Recent from talks

Contribute something

Nothing was collected or created yet.

Economic indicator

View on Wikipedia| Part of a series on |

| Economics |

|---|

|

|

|

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation), inverted yield curve,[1] consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and changes in credit conditions.

The leading business cycle dating committee in the United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics and statistics. Other producers of economic indicators includes the United States Census Bureau and United States Bureau of Economic Analysis.

Classification by timing

[edit]

Economic indicators can be classified into three categories according to their usual timing in relation to the business cycle: leading indicators, lagging indicators, and coincident indicators.

Leading indicators

[edit]

Leading indicators are indicators that usually, but not always, change before the economy as a whole changes.[3] They are therefore useful as short-term predictors of the economy. Leading indicators include the index of consumer expectations, building permits, and credit conditions. The Conference Board publishes a composite Leading Economic Index consisting of ten indicators designed to predict activity in the U. S. economy six to nine months in future.

Components of the Conference Board's Leading Economic Indicators Index:[4]

- Average weekly hours (manufacturing) — Adjustments to the working hours of existing employees are usually made in advance of new hires or layoffs, which is why the measure of average weekly hours is a leading indicator for changes in unemployment.

- Average weekly initial jobless claims for unemployment insurance — The CB reverses the value of this component from positive to negative because a positive reading indicates a loss in jobs. The initial jobless-claims data is more sensitive to business conditions than other measures of unemployment, and as such leads the monthly unemployment data released by the U.S. Department of Labor.

- Manufacturers' new orders for consumer goods/materials — This component is considered a leading indicator because increases in new orders for consumer goods and materials usually mean positive changes in actual production. The new orders decrease inventory and contribute to unfilled orders, a precursor to future revenue.

- Vendor performance (slower deliveries diffusion index) — This component measures the time it takes to deliver orders to industrial companies. Vendor performance leads the business cycle because an increase in delivery time can indicate rising demand for manufacturing supplies. Vendor performance is measured by a monthly survey from the National Association of Purchasing Managers (NAPM). This diffusion index measures one-half of the respondents reporting no change and all respondents reporting slower deliveries.

- Manufacturers' new orders for non-defense capital goods — As stated above, new orders lead the business cycle because increases in orders usually mean positive changes in actual production and perhaps rising demand. This measure is the producer's counterpart of new orders for consumer goods/materials component (#3).

- Building permits for new private housing units.

- Stock prices of 500 common stocks — Equity market returns are considered a leading indicator because changes in stock prices reflect investors' expectations for the future of the economy and interest rates.

Corporate equities as leading indicator with respect to GDP - Leading Credit Index - a composite index developed by the Conference Board consisting of six financial indicators such as yield spreads, loan survey information and investor sentiment[5]

- Interest rate spread (10-year Treasury vs. Federal Funds target) — The interest rate spread is often referred to as the yield curve and implies the expected direction of short-, medium- and long-term interest rates. Changes in the yield curve have been the most accurate predictors of downturns in the economic cycle. This is particularly true when the curve becomes inverted, that is, when the longer-term returns are expected to be less than the short rates.

- Index of consumer expectations — This is the only component of the leading indicators that is based solely on expectations. This component leads the business cycle because consumer expectations can indicate future consumer spending or tightening. The data for this component comes from the University of Michigan's Survey Research Center, and is released once a month.

Economist D.W. Mackenzie suggests that the ratio of private to public employment may also be useful as a leading economic indicator.

Lagging indicators

[edit]Lagging indicators are indicators that usually change after the economy as a whole does. Typically the lag is a few quarters of a year. The unemployment rate is a lagging indicator: employment tends to increase two or three quarters after an upturn in the general economy.[citation needed]. In a performance measuring system, profit earned by a business is a lagging indicator as it reflects a historical performance; similarly, improved customer satisfaction is the result of initiatives taken in the past.[citation needed]

The Index of Lagging Indicators is published monthly by The Conference Board, a non-governmental organization, which determines the value of the index from seven components.

The Index tends to follow changes in the overall economy.

