Recent from talks

Nothing was collected or created yet.

Call centre

View on Wikipedia

| E-commerce |

|---|

| Digital content |

| Retail goods and services |

| Online shopping |

| Mobile commerce |

| Customer service |

| E-procurement |

| Purchase-to-pay |

| Super-apps |

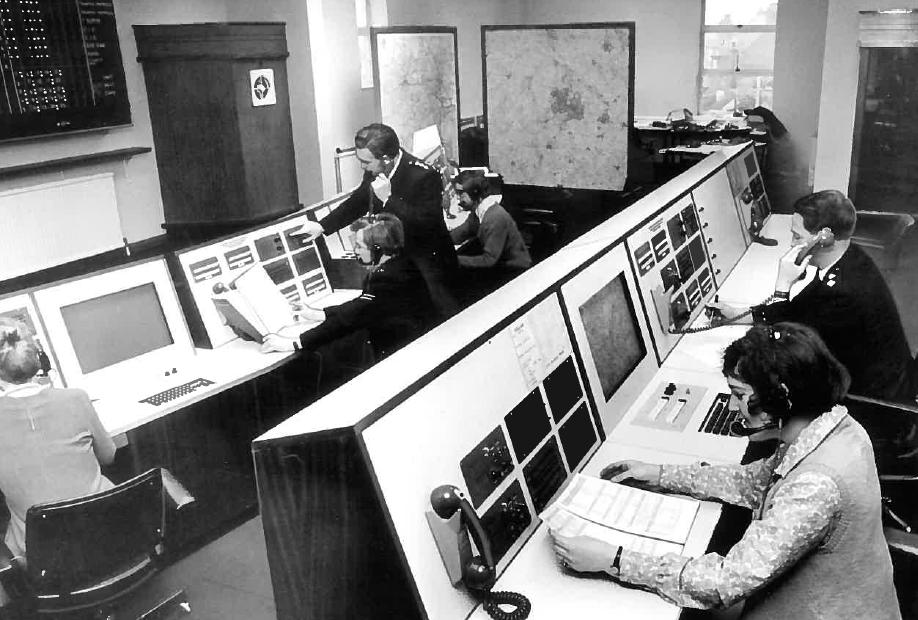

A call centre (Commonwealth spelling) or call center (American spelling; see spelling differences) is a managed capability that can be centralised or remote that is used for receiving or transmitting a large volume of enquiries by telephone. An inbound call centre is operated by a company to administer incoming product or service support or information inquiries from consumers. Outbound call centres are usually operated for sales purposes such as telemarketing, for solicitation of charitable or political donations, debt collection, market research, emergency notifications, and urgent/critical needs blood banks. A contact centre is a further extension of call centres' telephony based capabilities, administering centralised handling of individual communications including letters, faxes, live support software, social media, instant message, and email.[1]

A call centre was previously seen as an open workspace for call centre agents, with workstations that included a computer and display for each agent and were connected to an inbound/outbound call management system, and one or more supervisor stations. It can be independently operated or networked with additional centres, often linked to a corporate computer network, including mainframes, microcomputer, servers and LANs. It is expected that artificial intelligence-based chatbots will significantly impact call centre jobs and will increase productivity substantially.[2][3][4] Many organisations have already adopted AI-based chatbots to improve their customer service experience.[4][5][3]

The contact centre is a central point from which all customer contacts are managed. Through contact centres, valuable information can be routed to the appropriate people or systems, contacts can be tracked, and data may be gathered. It is generally a part of the company's customer relationship management infrastructure. The majority of large companies use contact centres as a means of managing their customer interactions. These centres can be operated by either an in-house department responsible or outsourcing customer interaction to a third-party agency (known as Outsourcing Call Centres[6]).

