that year, underscoring their suitability for base load due to minimal downtime and fuel independence from external supply chains.[36] [37] Large-scale hydroelectric plants with reservoirs enable dispatchability by storing water for on-demand release, generating electricity via turbines while emitting negligible greenhouse gases during operation. Such facilities contribute firm capacity exceeding 24 gigawatts in flexible modes within integrated systems.[38] However, U.S. hydropower averages a 36% capacity factor, as plants often prioritize peaking and seasonal adjustments over uninterrupted base load, with trends showing declines at many sites since 1980 due to hydrological variability and competing water uses.[39] [40] Despite this, hydro remains a key dispatchable clean asset for grid balancing, particularly in regions with abundant water resources.[41] Geothermal power extracts heat from the Earth's subsurface to drive steam turbines, yielding consistent baseload output with capacity factors routinely surpassing 90% at modern plants.[42] This technology operates independently of daily or seasonal fluctuations, positioning it as a scalable clean dispatchable source, though deployment is geographically constrained to tectonically active areas. Globally, geothermal achieves a mean capacity factor of 74%, competitive with other low-emission options and superior to many renewables in reliability.[43] Emerging enhanced geothermal systems aim to expand accessibility, potentially rivaling nuclear and hydro in cost-effectiveness for dispatchable clean power.[44]Emerging Technologies

Small modular reactors (SMRs) are advanced nuclear fission designs with capacities typically under 300 MWe, enabling factory fabrication, modular deployment, and inherent safety features that facilitate base load operation with reduced regulatory and construction risks compared to traditional large reactors.[45] SMRs provide dispatchable, zero-carbon electricity suitable for continuous generation, with projected operational lifespans exceeding 60 years and capabilities for load-following if needed, though optimized for steady baseload output.[46] As of 2025, designs like NuScale's VOYGR (77 MWe per module) and Rolls-Royce's 470 MWe unit are advancing toward commercialization, with U.S. Department of Energy support targeting deployment by the early 2030s to meet rising demand from data centers and electrification.[47] Deployment challenges include supply chain scaling and first-of-a-kind costs, estimated at $5,000–$8,000 per kW initially, but modular repetition could lower levelized costs to competitive levels with renewables-plus-storage.[48] Enhanced geothermal systems (EGS), including superhot rock variants, expand base load potential by accessing deep, hot dry rock formations through hydraulic fracturing and fluid circulation, independent of tectonic plate boundaries.[49] These systems deliver firm, 24/7 renewable power with capacities from 5–50 MWe per well pair, achieving high capacity factors over 90% via closed-loop or open-loop configurations that minimize seismic risks when engineered properly.[50] Pilot projects, such as those by Fervo Energy in Utah, demonstrated 3.5 MWe output in 2023 with drilling costs dropping toward $5 million per well, positioning EGS for national-scale baseload by 2050 if federal incentives like the U.S. DOE's $80 million Enhanced Geothermal Shot target are met.[51] Eavor's closed-loop Eavor-Loop technology, operational in pilots since 2022, further promises scalable baseload without wastewater issues, though upfront drilling remains the primary barrier to widespread adoption.[52] Nuclear fusion, pursued via tokamaks, stellarators, and inertial confinement, aims for unlimited base load from deuterium-tritium reactions but remains pre-commercial as of 2025, with net energy gain achieved sporadically (e.g., NIF's 2022–2023 ignition milestones yielding 2–3 MJ excess).[53] Private ventures like Commonwealth Fusion Systems target pilot plants by 2028–2030, but full commercialization roadmaps from the U.S. DOE extend to the 2040s, contingent on sustained Q>10 plasma confinement and tritium breeding at scale.[54] Fusion's base load viability hinges on resolving material durability under neutron flux and cost reductions from $10–$20 billion per GW initial plants, offering potential for dispatchable clean power without long-lived waste if timelines align with global decarbonization needs.[55]Economics and Cost Structures