The components on the Conference Board's index are:

- The average duration of unemployment (inverted)

- The value of outstanding commercial and industrial loans

- The change in the Consumer Price Index for services

- The change in labour cost per unit of output

- The ratio of manufacturing and trade inventories to sales

- The ratio of consumer credit outstanding to personal income

- The average prime rate charged by banks

Coincident indicators

[edit]Coincident indicators change at approximately the same time as the whole economy, thereby providing information about the current state of the economy. There are many coincident economic indicators, such as Gross Domestic Product, industrial production, personal income and retail sales. A coincident index may be used to identify, after the fact, the dates of peaks and troughs in the business cycle.[6]

There are four economic statistics comprising the Index of Coincident Economic Indicators:[7]

- Number of employees on non-agricultural payrolls

- Personal income less transfer payments

- Industrial production

- Manufacturing and trade sale

The Philadelphia Federal Reserve produces state-level coincident indexes based on 4 state-level variables:[8]

- Nonfarm payroll employment

- Average hours worked in manufacturing

- Unemployment rate

- Wage and salary disbursements deflated by the consumer price index (U.S. city average)

By direction

[edit]There are also three terms that describe an economic indicator's direction relative to the direction of the general economy:

- Procyclical indicators

- move in the same direction as the general economy: they increase when the economy is doing well; decrease when it is doing badly. Gross domestic product (GDP) is a procyclic indicator.

- Countercyclical indicators

- move in the opposite direction to the general economy. The unemployment rate and the wage share are countercyclic: in the short run they rise when the economy is deteriorating.

- Acyclical indicators

- are those with little or no correlation to the business cycle: they may rise or fall when the general economy is doing well, and may rise or fall when it is not doing well.[9]

Local indicators

[edit]Local governments often need to project future tax revenues. The city of San Francisco, for example, uses the price of a one-bedroom apartment on Craigslist, weekend subway ridership numbers, parking garage usage, and monthly reports on passenger landings at the city's airport.[10]

See also

[edit]- Big Mac Index

- Bureau of Labor Statistics

- CAPRI model

- Consumer confidence index

- Consumer leverage ratio

- Consumer price index

- Core inflation

- Cost-weighted activity index

- Disposable household and per capita income

- Employment rate

- Economic data

- Fundamental analysis

- Genuine Progress Index

- Hemline index

- Inflation

- Lipstick effect

- List of economic reports by U.S. government agencies

- Macroeconomic indicators

- Misery index (economics)

- Purchasing Managers' Index

- real GDP per capita growth

- The Conference Board

References

[edit]- ^ "The impact of an inverted yield curve".

- ^ "What Does the Producer Price Index Tell You?". 3 June 2021.

- ^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey: Pearson Prentice Hall. p. 314.

- ^ "US LEADING INDICATORS". www.conference-board.org. July 20, 2023. Retrieved 17 August 2023.

- ^ "Using a Leading Credit Index to Predict Turning Points in the U.S. Business Cycle". www.conference-board.org. December 2011. Retrieved 17 August 2023.

- ^ Smith, Charles Emrys, "Economic Indicators", in Wankel, C. (ed.) Encyclopedia of Business in Today's World (2009). California, US.

- ^ Yamarone, Richard (2012). "Indexes of Leading, Lagging, and Coincident Indicators". The Trader's Guide to Key Economic Indicators. John Wiley & Sons, Inc. pp. 47–63. doi:10.1002/9781118532461.ch2. ISBN 9781118532461.

- ^ "State Coincident Indexes". Federal Reserve Bank of Philadelphia. Retrieved 4 October 2010.

- ^ About.com, A Beginner's Guide to Economic Indicators Archived 2009-08-31 at the Wayback Machine, retrieved November 2009. This was the source of "procyclic", "acyclic", etc., as well as confirmation of "leading", "lagging", etc., and the source of some of the examples.

- ^ "A Fresh Approach To Measuring The Economy". NPR. 2010-04-11. Retrieved 2010-04-20.