History

[edit]

Answering services, as known in the 1960s through the 1980s, earlier and slightly later, involved a business that specifically provided the service. Primarily, by using an off-premises extension (OPX) for each subscribing business, connected at a switchboard at the answering service business, the answering service would answer the otherwise unattended phones of the subscribing businesses with a live operator. The live operator could take messages or relay information, doing so with greater human interactivity than a mechanical answering machine. Although undoubtedly more costly (the human service, the cost of setting up and paying the phone company for the OPX on a monthly basis), it had the advantage of being more ready to respond to the unique needs of after-hours callers. The answering service operators also had the option of calling the client and alerting them to particularly important calls.

The origins of call centres date back to the 1960s with the UK-based Birmingham Press and Mail, which installed Private Automated Business Exchanges (PABX) to have rows of agents handling customer contacts.[7][8] By 1973, call centres had received mainstream attention after Rockwell International patented its Galaxy Automatic Call Distributor (GACD) for a telephone booking system as well as the popularisation of telephone headsets as seen on televised NASA Mission Control Center events.[9][10]

During the late 1970s, call centre technology expanded to include telephone sales, airline reservations, and banking systems. The term "call centre" was first published and recognised by the Oxford English Dictionary in 1983. The 1980s saw the development of toll-free telephone numbers to increase the efficiency of agents and overall call volume. Call centres increased with the deregulation of long-distance calling and growth in information-dependent industries.[11]

As call centres expanded, workers in North America began to join unions[12] such as the Communications Workers of America[13] and the United Steelworkers. In Australia, the National Union of Workers represents unionised workers; their activities form part of the Australian labour movement.[14] In Europe, UNI Global Union of Switzerland is involved in assisting unionisation in the call center industry,[15] and in Germany Vereinte Dienstleistungsgewerkschaft represents call centre workers.

During the 1990s, call centres expanded internationally and developed into two additional subsets of communication: contact centres and outsourced bureau centres. A contact centre is a coordinated system of people, processes, technologies, and strategies that provides access to information, resources, and expertise, through appropriate channels of communication, enabling interactions that create value for the customer and organisation.[16] In contrast to in-house management, outsourced bureau contact centres are a model of contact centre that provide services on a "pay per use" model. The overheads of the contact centre are shared by many clients, thereby supporting a very cost effective model, especially for low volumes of calls. The modern contact centre includes automated call blending of inbound and outbound calls as well as predictive dialling capabilities, dramatically increasing agents' productivity. New implementations of more complex systems require highly skilled operational and management staff that can use multichannel online and offline tools to improve customer interactions.[17][18][19]

Technology

[edit]

Call centre technologies often include: speech recognition software which allowed Interactive Voice Response (IVR) systems to handle first levels of customer support, text mining, natural language processing to allow better customer handling, agent training via interactive scripting and automatic mining using best practices from past interactions, support automation and many other technologies to improve agent productivity and customer satisfaction. Automatic lead selection or lead steering is also intended to improve efficiencies, both for inbound and outbound campaigns. This allows inbound calls to be directly routed to the appropriate agent for the task, whilst minimising wait times and long lists of irrelevant options for people calling in.[21]

For outbound calls, lead selection allows management to designate what type of leads go to which agent based on factors including skill, socioeconomic factors, past performance, and percentage likelihood of closing a sale per lead.

The universal queue standardises the processing of communications across multiple technologies such as fax, phone, and email. The virtual queue provides callers with an alternative to waiting on hold when no agents are available to handle inbound call demand.

Premises-based technology

[edit]Historically call centres have been built on Private branch exchange (PBX) equipment owned, hosted, and maintained by the call centre operator. The PBX can provide functions such as automatic call distribution, interactive voice response, and skills-based routing.