Capital and Operating Costs

Capital costs for base load power plants, encompassing engineering, procurement, construction, and commissioning expenses expressed as overnight costs in USD per kilowatt of capacity, vary significantly by technology due to differences in design complexity, regulatory requirements, and material needs. Nuclear power plants exhibit the highest capital intensity, with U.S. estimates for advanced designs ranging from approximately 7,000 to 9,000 USD/kW in 2023 dollars, driven by stringent safety features, specialized containment structures, and long construction timelines often exceeding 5-7 years.[56] In contrast, natural gas combined-cycle (NGCC) plants, which can also serve base load roles, have lower capital requirements of around 1,000 to 1,200 USD/kW, reflecting simpler modular turbines and shorter build times of 2-3 years.[57] Coal-fired plants fall in between, with capital costs typically 3,000 to 4,000 USD/kW, incorporating boilers and pollution controls but benefiting from established supply chains.[58] Operating costs, including fixed operations and maintenance (O&M), variable fuel, and minor upkeep, are inversely related to capital intensity for base load sources, as high-CAPEX plants like nuclear prioritize fuel efficiency. Nuclear plants achieve low variable O&M of 9-16 USD/MWh, with fuel costs comprising only about 20% of total operating expenses due to the energy density of uranium and refueling cycles every 18-24 months.[59] Coal plants, however, face higher total operating costs averaging 46 USD/MWh in 2024, dominated by fuel procurement (up to 70% of OPEX) amid volatile coal prices and emissions compliance.[60] NGCC units have moderate OPEX, with fuel sensitivity to natural gas markets pushing variable costs to 20-40 USD/MWh depending on utilization, though fixed O&M remains low at under 15 USD/kW-year.[61] These cost structures underscore trade-offs in base load provision: nuclear's upfront burden supports near-zero marginal costs for continuous output, enhancing economic dispatch in high-utilization scenarios above 90% capacity factors, while fossil alternatives offer flexibility at the expense of ongoing fuel exposure. Actual costs can escalate due to site-specific factors, supply chain disruptions, or overruns, as evidenced by U.S. nuclear projects exceeding estimates by 50-100% in recent decades.[62]| Technology | CAPEX (USD/kW, approx. 2023) | Fixed O&M (USD/kW-yr) | Variable O&M incl. Fuel (USD/MWh) |

|---|---|---|---|

| Nuclear | 7,000-9,000 | 100-150 | 9-16 |

| Coal | 3,000-4,000 | 30-50 | 30-50 |

| NGCC | 1,000-1,200 | 10-15 | 20-40 |

Levelized Cost Comparisons

The levelized cost of electricity (LCOE) represents the net present value of a power plant's total lifetime costs—capital expenditures, fixed and variable operations and maintenance, fuel, and decommissioning—divided by the expected lifetime electricity generation, expressed in dollars per megawatt-hour.[65] For base load applications requiring near-continuous operation and high capacity factors (typically above 80%), LCOE comparisons must account for inherent differences in dispatchability, as intermittent renewables deliver power only under favorable conditions, necessitating overcapacity, storage, or backup to match the firm output of traditional base load plants.[66][67] Lazard's June 2025 unsubsidized LCOE analysis highlights renewables' lower ranges driven by declining capital costs and no fuel expenses, contrasted with higher upfront investments for dispatchables, though the latter achieve superior energy yields via elevated capacity factors.[68]| Technology | Unsubsidized LCOE ($/MWh) | Capacity Factor (%) |