External links

[edit]- OECD Economic Indicators

- Economic Indicators Mobile App

- U.S. Bureau of Labor Statistics

- The Conference Board - Economic Indicators

- FED101 - Economic Indicators

- International Conference on Indicators and Survey Methodology Archived 2017-06-22 at the Wayback Machine

- Economic Indicators Monthly analysis from American Institute for Economic Research (AIER)

- Top Economic Indicators History Top Economic Indicators Grouped by Categories

- U.S. Economic Indicators

- United States Economic Indicators (current and historical, open data) (quandl.com)

- GPO Economic Indicators

Economic indicator

View on GrokipediaDefinition and Fundamentals

Core Definition and Characteristics

An economic indicator is a quantifiable statistic that captures specific dimensions of economic activity, such as production levels, employment trends, or price changes, to gauge the current state, performance, or prospective direction of an economy or sector.[7] These metrics are derived from systematic data collection, including surveys of businesses, household polls, administrative records, and transaction logs, and are compiled periodically—often monthly or quarterly—by official agencies like national statistical bureaus or central banks to facilitate consistent monitoring.[8] For instance, indicators encompass aggregates like gross domestic product (GDP), which measures total value added in goods and services, or the consumer price index (CPI), tracking average price shifts in a basket of consumer goods.[1] Central characteristics of economic indicators include their temporal orientation relative to business cycles: leading indicators, such as new housing starts or manufacturing orders, fluctuate ahead of broader economic shifts to signal upcoming expansions or contractions; coincident indicators, including GDP and personal income, align with real-time economic conditions; and lagging indicators, like average duration of unemployment, validate trends only after they have materialized.[7] They are empirical by design, relying on observable data rather than subjective assessments, yet subject to methodological revisions as preliminary estimates incorporate fuller datasets, which can alter initial readings by 0.5 to 1 percentage point in metrics like quarterly GDP growth.[9] Reliability hinges on standardized definitions and sampling techniques, as deviations in coverage—such as excluding informal sectors in developing economies—can introduce underestimation biases, with formal sector data often capturing only 50-70% of total activity in low-income countries.[1] Effective economic indicators exhibit traits like timeliness, allowing release within weeks of the reference period to inform policy decisions, and comparability, enabling cross-country analysis through harmonized frameworks such as those from the System of National Accounts.[10] However, their proxy nature means they aggregate diverse causal factors—e.g., GDP conflates productivity gains with population growth—necessitating complementary use with multiple indicators for robust inference, as single metrics can mislead amid structural shifts like technological disruptions.[11] High-quality indicators prioritize transparency in construction, with metadata detailing adjustments for seasonality or inflation, to mitigate interpretive errors in forecasting economic momentum.[12]Role in Assessing Economic Health

Economic indicators provide quantifiable metrics to evaluate the vitality and trajectory of an economy, enabling stakeholders to identify periods of expansion, contraction, or stability through data on output, labor markets, and prices. For example, gross domestic product (GDP) measures overall economic output, while unemployment rates gauge labor utilization; sustained GDP growth above potential levels alongside low unemployment typically signals robust health, whereas declines in these metrics may indicate weakening conditions.[13][14] These tools underpin empirical assessments by central banks and governments, informing decisions on interest rates, fiscal spending, and regulatory adjustments to mitigate downturns or curb overheating.[15] Indicators are classified by timing relative to business cycle phases—leading, coincident, and lagging—each serving distinct roles in health evaluation. Leading indicators, such as the Conference Board's index incorporating average weekly hours, new orders, and stock prices, anticipate future turns by signaling shifts before they fully manifest in activity.[4] Coincident indicators, including nonfarm payroll employment from the Bureau of Labor Statistics' Current Employment Statistics survey and industrial production, mirror contemporaneous economic conditions, offering real-time snapshots of aggregate demand and supply dynamics.[16] Lagging indicators, like the duration of unemployment and corporate bond yields relative to commercial paper rates, validate trends post-occurrence, confirming the persistence of expansions or recessions.[17] By aggregating these signals, policymakers achieve a multifaceted view of economic health; for instance, divergences between leading forecasts and coincident data can prompt preemptive actions, as seen in Federal Reserve analyses of labor market cyclical positions via unemployment trends.[14] International bodies like the IMF utilize comparable metrics—such as GNP growth, inflation, and current account balances—to assess policy effectiveness and global stability, highlighting how indicator-based monitoring supports causal interventions like monetary tightening to address inflationary pressures.[6] However, their reliability depends on data quality and timeliness, with revisions in official series like GDP underscoring the need for cross-verification across multiple sources to avoid overreliance on preliminary estimates.[18]Historical Development