Virtual call centre

[edit]In a virtual call centre model, the call centre operator (business) pays a monthly or annual fee to a vendor that hosts the call centre telephony and data equipment in their own facility, cloud-based. In this model, the operator does not own, operate or host the equipment on which the call centre runs. Agents connect to the vendor's equipment through traditional PSTN telephone lines, or over voice over IP. Calls to and from prospects or contacts originate from or terminate at the vendor's data centre, rather than at the call centre operator's premises. The vendor's telephony equipment (at times data servers) then connects the calls to the call centre operator's agents.[22]

Virtual call centre technology allows customer service representatives to operate remotely, connecting to the organisation’s telephony and CRM systems via cloud infrastructure instead of working from a central office. This approach promotes greater accessibility for individuals with disabilities and supports distributed or hybrid workforce models across different regions. The only required equipment is Internet access, a workstation, and a softphone.[23] If the virtual call centre software utilises webRTC, a softphone is not required to dial. The companies are preferring Virtual Call Centre services due to cost advantage. Companies can start their call centre business immediately without installing the basic infrastructure like Dialer, ACD and IVRS.[24]

Virtual call centres became increasingly used after the COVID-19 pandemic restricted businesses from operating with large groups of people working in close proximity.

Cloud computing

[edit]Through the use of application programming interfaces (APIs), hosted and on-demand call centres that are built on cloud-based software as a service (SaaS) platforms can integrate their functionality with cloud-based applications for customer relationship management (CRM), lead management and more.

Developers use APIs to enhance cloud-based call centre platform functionality—including Computer telephony integration (CTI) APIs which provide basic telephony controls and sophisticated call handling from a separate application, and configuration APIs which enable graphical user interface (GUI) controls of administrative functions.

Outsourcing

[edit]Outsourced call centres are often located in developing countries, where wages are significantly lower than in western countries with higher minimum wages. These include the call centre industries in the Philippines, Bangladesh, and India.

Companies that regularly utilise outsourced contact centre services include British Sky Broadcasting and Orange[25] in the telecommunications industry, Adidas in the sports and leisure sector,[26] Audi in car manufacturing[27] and charities such as the RSPCA.

Industries

[edit]Healthcare

[edit]The healthcare industry has and continues to use outbound call centre programmes for years to help manage billing, collections, and patient communication.[28] The inbound call centre is a new[when?] and increasingly popular service for many types of healthcare facilities, including large hospitals. Inbound call centres can be outsourced or managed in-house.

These healthcare call centres are designed to help streamline communications, enhance patient retention and satisfaction, reduce expenses and improve operational efficiencies.

Hospitality

[edit]Many large hospitality companies such as the Hilton Hotels Corporation and Marriott International make use of call centres to manage reservations. These are known in the industry as "central reservations offices". Staff members at these call centres take calls from clients wishing to make reservations or other inquiries via a public number, usually a 1-800 number. These centres may operate as many as 24 hours per day, seven days a week, depending on the call volume the chain receives.[29]

Evaluation

[edit]Mathematical theory

[edit]Queueing theory is a branch of mathematics in which models of service systems have been developed. A call centre can be seen as a queueing network and results from queueing theory such as the probability an arriving customer needs to wait before starting service useful for provisioning capacity.[30] (Erlang's C formula is such a result for an M/M/c queue and approximations exist for an M/G/k queue.) Statistical analysis of call centre data has suggested arrivals are governed by an inhomogeneous Poisson process and jobs have a log-normal service time distribution.[31] Simulation algorithms are increasingly being used to model call arrival, queueing and service levels.[32]

Call centre operations have been supported by mathematical models beyond queueing, with operations research, which considers a wide range of optimisation problems seeking to reduce waiting times while keeping server utilisation and therefore efficiency high.[33]

Criticism

[edit]Call centres have received criticism for low rates of pay and restrictive working practices for employees, which have been deemed as a dehumanising environment.[34][35][36] Other research illustrates how call centre workers develop ways to counter or resist this environment by integrating local cultural sensibilities or embracing a vision of a new life.[37] Most call centres provide electronic reports that outline performance metrics, quarterly highlights and other information about the calls made and received. This has the benefit[38] of helping the company to plan the workload and time of its employees. However, it has also been argued that such close monitoring breaches the human right to privacy.[39]

Complaints are often logged by callers who find the staff do not have enough skill or authority to resolve problems,[40] as well as appearing apathetic.[41] These concerns are due to a business process that exhibits levels of variability because the experience a customer gets and results a company achieves on a given call are dependent upon the quality of the agent.[42] Call centres are beginning to address this by using agent-assisted automation to standardise the process all agents use.[43][44][45] However, more popular alternatives are using personality and skill based approaches.[46][47] The various challenges encountered by call operators are discussed by several authors.[48][49][50][51][52]