|---|---|---|

| Utility-Scale Solar PV | 38–78 | 20–30 |

| Onshore Wind | 37–86 | 30–55 |

| Gas Combined Cycle | 48–109 | 30–90 |

| Coal | 71–173 | 65–85 |

| Nuclear | 141–220 | 89–92 |

Incentives and Subsidies

Capacity payments represent a key incentive mechanism for baseload generators in deregulated electricity markets, compensating providers for maintaining available capacity rather than solely for energy dispatched, thereby addressing fixed costs and ensuring reliability during peak demand. In the PJM Interconnection, for instance, capacity auction prices for the 2025/26 delivery year reached record highs of $666.50 per megawatt-day in some zones, a over 2,100% increase from prior levels, signaling market demand for dispatchable resources amid retiring coal and nuclear plants.[71][72] These payments, often structured as forward contracts, encourage investment in or retention of baseload assets like natural gas combined-cycle plants and nuclear reactors, which operate continuously to meet minimum load requirements.[73] Historically, traditional baseload sources such as coal, natural gas, and nuclear have benefited from substantial government subsidies, including tax credits, loan guarantees, and production incentives, which offset high capital costs and long construction timelines. In the United States, coal received approximately $20 billion in federal subsidies in recent years, while nuclear power has been supported through mechanisms like the Price-Anderson Act for liability insurance and, more recently, zero-emission credits in states like New York and Illinois.[74] Globally, explicit fossil fuel subsidies—including those for coal and gas used in baseload generation—totaled around $1.5 trillion in 2022, primarily through underpriced consumer costs rather than direct production aid.[75] The Inflation Reduction Act of 2022 extended tax credits to existing nuclear plants, providing up to $15 per megawatt-hour for clean baseload output, aiming to prevent premature retirements and support decarbonization without relying on intermittent renewables.[76] However, the proliferation of subsidies for variable renewables—such as the U.S. Production Tax Credit and Investment Tax Credit, which disbursed over $31 billion in 2024—has distorted markets against baseload investments by flooding grids with low-marginal-cost intermittent power, eroding energy revenues for dispatchable plants.[77] This dynamic necessitates compensatory incentives like capacity markets to sustain baseload capacity, as unsubsidized reliable generators struggle to compete on price alone during off-peak hours. Empirical analyses indicate that without such mechanisms, renewable subsidies can increase overall system costs by underpricing intermittency's integration expenses, including backup needs, while baseload sources provide inherent firmness.[78] Proposals for dispatchable energy credits, as explored in Texas during 2021 winter storm aftermaths, seek to explicitly value flexibility and availability, though implementation varies by jurisdiction.[79]| Incentive Type | Description | Examples for Baseload Sources |

|---|---|---|

| Capacity Payments | Fixed payments for committed capacity availability | PJM auctions rewarding gas and nuclear; up to $750,000/month for 100 MW commitment[80] |

| Tax Credits/Production Incentives | Per-unit output or investment credits | U.S. nuclear zero-emission credits; IRA clean electricity PTC up to 1.5 cents/kWh base, scaled for reliability[76] |

| Loan Guarantees & Insurance | Risk mitigation for capital-intensive projects | DOE loan programs for advanced nuclear; Price-Anderson for liability[62] |

Role in Modern Power Systems

Ensuring Grid Stability and Reliability

Baseload power generation ensures grid stability by supplying a continuous minimum level of electricity to match the base demand, preventing supply shortfalls that could lead to frequency deviations or blackouts.[82] Synchronous generators in baseload plants, such as nuclear and fossil fuel facilities, provide inherent system inertia through their rotating masses, which store kinetic energy and resist rapid changes in grid frequency following sudden supply-demand imbalances.[83][84] This inertia slows the initial rate of change of frequency (RoCoF), giving operators time to deploy automatic controls and reserves.[85] In grids with declining baseload capacity, reduced inertia heightens vulnerability to disturbances, as evidenced by faster frequency swings and increased risk of cascading failures.[86] For instance, the North American Electric Reliability Corporation (NERC) identifies inertia deficits as a key risk in transforming grids dominated by inverter-based renewables, which lack physical rotation and thus contribute minimally to this stabilizing effect.[87] Empirical observations in regions like South Australia, where high renewable penetration led to low inertia during the 2016 blackout, demonstrate how rapid RoCoF can trigger protective disconnections of generation, exacerbating instability.[88] Beyond inertia, baseload plants deliver essential ancillary services, including primary frequency response via turbine governors and voltage regulation through excitation systems, maintaining synchronism across the interconnected grid.[89] These capabilities underpin reliability by enabling real-time balancing and black-start functions, where select plants can restart the grid post-blackout without external power.[90] In contrast, variable sources require supplementary measures like synthetic inertia from advanced inverters, but these are less proven at scale and depend on baseload or dispatchable backups for overall resilience.[91] NERC assessments emphasize that preserving sufficient synchronous generation is critical to avert reliability gaps as renewable integration accelerates.[92]Integration with Variable Renewable Energy