Origins in Early Economic Thought

The origins of economic indicators can be traced to the 17th-century emergence of political arithmetic, a quantitative approach to analyzing national resources and population pioneered by William Petty. In his posthumously published Political Arithmetick (1690), Petty employed numerical estimates of land values, population sizes, and income streams to compare economic capacities across nations, such as Britain and France, marking the first systematic use of statistics in economic inquiry rather than mere qualitative description.[19][20] This method emphasized empirical enumeration—drawing on census-like data, tax records, and valuations—to inform policy on wealth distribution and state power, providing a foundational impulse for later econometric practices.[21] Mercantilist thinkers, dominant from the 16th to 18th centuries, treated the balance of trade as a core proto-indicator of national economic vitality, equating prosperity with surpluses in exports over imports to amass bullion reserves.[22] Figures like Thomas Mun advocated tracking merchandise flows and precious metal inflows as direct gauges of state strength, with policies designed to ensure positive balances through tariffs and export subsidies, viewing deficits as drains on monetary stocks essential for military and commercial dominance.[23] This focus on trade aggregates as measurable signals of economic health contrasted with earlier ad hoc fiscal records but prioritized accumulation over productive capacity. In the mid-18th century, the Physiocrats, led by François Quesnay, advanced a sector-specific indicator in the produit net (net product), quantifying agricultural surplus after subsistence costs as the sole genuine measure of societal wealth.[24] Their Tableau Économique (1758) modeled intersectoral flows to isolate this agrarian excess, rejecting mercantilist monetary metrics and industrial outputs as illusory since only land yielded reproducible surplus.[25] Adam Smith, in The Wealth of Nations (1776), critiqued these views by broadening wealth assessment to annual labor output and consumption flows, emphasizing productivity gains from division of labor over narrow sectoral or trade balances, though without formalized statistics; his framework influenced subsequent empirical expansions by prioritizing real production metrics.[26]Standardization in the 20th Century

In the early 1930s, amid the Great Depression, efforts to standardize economic indicators gained momentum in the United States through the work of economist Simon Kuznets at the National Bureau of Economic Research (NBER). Kuznets developed systematic national income estimates, computing aggregates back to 1869 and breaking them down by industry, final product, and end use, which provided a foundational framework for measuring economic output.[27] In 1934, he presented these estimates to the U.S. Senate, emphasizing their utility for policy analysis while cautioning against over-reliance on aggregates without distributional details.[28] This work, initially funded by the NBER and later supported by the U.S. Department of Commerce's Business Finance and Defense Corporation, marked a shift from ad hoc calculations to rigorous, reproducible methodologies.[29] World War II accelerated standardization as governments required precise data for resource allocation and wartime planning. In the U.S., the Department of Commerce expanded Kuznets's framework into comprehensive national income and product accounts by the mid-1940s, incorporating gross national product (GNP) and related metrics to track production, consumption, and investment flows.[30] These accounts emphasized double-entry bookkeeping principles to ensure balance between supply and demand sides, reducing inconsistencies in prior estimates. Internationally, British economist Richard Stone contributed to aligned systems, producing a 1947 report on integrated economic accounts that influenced global norms.[31] Postwar reconstruction prompted international coordination to enable cross-country comparisons. The United Nations Statistical Commission initiated the first global standard with the 1953 System of National Accounts (SNA), which outlined methodologies for compiling GDP, national income, and balance sheets, focusing on production, distribution, and accumulation flows.[32] This framework addressed variations in national practices by promoting uniform definitions—such as market prices for valuation and residency-based territorial scope—while accommodating data limitations in developing economies. Subsequent refinements, including the 1968 SNA revision, incorporated input-output tables and sectoral breakdowns, further embedding standardization in institutions like the IMF and OECD for balance-of-payments and short-term indicators.[33] By century's end, these standards had transformed disparate statistics into comparable tools for assessing growth and cycles, though challenges persisted in areas like informal economies and non-market activities.[34]Post-WWII Expansion and Refinements