Media portrayals

[edit]Call centres located in India have been the focus of several documentary films: the 2004 film Thomas L. Friedman Reporting: The Other Side of Outsourcing, the 2005 films John and Jane, Nalini by Day, Nancy by Night, 1-800-India: Importing a White-Collar Economy, and the 2006 film Bombay Calling, among others.[53] An Indian call centre is also the subject of the 2006 film Outsourced and a key location in the 2008 film, Slumdog Millionaire. The 2014 BBC fly on the wall documentary series The Call Centre gave an often distorted although humorous view of life in a Welsh call centre.[54]

See also

[edit]- Automatic call distributor

- Business process outsourcing

- Call management

- List of call centre companies

- Predictive dialling

- Operator messaging

- Queue management system

- Skills based routing

- The Call Centre, a BBC fly-on-the-wall documentary at a Welsh call centre

- Virtual queue

Business portal

Business portal Telephones portal

Telephones portal

References

[edit]- ^ "Contact Center vs Communication Center vs Call Center". EWA Bespoke Communications. 2010-03-26.

- ^ Adam, M., Wessel, M. & Benlian, A. AI-based chatbots in customer service and their effects on user compliance. Electron Markets 31, 427–445 (2021). doi:10.1007/s12525-020-00414-7

- ^ a b Krishnan, C., Gupta, A., Gupta, A., Singh, G. (2022). Impact of Artificial Intelligence-Based Chatbots on Customer Engagement and Business Growth. In: Hong, TP., Serrano-Estrada, L., Saxena, A., Biswas, A. (eds) Deep Learning for Social Media Data Analytics. Studies in Big Data, vol 113. Springer, Cham. doi:10.1007/978-3-031-10869-3_11

- ^ a b "AI-enabled customer service is now the quickest and most effective route for institutions to deliver personalized, proactive experiences that drive customer engagement". New York: McKinsey & Company. March 27, 2023.

- ^ Brandon Turpin (August 2, 2023). "How chatbots can provide a better customer experience". IBM.

- ^ Jolaoso, Christiana (4 February 2024). Main, Kelly (ed.). "Call Center Outsourcing: Pros, Cons & Best Practices – Forbes Advisor". Forbes. Retrieved 2024-02-14.

- ^ Science and invention in Birmingham#cite note-45

- ^ "The history of the call center". Call Centre Helper Magazine. 19 January 2011. Retrieved 29 November 2014.

- ^ Smith, Ernie (5 August 2016). "The History of the Call Center Explains How Customer Service Got So Annoying". Vice.com.

- ^ "The History of Call Centers Timeline". Voxjar.com. 2017-12-20.

- ^ Butler, David L. Bottom-Line Call Center Management. Butterworth-Heinemann.

- ^ Kumar, Pradeep; Schenk, Christopher Robert (2006). Paths to Union Renewal. Broadview Press. ISBN 1-55193-058-7.

- ^ "Improving Call Center Jobs a Top Priority for CWA Customer Service". Communication Workers of America. 2010-05-06. Retrieved 2011-02-23.

- ^ "Call Centre Union Busters Get Wake-Up Call". Workers Online. Retrieved 2008-07-08.

- ^ "Uni Global Union's call centre organising campaigns". Uni Global Union. Archived from the original on 2008-06-15. Retrieved 2008-07-08.

- ^ Cleveland, Brad, "Call Center Management on Fast Forward (Third Edition)", ICMI Press, 2012

- ^ Viswanathan, Ravi; Sandell, Scott (21 June 2016). "Reinventing customer service: the modern contact center". Nea.com.

- ^ "Contact Center Modernization". Genesys.com. 2016.

- ^ Bernier, Paula (3 August 2012). "The History and Advancement of the Contact Center and the Customer Experience". Tmcnet.com.

- ^ "CallWeb". CallWeb. Retrieved 2023-05-04.