Baseload power sources, such as nuclear and hydroelectric plants, provide essential stability when integrating variable renewable energy (VRE) sources like wind and solar, which exhibit unpredictable output fluctuations due to weather dependencies. These sources ensure continuous supply to meet the minimum grid demand, compensating for periods of low VRE generation, such as calm nights or cloudy days, thereby maintaining frequency control and system inertia critical for preventing blackouts.[93][94] In grids with high VRE penetration, baseload capacity reduces the need for rapid-response fossil fuel backups during ramps, lowering overall emissions compared to relying solely on gas peakers.[95] Flexible operation of baseload plants enhances VRE integration by allowing load-following, where output is adjusted to match net load variations after VRE subtraction. For instance, nuclear reactors can ramp at rates of 1-5% per minute in modern designs, enabling them to curtail during VRE peaks and increase during troughs, which optimization models show reduces system operating costs by up to 10-20% and minimizes VRE curtailment by 30-50% in simulated scenarios.[96][97] This flexibility is particularly valuable in regions like France, where nuclear comprises over 70% of generation and routinely adjusts to accommodate up to 20 GW of intermittent renewables without compromising reliability.[98] However, rigid baseload designs, if not retrofitted, face economic penalties from must-run constraints during high VRE output, highlighting the need for technological upgrades like advanced control systems. Empirical data from high-VRE grids underscore baseload's role amid integration challenges. In Germany's Energiewende, which targeted 80% renewables by 2050, VRE shares exceeding 50% on windy days have led to negative wholesale prices and forced baseload curtailment, yet reliance on coal and gas for baseload has persisted to avert supply shortfalls, with import dependencies rising during 2022-2023 winters.[99] Similarly, U.S. Western grid studies integrating 30-35% wind and solar reveal that without sufficient baseload or storage, frequency stability degrades, necessitating over 10 GW of flexible reserves to handle ramps exceeding 1 GW/minute.[100] Storage solutions like batteries address short-term variability but remain cost-prohibitive for seasonal gaps, with levelized costs 2-5 times higher than dispatchable baseload for firm capacity.[101] Thus, hybrid systems combining baseload with VRE achieve higher capacity factors and reliability than VRE-alone portfolios, as demonstrated in net load analyses showing reduced variability through geographic diversity.[102] Policy implications emphasize retaining baseload to mitigate VRE risks, countering narratives that dismiss it in favor of flexibility alone, which often overlook empirical reliability metrics. Grids phasing out baseload prematurely, as in California's duck curve dynamics, experience increased peaker emissions and procurement costs exceeding $50/MWh for balancing services.[103] Advanced baseload technologies, including small modular reactors, further enable co-location with VRE for localized balancing, supporting decarbonization without sacrificing dispatchability.[104]Debates and Controversies