Following World War II, the Employment Act of 1946 established the Council of Economic Advisers (CEA) in the United States to provide objective economic analysis and policy recommendations to the president, marking a formal commitment to using empirical economic indicators for macroeconomic stabilization.[35] This legislation also mandated the Joint Economic Committee of Congress to oversee economic reporting, leading to the inaugural publication of the Economic Indicators report in 1947, which compiled key metrics such as gross national product, employment, and prices to inform fiscal and monetary decisions.[36] These developments reflected a shift toward data-driven governance, as wartime mobilization had highlighted the value of systematic economic measurement for resource allocation, though initial indicators focused primarily on aggregate output and labor amid concerns over postwar inflation and unemployment spikes reaching 4.3% by 1949.[37] Internationally, the United Nations Statistical Commission introduced the first System of National Accounts (SNA) in 1953, standardizing the framework for measuring economic activity across countries through integrated accounts for production, distribution, and expenditure.[32] This system expanded beyond prewar efforts by incorporating detailed sectoral balances, input-output tables, and cross-border flows, facilitating comparable gross domestic product (GDP) estimates and enabling institutions like the International Monetary Fund to monitor global imbalances.[38] Refinements included adjustments for non-market activities and capital formation, addressing limitations in earlier national income estimates that often overlooked intermediate consumption; by the 1968 SNA revision, these enhancements supported more accurate growth tracking during the era's average annual global GDP expansion of approximately 5%.[39] In the realm of business cycle analysis, the National Bureau of Economic Research (NBER) formalized classifications of leading, coincident, and lagging indicators in the early 1950s, building on Wesley Mitchell's foundational work to create composite indexes that anticipated expansions and contractions.[40] The 1950 NBER list included 21 leading series (e.g., stock prices and new orders), 7 coincident (e.g., industrial production), and 6 lagging indicators (e.g., labor costs), selected based on historical correlation with reference cycles dating back to 1885; these were seasonally adjusted and diffused to gauge breadth of movement across components.[41] By 1960, the U.S. Department of Commerce adopted and refined these into official indexes, incorporating computational advances to improve timeliness and predictive power, as evidenced by their role in signaling the 1960 recession six months in advance through declining leading indicators.[42] Such expansions democratized indicator use for private forecasting while highlighting challenges like data revisions, which could alter initial GDP estimates by up to 1-2 percentage points in quarterly releases.[30] These postwar advancements were driven by causal necessities: rapid industrialization in Europe and Asia via Marshall Plan aid (totaling $13 billion from 1948-1952) necessitated robust metrics for aid effectiveness, while U.S. policymakers sought to avert 1930s-style depressions through proactive intervention.[43] Refinements emphasized empirical validation over theoretical abstraction, with NBER criteria requiring indicators to conform to economic behavior, exhibit consistent timing, and avoid spurious correlations, though biases in source data—such as underreporting of informal sectors in developing economies—persisted until later methodological updates.[40] By the 1970s, this infrastructure underpinned Keynesian demand management, correlating with sustained U.S. GDP growth averaging 3.8% annually from 1947-1973, albeit with emerging critiques of overreliance on aggregates that masked distributional shifts.[44]Classifications