... a complete on-line data collection system. Its functionalities allow for Web surveys, of course, but it has also been used to build registration systems, project tracking systems, intelligent forms, etc.

- ^ Shah, Shariq; Ghomeshi, Hossein; Vakaj, Edlira; Cooper, Emmett; Fouad, Shereen (2023-08-01). "A review of natural language processing in contact centre automation". Pattern Analysis and Applications. 26 (3): 823–846. doi:10.1007/s10044-023-01182-8. ISSN 1433-755X.

- ^ M. Popovic and V. Kovacevic (2001). "An Approach to Internet-Based Virtual Call Center Implementation". Networking — ICN 2001. Lecture Notes in Computer Science. Vol. 2093. University of Novi Sad, Yugoslavia. pp. 75–84. doi:10.1007/3-540-47728-4_8. ISBN 978-3-540-42302-7.

- ^ David S. Joachim. "Computer Technology Opens a World of Work to Disabled People". New York Times. Archived from the original on 2010-03-23. Retrieved 2010-03-15.

- ^ Kumar, Harish (2016). "Hosted Contact / Call Center Services in Indian Telecommunications Licensing and Regulation". Researchgate: 6. doi:10.13140/RG.2.1.2931.9445.

- ^ "Orange currently outsources work to Indian units of Convergys Corp". The Wall Street Journal.

- ^ "adidas setup a dedicated customer care centre". Adidas. Archived from the original on 2013-10-27. Retrieved 2014-11-26.

- ^ "Audi chose Confero as an outsourced contact centre". Confero.

- ^ "Billing and Collections". Modern Healthcare. 2019-01-30.

- ^ Kasavana, Michael L.; Brooks, Richard M. (1998). Managing Front Office Operations. Educational Institute of the American Hotel & Motel Association. ISBN 9780866121798.

- ^ Gans, N.; Koole, G.; Mandelbaum, A. (2003). "Telephone Call Centers: Tutorial, Review, and Research Prospects" (PDF). Manufacturing & Service Operations Management. 5 (2): 79–141. doi:10.1287/msom.5.2.79.16071. Archived (PDF) from the original on 2015-12-08.

- ^ Brown, L.; Gans, N.; Mandelbaum, A.; Sakov, A.; Shen, H.; Zeltyn, S.; Zhao, L. (2005). "Statistical Analysis of a Telephone Call Center" (PDF). Journal of the American Statistical Association. 100 (469): 36–50. doi:10.1198/016214504000001808. S2CID 1639154. Archived (PDF) from the original on 2015-12-08.

- ^ "A Primer On Two Call Center Staffing Methods for Call Center Workforce Management". Portage Communications. Retrieved 2016-10-14.

- ^ Borst, S.; Mandelbaum, A.; Reiman, M. I. (2004). "Dimensioning Large Call Centers" (PDF). Operations Research. 52 (1): 17–34. doi:10.1287/opre.1030.0081. JSTOR 30036558. Archived (PDF) from the original on 2003-07-05.

- ^ "Working conditions and health in Swedish call centres". European Foundation for the Improvement of Living and Working Conditions. 2005-06-05. Archived from the original on 2008-06-20. Retrieved 2008-05-29.

- ^ "Hourly Rate Survey Report for Industry: Call Center". PayScale. Retrieved 2008-06-05.

- ^ "Advice regarding call centre working practices" (PDF). Health and Safety Executive. Archived from the original (PDF) on 2009-02-20. Retrieved 2008-06-05.

- ^ Pal, Mahuya; Buzzanell, Patrice (2013). "Breaking the Myth of Indian Call Centers: A Postcolonial Analysis of Resistance". Communication Monographs. 80 (2): 199–219. doi:10.1080/03637751.2013.776172. S2CID 143554201.

- ^ "The Call Center Answer Team reaches out to the industry for to crack a tough nut". Q&A: How Many Calls Should I Monitor. callcentermagazine.com. 2003-07-30. Archived from the original on 2006-03-13. Retrieved 2008-06-05.

