Recent from talks

Contribute something

Nothing was collected or created yet.

Real estate development

View on Wikipedia

Real estate development, or property development, is a business process, encompassing activities that range from the renovation and re-lease of existing buildings to the purchase of raw land and the sale of developed land or parcels to others. Real estate developers are the people and companies who coordinate all of these activities, converting ideas from paper to real property.[1] Real estate development is different from construction or housebuilding, although many developers also manage the construction process or engage in housebuilding.

Developers buy land, finance real estate deals, build or have builders build projects, develop projects in joint ventures, and create, imagine, control, and orchestrate the process of development from beginning to end.[2] Developers usually take the greatest risk in the creation or renovation of real estate and receive the greatest rewards. Typically, developers purchase a tract of land, determine the marketing of the property, develop the building program and design, obtain the necessary public approval and financing, build the structures, and rent out, manage, and ultimately sell it.[1]

Sometimes property developers will only undertake part of the process. For example, some developers source a property and get the plans and permits approved before selling the property with the plans and permits to a builder at a premium price. Alternatively, a developer who is also a builder may purchase a property with the plans and permits in place so that they do not have the risk of failing to obtain planning approval and can start construction on the development immediately. The financial risks of real estate development and real estate investing differ due to leverage effects.[3]

Developers work with many different counterparts along each step of this process, including architects, city planners, engineers, surveyors, inspectors, contractors, lawyers, leasing agents, etc. In the Town and Country Planning context in the United Kingdom, 'development' is defined in the Town and Country Planning Act 1990 s55.

Organizing for development

[edit]A development team can be put together in one of several ways. At one extreme, a large company might include many services, from architecture to engineering. At the other end of the spectrum, a development company might consist of one principal and a few staff who hire or contract with other companies and professionals for each service as needed.

Assembling a team of professionals to address the environmental, economic, private, physical and political issues inherent in a complex development project is critical. A developer's success depends on the ability to coordinate and lead the completion of a series of interrelated activities efficiently and at the appropriate time.[4]

Development process requires skills of many professionals: architects, landscape architects, civil engineers and site planners to address project design; market consultants to determine demand and a project's economics; attorneys to handle agreements and government approvals; environmental consultants and soils engineers to analyze a site's physical limitations and environmental impacts; surveyors and title companies to provide legal descriptions of a property; and lenders to provide financing. The general contractor of the project hires subcontractors to put the architectural plans into action.

Land development

[edit]Purchasing unused land for a potential development is sometimes called speculative development.

Subdivision of land is the principal mechanism by which communities are developed. Technically, subdivision describes the legal and physical steps a developer must take to convert raw land into developed land. Subdivision is a vital part of a community's growth, determining its appearance, the mix of its land uses, and its infrastructure, including roads, drainage systems, water, sewerage, and public utilities.

Land development can pose the most risk, but can also be the most profitable technique as it is dependent on the public sector for approvals and infrastructure and because it involves a long investment period with no positive cash flow.

After subdivision is complete, the developer usually markets the land to a home builder or other end user, for such uses as a warehouse or shopping center. In any case, use of spatial intelligence tools mitigate the risk of these developers by modeling the population trends and demographic make-up of the sort of customers a home builder or retailer would like to have surrounding their new development.[5]

See also

[edit]References

[edit]- ^ a b Frej, Anne B; Peiser, Richard B. (2003). Professional Real Estate Development: The ULI Guide to the Business (2 ed.). Urban Land Institute. p. 3. ISBN 0874208947. OCLC 778267123.

- ^ New York Times, March 16, 1963, "Personality Boom is Loud for Louis Lesser"

- ^ Geltner, David; Kumar, Anil; Van de Minne, Alex M. (2020). "Riskiness of Real Estate Development: A Perspective from Urban Economics and Option Value Theory". Real Estate Economics. 48 (2): 406–445. doi:10.1111/1540-6229.12258. hdl:1721.1/126820.

- ^ Homes, Synsera (13 September 2019). "Article: What does a property developer do? Sept 2019". Synsera Homes. Archived from the original on 2020-08-08. Retrieved 2020-04-15.

- ^ "What is a Lady Bird Deed". April 18, 2020. Archived from the original on 2020-09-27. Retrieved 2020-04-18.

External links

[edit] Media related to Real estate development at Wikimedia Commons

Media related to Real estate development at Wikimedia Commons

Real estate development

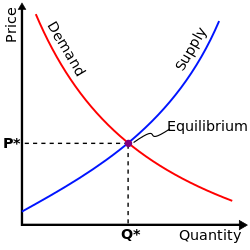

View on GrokipediaReal estate development encompasses the sequential process of identifying opportunities, acquiring land or properties, securing financing, obtaining regulatory approvals, designing and constructing improvements, and ultimately leasing or selling the developed assets to end-users, with the objective of creating economic value through enhanced utility and market demand fulfillment.[1] This activity spans residential, commercial, industrial, and mixed-use projects, transforming raw or underutilized land into functional built environments that support human habitation, commerce, and infrastructure.[2] The development process typically unfolds in distinct phases, including pre-development (feasibility analysis, site selection, and entitlement), construction (procurement and building), and post-construction (marketing, occupancy, and asset management), each fraught with uncertainties related to market fluctuations, cost overruns, and regulatory hurdles.[3] Historically, surges in development have aligned with economic expansions, such as the post-World War II suburban boom that facilitated widespread homeownership and urban decentralization in the United States.[4] Economically, real estate development exerts substantial influence, contributing trillions to gross domestic product via construction activity, job creation, and multiplier effects on ancillary industries; for instance, the U.S. commercial real estate sector alone supported $2.3 trillion in GDP and 15.1 million jobs in 2022.[5] Residential development similarly bolsters GDP through new builds, sales, and renovations, while fostering local economic vitality by increasing property tax bases and stimulating demand for goods and services.[6] However, its cyclical nature ties performance to broader macroeconomic factors like interest rates, employment levels, and demographic shifts, amplifying both growth potential and vulnerability to downturns.[7] Notable characteristics include inherent high-risk profiles due to capital intensity and illiquidity, with developers often leveraging debt amid exposures to interest rate volatility and loan delinquencies, as evidenced by rising commercial real estate distress since 2022.[8] Controversies frequently arise from environmental impacts, community opposition to density increases, and policy-induced supply constraints that exacerbate housing shortages despite development's role in equilibrating supply and demand.[9] Climate vulnerabilities further complicate site selection and insurance costs, compelling developers to integrate resilience measures amid empirical evidence of heightened risks in flood- and wildfire-prone areas.[10]