Indicators by Timing

Economic indicators are classified by their timing relative to changes in the business cycle, a framework developed to anticipate, reflect, or confirm economic expansions and contractions. This categorization—leading, coincident, and lagging—relies on historical patterns observed in how specific metrics correlate with overall economic activity, as tracked by bodies like The Conference Board. Leading indicators typically shift before the broader economy, providing predictive signals; coincident indicators move in tandem with current conditions; and lagging indicators follow after trends have established, offering confirmation but less foresight.[4][45] Leading indicators forecast future economic turning points, often changing several months in advance of peaks or troughs in gross domestic product (GDP) or employment. The Conference Board's Leading Economic Index (LEI), published monthly since 1996, aggregates ten components to gauge these signals, including average weekly manufacturing hours, initial unemployment claims, new orders for consumer and capital goods, stock prices, and building permits. For instance, a sustained decline in the LEI preceded the 2008 recession by about six months and the 2020 downturn by a similar margin, though it has occasionally produced false positives during volatile periods. Other examples include money supply growth and yield curve inversions, which empirical analysis shows precede recessions in over 90% of U.S. cases since 1950.[46][47][4] Coincident indicators provide a real-time snapshot of economic activity, rising or falling concurrently with output and employment cycles. The Conference Board's Coincident Economic Index (CEI) combines four metrics: nonfarm payroll employment, personal income excluding transfers, industrial production, and manufacturing and trade sales, which together mirror GDP movements closely. Examples also encompass retail sales volume and average weekly hours worked in manufacturing; for example, during the 2020 contraction, U.S. industrial production dropped 12.1% in March, aligning precisely with GDP's 5% quarterly decline. These indicators help assess the economy's present state but do not predict shifts.[4][48][49] Lagging indicators confirm trends only after they have persisted, often by three to twelve months, due to their dependence on accumulated data like accounting reports or policy responses. Common examples include the unemployment rate, which rises after recessions begin as firms delay layoffs; corporate profits, reported quarterly with delays; and labor costs per unit of output, which adjust slowly to productivity changes. The unemployment rate, for instance, peaked at 14.8% in April 2020, well after the NBER-declared recession start in February, confirming the downturn's depth. Interest rates and consumer price indices can also lag, as central bank adjustments follow observed inflation. While useful for validating long-term patterns, these indicators risk overemphasizing past conditions amid structural shifts, such as technological disruptions altering traditional correlations.[50][51][52]Indicators by Scope and Scale

Economic indicators are categorized by scope, which denotes the breadth of economic activity encompassed—from narrow, sector-specific metrics to broad, economy-wide aggregates—and by scale, which reflects the level of aggregation or geographical extent, spanning micro-level individual or firm data to macro-level national or global aggregates. This classification aids in contextualizing indicators' applicability, as narrower scopes facilitate targeted analysis within industries, while broader scopes inform overarching policy decisions; similarly, smaller scales enable granular insights into behaviors, whereas larger scales reveal systemic trends. Such distinctions arise from the inherent structure of economic measurement, where data aggregation influences interpretability and relevance to decision-making.[7] By scope, indicators divide into sectoral (narrow) and comprehensive (broad) types. Sectoral indicators focus on specific industries or markets, such as the Purchasing Managers' Index (PMI) for manufacturing, which surveys business conditions in that sector to signal expansion or contraction based on orders, production, and employment; for instance, a PMI above 50 indicates growth, as reported by the Institute for Supply Management in monthly releases. Broad-scope indicators, conversely, aggregate across sectors to assess the entire economy, exemplified by Gross Domestic Product (GDP), which quantifies total value added from all goods and services produced within a jurisdiction, with U.S. GDP reaching $27.36 trillion in 2023 per Bureau of Economic Analysis data. This breadth allows for holistic health assessments but risks masking sectoral disparities. By scale, indicators range from microeconomic, capturing individual or firm-level dynamics, to macroeconomic at national levels, and supranational for global views. Microeconomic indicators, though less emphasized in aggregate reporting, include metrics like household consumption surveys or firm-level productivity data, which reveal behavioral responses to incentives; for example, the Federal Reserve's Survey of Consumer Finances tracks net worth and debt at the household level, showing median net worth at $192,700 in 2022. Macroeconomic indicators aggregate to national economies, such as the unemployment rate, computed monthly by the Bureau of Labor Statistics via the Current Population Survey, standing at 3.8% in August 2024 for the U.S. labor force of approximately 167 million.[53] Global-scale indicators extend to international aggregates, like World Bank-compiled world GDP, estimated at $105 trillion in 2023, or IMF trade volume data, which highlight cross-border flows influencing interconnected growth. These scales underscore causal linkages, where micro behaviors underpin macro outcomes, though aggregation can obscure heterogeneity, as evidenced by varying regional unemployment within nations.| Classification | Examples | Key Features | Source |

|---|---|---|---|

| Narrow Scope (Sectoral) | Manufacturing PMI, Retail Sales | Targets specific industries; sensitive to sector shocks | ISM Reports |

| Broad Scope (Aggregate) | GDP, CPI | Encompasses full economy; used for policy benchmarks | BEA, BLS[54] |

| Micro Scale | Household Debt Levels, Firm Investment | Individual/firm data; informs micro-founded models | Fed SCF |

| Macro Scale | National Unemployment, Inflation Rate | National aggregates; tracks cyclical fluctuations | BLS |

| Global Scale | World Trade Volume, Global GDP | Cross-country metrics; reveals spillovers | World Bank, IMF |