- ^ "Who's on the Line? Women in Call Centres Project" (PDF). Atlantic Centre of Excellence for Women's Health. Health Canada. Archived (PDF) from the original on 2005-02-15. Retrieved 2008-06-05.

- ^ Shaw, Russell (2006-01-30). "Tone-deaf to customer complaints, Dell opens yet another call center in India". ZDNet. Archived from the original on January 23, 2009. Retrieved 2008-06-05.

- ^ Ahmed, Zubair (2006-02-22). "Abuse rattles Indian call centre staff". BBC News. Retrieved 2008-06-05.

- ^ Fleming, J., Coffman, C., Harter, J. (2005) Manage Your Human Sigma, Harvard Business Review

- ^ Paprzycki, Marcin; et al. (2004). Data Mining Approach for Analyzing Call Center Performance. Lecture Notes in Computer Science. Vol. 3029. Berlin: Springer. doi:10.1007/b97304. hdl:1959.17/43613. ISBN 978-3-540-22007-7. S2CID 463672.

- ^ Evaluation of the Performance of customer service representatives in a call center using DEA/Network Model/Fussy Sets (Thesis). Virginia Tech. November 2002. hdl:10919/31704. Retrieved 1 July 2008.

- ^ Srinivasan, Raj; Talim, JéRome; Wang, Jinting; et al. (2004). "Performance analysis of a call center with interactive voice response units". Top. 12 (1). Springer Berlin: 91–110. doi:10.1007/BF02578926. S2CID 62154813.

- ^ Skyrme, Pamela; et al. "Using personality to predict outbound call center job performance" (PDF). Archived (PDF) from the original on 2006-09-01. Retrieved 1 July 2008.

- ^ Stolletz, Raik; Stefan Helber (2004). "Performance analysis of an inbound call center with skills-based routing". OR Spectrum. 26 (3): 331–352. doi:10.1007/s00291-004-0161-y. S2CID 60731382.

- ^ Witt, L. A.; et al. (2004). "When Conscientiousness Isn't Enough: Emotional Exhaustion and Performance Among Call Center Customer Service Representatives". Journal of Management. 30 (1): 149–160. doi:10.1016/j.jm.2003.01.007. S2CID 145705159.

- ^ Aguir, Salah; Karaesmen, Fikri; Aksin, O. Zeynep; Chauvet, Fabrice; et al. (2004). "The impact of retrials on call center performance" (PDF). OR Spectrum. 26 (3): 353–376. CiteSeerX 10.1.1.579.9384. doi:10.1007/s00291-004-0165-7. S2CID 6818864. Archived (PDF) from the original on 2012-07-14.

- ^ Murthy, Nagesh N.; Challagalla, G. N.; Vincent, L. H.; Shervani, T. A.; et al. (2008). "The Impact of Simulation Training on Call Center Agent Performance: A Field-Based Investigation". Management Science. 54 (2): 384–399. doi:10.1287/mnsc.1070.0818. S2CID 17749514.

- ^ Armony, Mor; Itay Gurvich. "When promotions meet operations: cross-selling and its effect on call-center performance" (PDF). Archived from the original (PDF) on 24 January 2009. Retrieved 1 July 2008.

- ^ Goldberg, L.S.; A.A. Grandey (2007). "Display rules versus display autonomy: emotion regulation, emotional exhaustion, and task performance in a call center simulation". J Occup Health Psychol. 12 (3): 301–18. doi:10.1037/1076-8998.12.3.301. PMID 17638495.

- ^ Hudson, Dale (2009). "Undesirable Bodies and Desirable Labor: Documenting the Globalization and Digitization of Transnational American Dreams in Indian Call Centers". Cinema Journal. 49 (1): 82–102. doi:10.1353/cj.0.0164. S2CID 144859546.

- ^ "BBC Three – The Call Centre, Series 1". Bbc.co.uk. 2013-12-10. Retrieved 2017-12-10.

Further reading

[edit]- Cusack M., "Online Customer Care", American Society for Quality (ASQ) Press, 2000.