Challenges to the Baseload Paradigm

The baseload paradigm, which prioritizes continuously operating large-scale generators like nuclear and coal plants to meet minimum grid demand, faces significant technical challenges in systems with high penetration of variable renewable energy (VRE) sources such as wind and solar. These plants exhibit limited operational flexibility, with ramping times often exceeding several hours and minimum stable generation levels that prevent rapid shutdowns or reductions during periods of excess renewable output.[105][4] For instance, nuclear reactors typically require 6-12 hours to adjust output significantly, making them ill-suited to balance the intra-hour variability of VRE, which can fluctuate by 30-50% in short periods.[106] This inflexibility leads to overgeneration risks, where baseload capacity must either curtail renewables or accept negative wholesale prices to avoid grid instability, as observed in European markets where negative pricing occurred for over 5,000 hours in 2023.[107] Economically, the fixed high capital costs of baseload plants—often exceeding $6,000 per kW for nuclear—demand high capacity factors above 80% for viability, yet VRE integration reduces these factors by displacing steady output during peak renewable production.[108] In contrast, flexible resources like battery storage and gas turbines offer lower marginal costs and faster response times (seconds to minutes), enabling better utilization of cheap VRE. Studies indicate that systems relying on baseload overbuild capacity by 20-50% to ensure reliability, inflating total system costs compared to diversified flexible portfolios that achieve equivalent reliability at 10-30% lower expense.[4][32] This mismatch has contributed to early retirements of baseload assets, such as the closure of 10 GW of U.S. coal capacity between 2020 and 2024, driven by uneconomic operation amid falling VRE prices.[109] Empirical evidence from high-VRE grids underscores these issues. In South Australia, where renewables supplied 70% of electricity in 2023, the shift to batteries and demand response replaced traditional baseload, averting blackouts after the 2016 event through flexible backup rather than rigid capacity.[110] Similarly, California's grid, with 40% renewable penetration by 2024, relies on intraday storage and imports over baseload nuclear, which constitutes less than 7% of generation despite operational plants.[111] These cases demonstrate that reliability can be maintained without dominant baseload by leveraging geographic diversity, forecasting accuracy (now at 95% for day-ahead wind/solar), and ancillary services from non-synchronous generators, challenging the necessity of the paradigm for modern decarbonized systems.[108][112] However, such transitions require robust grid enhancements, as incomplete flexibility has led to curtailment rates exceeding 5% in regions like Germany during low-demand, high-wind periods.[107]Empirical Evidence on Reliability and Costs

Nuclear power plants demonstrate high operational reliability through capacity factors averaging 92.7% in the United States for 2023, reflecting consistent output near full rated capacity.[113] In contrast, coal-fired plants averaged 49.3%, combined-cycle natural gas 56.8%, onshore wind 35.4%, and utility-scale solar 24.9% during the same period, underscoring the dispatchable nature of baseload sources in meeting continuous demand.[113] Forced outage rates further highlight this disparity: nuclear plants experience unplanned downtime of 1-2%, compared to 6-10% for coal plants, with modern wind turbines at around 1.8% but limited by intermittency rather than mechanical failure.[114] [115] Empirical analyses of grid stability reveal challenges with high renewable penetration absent sufficient baseload or flexible backup. In regions like California and Texas, increased variable renewable energy shares correlated with frequency of emergency alerts and rolling blackouts during peak demand or low wind/solar output, as seen in California's 2020 heatwave events where solar overproduction midday necessitated curtailment while evening shortfalls strained gas peakers.[116] A 2025 U.S. Department of Energy report projected potential blackout risks increasing up to 100-fold by 2030 if retirements of reliable dispatchable capacity outpace additions of firm alternatives like nuclear.[116] Similarly, South Australia's 2016 statewide blackout followed a storm impacting wind farms, exposing vulnerabilities in a grid with over 40% renewables at the time, though subsequent inquiries noted systemic issues including inadequate inertia from synchronous generators typical of baseload plants.[117] On costs, existing nuclear plants exhibit low operating expenses, averaging $28 per MWh in merchant markets for 2023, driven by minimal fuel and variable costs once capital is sunk.[118] This contrasts with unsubsidized renewables' levelized costs around $40/MWh for wind and solar, but empirical adjustments for intermittency—incorporating backup, storage, and grid reinforcements—elevate effective system costs significantly. Studies applying system LCOE methodologies estimate integration costs for variable renewables adding 20-50% or more to standalone figures at high penetration levels (e.g., 40-60%), due to overproduction curtailment, balancing reserves, and profile costs from mismatched supply-demand timing.[119] [120] For instance, value-adjusted LCOE analyses by the IEA and NEA account for renewables' lower capacity credits (10-40% vs. 90%+ for nuclear), rendering dispatchable baseload more competitive in firm power provision.[121]| Technology | Average Capacity Factor (US, 2023) | Forced Outage Rate | Operating Cost (per MWh, existing plants) |

|---|---|---|---|

| Nuclear | 92.7% | 1-2% | ~$28 |

| Coal | 49.3% | 6-10% | Varies, higher fuel |

| Wind | 35.4% | ~1.8% | Low, but intermittency adds system costs |

| Solar | 24.9% | Low mechanical | Low, but intermittency adds system costs |