Key Examples and Metrics

Output and Growth Measures

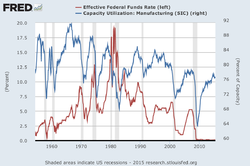

Gross Domestic Product (GDP) quantifies the total monetary value of final goods and services produced within a nation's borders during a specified period, serving as the benchmark indicator for aggregate economic output.[55] It is derived through the expenditure approach, which sums personal consumption expenditures, gross private domestic investment, government consumption and investment, and net exports (exports minus imports).[56] The U.S. Bureau of Economic Analysis computes GDP quarterly, with the advance estimate released about one month after quarter-end, followed by revisions incorporating more comprehensive data.[57] Real GDP adjusts nominal GDP figures for inflation via a deflator, isolating changes in output volume from price effects to better reflect productive capacity.[58] The real GDP growth rate is calculated as , typically annualized for quarterly data; positive rates signal expansion, as seen in the U.S. economy's 2.1% real GDP growth in the second quarter of 2024.[2][55] This metric informs assessments of economic health, with sustained growth above 2-3% annually often correlating with rising employment and living standards, though it excludes non-market activities like household labor.[2] The Industrial Production Index (IP), published monthly by the Federal Reserve, measures real output in manufacturing, mining, and electric/gas utilities, which account for about 15-20% of U.S. GDP but provide timely insights into goods-producing sectors.[59][60] IP is constructed using physical output data where available, supplemented by input-output models and value-added weights, with a base of 2017=100; for example, total IP reached 103.9% of its 2017 average in September 2025, reflecting modest post-pandemic recovery amid supply chain constraints.[61] Changes in IP often precede broader GDP shifts, as industrial activity responds quickly to demand fluctuations, though it omits services, which dominate modern economies.[59] Capacity utilization, derived from IP data, gauges the extent to which industrial facilities operate relative to potential, with rates above 80% indicating tight conditions that may spur inflation via supply bottlenecks.[61] U.S. capacity utilization averaged 78.2% in 2023, below historical norms, signaling underutilized resources amid slower growth.[61] These measures complement GDP by highlighting sectoral dynamics; for instance, divergences between IP and goods GDP can arise from inventory adjustments or trade effects, underscoring IP's role in refining output trend analysis.[60]Labor Market Indicators

Labor market indicators quantify employment dynamics, worker availability, and job turnover, serving as critical gauges of economic capacity utilization and potential wage inflation. Derived mainly from U.S. Bureau of Labor Statistics (BLS) surveys, these metrics distinguish between household-based estimates of labor force status and establishment-based counts of payroll jobs, revealing discrepancies that inform debates on true employment slack.[62] The unemployment rate, officially designated U-3 by the BLS, represents the share of the civilian labor force aged 16 and older who lack jobs but are available and actively searching for work during the survey reference week. Computed via the Current Population Survey (CPS), a monthly poll of approximately 60,000 households, U-3 excludes discouraged workers who have ceased searching and those marginally attached to the labor market.[63][64] In contrast, the broader U-6 measure incorporates these groups plus individuals employed part-time involuntarily due to economic conditions, often exceeding U-3 by a factor of two during downturns and highlighting underutilization beyond headline figures.[64][65] For example, as of August 2025, U-3 stood lower than U-6, underscoring how official rates may mask broader slack from long-term non-participation.[64] Nonfarm payroll employment, sourced from the Current Employment Statistics (CES) program, estimates total wage and salary jobs excluding farm, self-employed, and certain government workers through a survey of about 122,000 businesses and government agencies covering roughly one-third of nonfarm employment.[66] This metric tracks net monthly job changes by industry, with seasonally adjusted figures revealing trends like the modest +22,000 gain in August 2025 amid prior stagnation since April.[53] Unlike the CPS, CES counts multiple jobholders only once per employer and emphasizes payroll data, which can diverge from household reports during shifts in self-employment or gig work prevalence.[67] The labor force participation rate measures the percentage of the civilian noninstitutional population aged 16 and older either employed or actively seeking work, capturing potential supply beyond mere unemployment.[68] BLS data from the CPS show this rate at 62.3% in August 2025, reflecting long-term declines driven by aging demographics, early retirements, and reduced prime-age male engagement, which limit aggregate output potential absent policy interventions.[68][69] Additional indicators include average hourly earnings from CES, which track wage growth as a proxy for labor cost pressures, and the Job Openings and Labor Turnover Survey (JOLTS), which quantifies unfilled vacancies, hires, quits, and layoffs from a panel of 21,000 establishments.[66][70] JOLTS data for August 2025 indicated stable job openings at 7.2 million (4.3% rate), signaling balanced tightness without excess demand that might fuel sustained inflation.[71] These metrics collectively enable causal analysis of mismatches between labor supply and demand, though methodological variances—such as CPS undercounting of informal work—necessitate cross-validation for accurate policy assessment.[70][62]Price and Inflation Gauges