- Brad Cleveland, "Call Center Management on Fast Forward", ICMI Press, 2006.

- Kennedy I., Call centres, School of Electrical and Information Engineering, University of the Witwatersrand, 2003.

- Masi D.M.B., Fischer M.J., Harris C.M., Numerical Analysis of Routing Rules for Call centres, Telecommunications Review, 1998, noblis.org

- HSE website Psychosocial risk factors in call centres: An evaluation of work design and well-being.

- Reena Patel, Working the Night Shift: Women in India's Call Center Industry (Stanford University Press; 2010) 219 pages; traces changing views of "women's work" in India under globalisation.

- Fluss, Donna, "The Real-Time Contact centre", 2005 AMACOM

- Wegge, J., van Dick, R., Fisher, G., Wecking, C., & Moltzen, K. (2006, January). Work motivation, organisational identification, and well-being in call centre work. Work & Stress, 20(1), 60–83.

- Legros, B. (2016). Unintended consequences of optimizing a queue discipline for a service level defined by a percentile of the waiting time. Operations Research Letters, 44(6), 839–845.

- Krishnan, C., Gupta, A., Gupta, A., Singh, G. (2022). Impact of Artificial Intelligence-Based Chatbots on Customer Engagement and Business Growth. In: Hong, TP., Serrano-Estrada, L., Saxena, A., Biswas, A. (eds) Deep Learning for Social Media Data Analytics. Studies in Big Data, vol 113. Springer, Cham. doi:10.1007/978-3-031-10869-3_11

- Adam, M., Wessel, M. & Benlian, A. AI-based chatbots in customer service and their effects on user compliance. Electron Markets 31, 427–445 (2021). doi:10.1007/s12525-020-00414-7

- Hardalov, M., Koychev, I., Nakov, P. (2018). Towards Automated Customer Support. In: Agre, G., van Genabith, J., Declerck, T. (eds) Artificial Intelligence: Methodology, Systems, and Applications. AIMSA 2018. Lecture Notes in Computer Science(), vol 11089. Springer, Cham. doi:10.1007/978-3-319-99344-7_5

- Roberts, C. and Maier, T. (2024), "The evolution of service toward automated customer assistance: there is a difference", International Journal of Contemporary Hospitality Management, Vol. 36 No. 6, pp. 1914-1925. doi:10.1108/IJCHM-08-2022-1037

- Suendermann, D., Liscombe, J., Pieraccini, R., Evanini, K. (2010). “How am I Doing?”: A New Framework to Effectively Measure the Performance of Automated Customer Care Contact Centers. In: Neustein, A. (eds) Advances in Speech Recognition. Springer, Boston, MA. doi:10.1007/978-1-4419-5951-5_7

External links

[edit] Media related to call centres at Wikimedia Commons

Media related to call centres at Wikimedia Commons- Mandelbaum, Avishai Call Centers (Centres) Research Bibliography with Abstracts Archived 2017-04-29 at the Wayback Machine. Faculty of Industrial Engineering and Management, Technion-Israel Institute of Technology.

Call centre

View on GrokipediaA call centre is a centralized facility or department dedicated to handling large volumes of inbound and outbound telephone calls, primarily for customer service, sales, telemarketing, or support purposes.[1][2]

Emerging in the 1960s with initial inbound reservation systems and formalized in the 1970s through innovations like the Automatic Call Distributor, call centres enabled scalable communication management for businesses.[3][4][5]

Today, the industry operates on a global scale, with a market value exceeding $340 billion as of 2020 and projected growth to $500 billion by 2027, often involving outsourced operations to lower-cost regions for efficiency gains.[6][7]

Key operational features include scripted interactions, performance metrics such as average handle time, and technologies for call routing, though these contribute to high employee turnover rates averaging 30-45% annually due to repetitive, high-pressure workloads.[8][9][10]

While enabling cost-effective customer engagement and rapid query resolution, call centres have drawn scrutiny for worker stress and assembly-line-like conditions, prompting ongoing debates over labor practices and automation integration.[9][11]