Price and inflation gauges measure changes in the average level of prices for goods and services over time, providing key insights into inflationary pressures within an economy. These indicators help policymakers, businesses, and investors assess purchasing power erosion, cost-of-living adjustments, and monetary policy effectiveness. Common gauges include the Consumer Price Index (CPI), Producer Price Index (PPI), Personal Consumption Expenditures (PCE) Price Index, and GDP deflator, each capturing distinct aspects of price dynamics.[72][73] The CPI, published monthly by the U.S. Bureau of Labor Statistics (BLS), tracks the average percentage change in prices paid by urban consumers for a fixed market basket of approximately 80,000 goods and services, including housing, food, transportation, and medical care. It uses a Laspeyres index formula, weighting items based on consumer expenditure surveys conducted every two years, with geometric means applied at lower aggregation levels to partially account for substitution effects. The CPI covers about 93% of the U.S. population but excludes rural consumers and institutional households. Core CPI excludes volatile food and energy prices to highlight underlying trends.[73][74][75] In contrast, the PPI measures average changes in selling prices received by domestic producers for their output across stages of production, from raw materials to finished goods, using a similar Laspeyres framework but focused on producer revenues rather than consumer costs. Released monthly by the BLS, it serves as a leading indicator for consumer inflation, as producer price increases often pass through to retail levels, though with lags. PPI weights derive from shipment values in the Census Bureau's economic census, updated periodically, and include services since expansions in the 2000s. Core PPI variants exclude food, energy, and trade services for stability.[76][77][78] The PCE Price Index, produced by the Bureau of Economic Analysis (BEA), quantifies prices paid by U.S. consumers for a broad array of goods and services, encompassing all personal consumption expenditures including employer-provided health care and imputed rents. Unlike the fixed-basket CPI, it employs a chain-type Fisher index, which adjusts weights annually to reflect shifting consumption patterns, thereby mitigating substitution bias where consumers switch to relatively cheaper alternatives. The [Federal Reserve](/page/Federal Reserve) prefers PCE for its comprehensive coverage—about 100% of expenditures—and behavioral responsiveness, using it as the primary inflation target in monetary policy. Core PCE excludes food and energy.[79][72] The GDP deflator, also from the BEA, represents a broad measure of price changes for all domestically produced goods and services, calculated as the ratio of nominal GDP to real GDP (in chained 2017 dollars), implicitly weighting by current production quantities rather than fixed baskets. It includes exports but excludes imports, capturing economy-wide inflation including government and investment spending. Updated quarterly, it differs from consumer-focused indexes by reflecting producer-side prices and new goods entering GDP.[80][81]| Indicator | Scope | Methodology | Key Use |

|---|---|---|---|

| CPI | Consumer prices for urban basket | Laspeyres with partial substitution adjustment | Cost-of-living adjustments, Social Security indexing[73] |

| PPI | Producer selling prices by stage | Laspeyres based on shipments | Input cost monitoring, contract escalations[76] |

| PCE | Personal consumption expenditures | Chain-type Fisher | Federal Reserve inflation targeting[79] |

| GDP Deflator | All domestic output | Implicit from nominal/real GDP ratio | Overall economic inflation assessment[80] |